During the often volatile third quarter for the equity market, investing in defense can be an ideal way to become defensive in investment portfolios.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

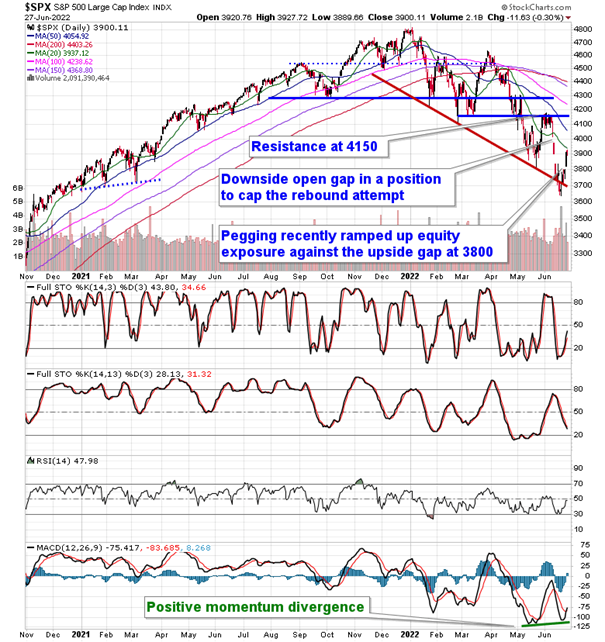

Stocks closed slightly lower on Monday as traders digested the gains from the week past and as portfolio managers start to window-dress their books ahead of the end of the first half of the year. The S&P 500 Index shed three-tenths of one percent, showing slight negative reaction to declining resistance at the 20-day moving average at 3936. MACD continues to positively diverge from price, providing indication of waning selling pressures following what has been one of the worst first half of the year performances for stocks on record. Both MACD and RSI remain below their middle lines, which is characteristic of a bearish trend. We continue to peg our recently ramped up equity exposure off of Friday’s upside gap around 3800 and we continue to watch for any signs of hesitation during the period of seasonal strength for stocks that is upon us around the downside open gap between 3975 and 4020.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

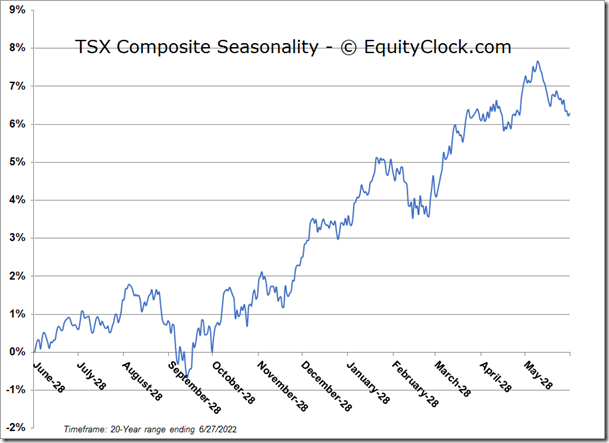

TSE Composite