The summer rally period for the equity market is upon us.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

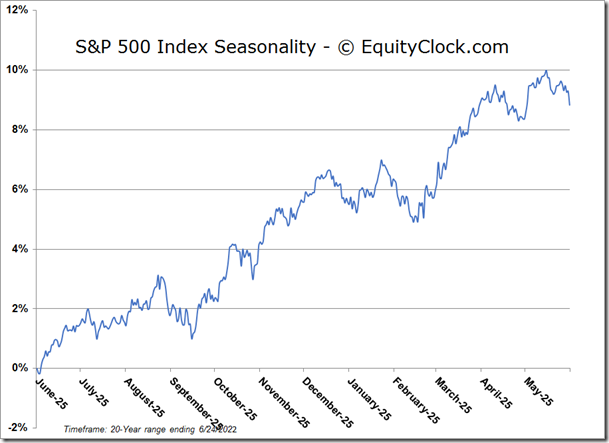

Stocks rallied on Friday as the summer rally period for equity market gets underway. The S&P 500 Index gained just over 3%, gapping above a near-term consolidation range around 3800 and closing one of the two downside gaps that had been charted in recent weeks. The next gap overhead can be pegged between 3975 and 4020, a hurdle that threatens to cap this rebound attempt. MACD is about to trigger a new buy signal and a bullish divergence compared to price is about to become confirmed, a solid indication of waning selling pressures and often a precursor to a change of trend. The benchmark is nowhere near breaking its trend of lower-lows and lower-highs that has been in place this year, but last week’s action at least provides the basis that downside pressures are fading, allowing for the average summer rally period to get off the ground.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

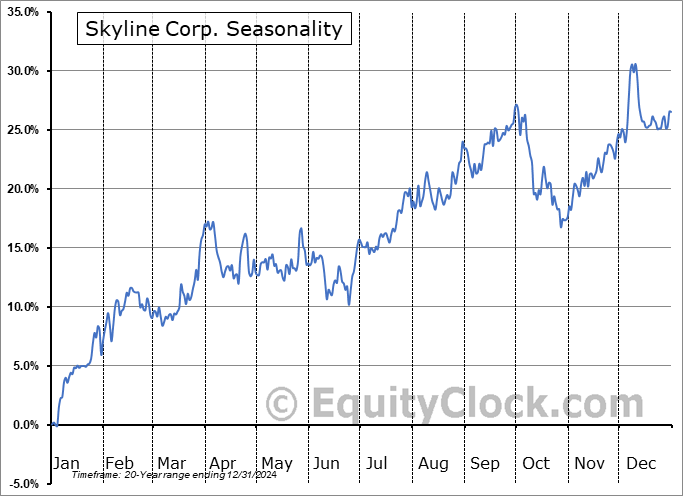

Seasonal charts of companies reporting earnings today:

S&P 500 Index

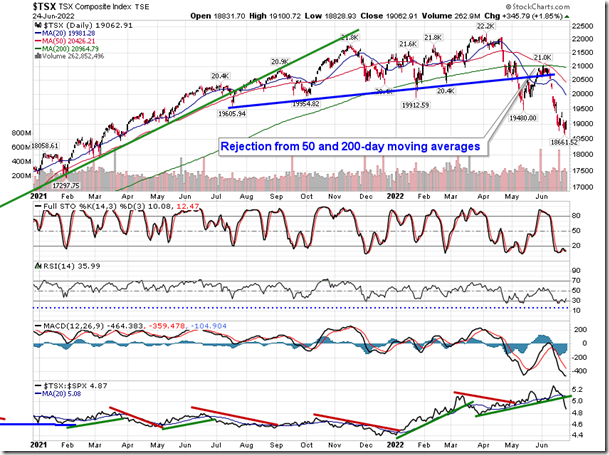

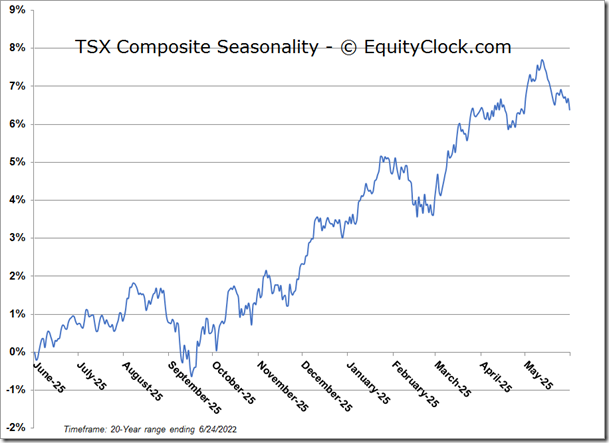

TSE Composite