Key test for the health of the real estate market ahead following the largest May increase to home inventory on record.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

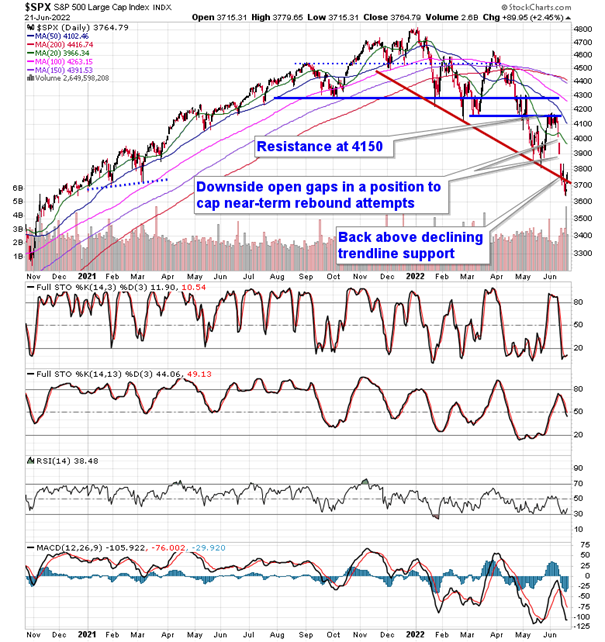

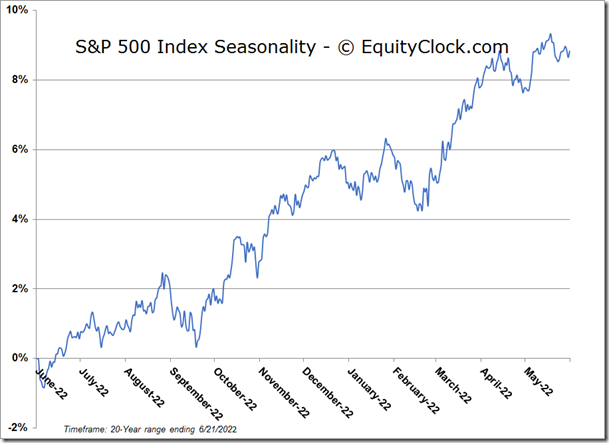

Stocks rallied to start the holiday shortened week as investors nibbled at beat down names following the selloff that has dominated the first half of the year. The S&P 500 Index closed with a gain of 2.45%, moving back above declining trendline support that was broken last week around 3700. Momentum indicators are showing early hints of curling higher, delivering what could be a positive momentum divergence compared with price, an indication of waning selling pressures. A bullish crossover of MACD and its signal line above the May lows and RSI holding above oversold territory at 30 would confirm. Given how stretched the market has become below major moving averages and with a seasonally favourable timeframe ahead, a bounce has certainly been due, but, of course, the argument that this is just as bear-market rally is certainly justified. Some of the groups that were sold off the most through the first six months of the year rallied the hardest on Tuesday, including Technology and Consumer Discretionary, suggesting that the mean reversion phase of the market is getting underway, something that should help to support stocks through month-end.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

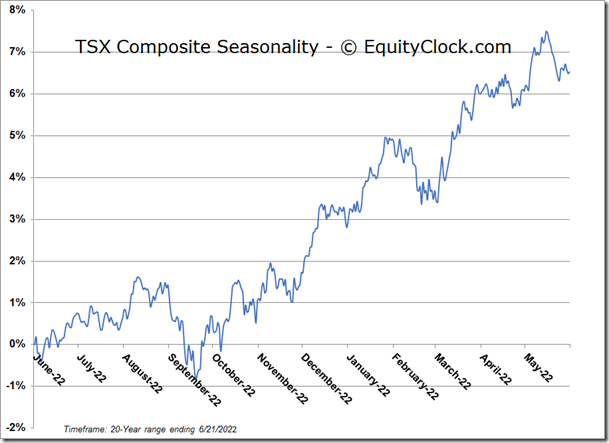

TSE Composite