The more that the consumer becomes strained, the more they are turning towards debt.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

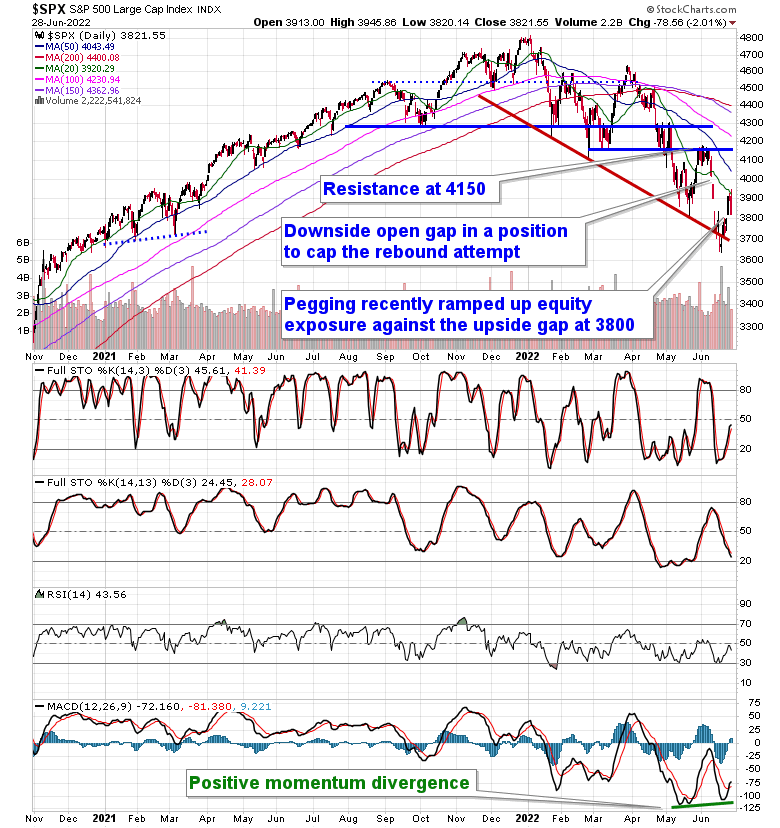

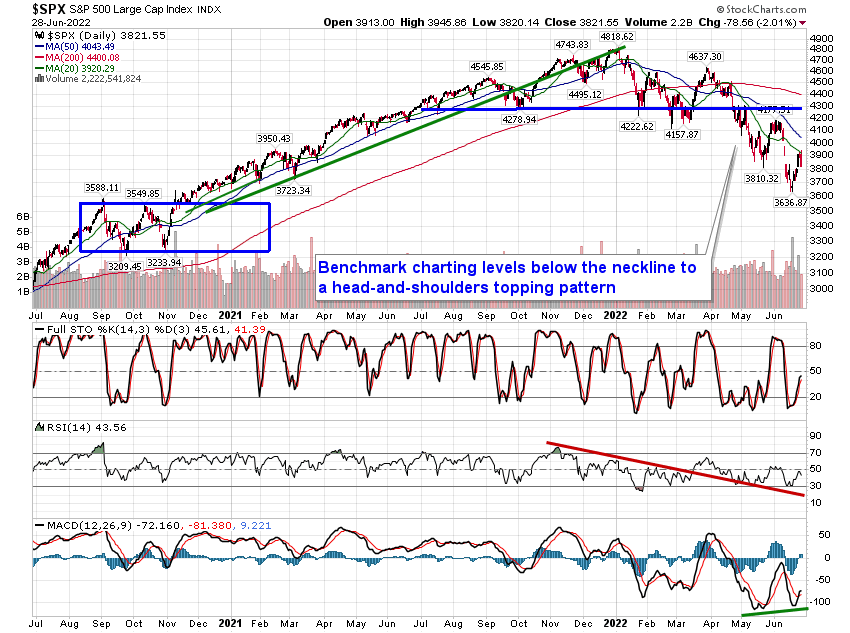

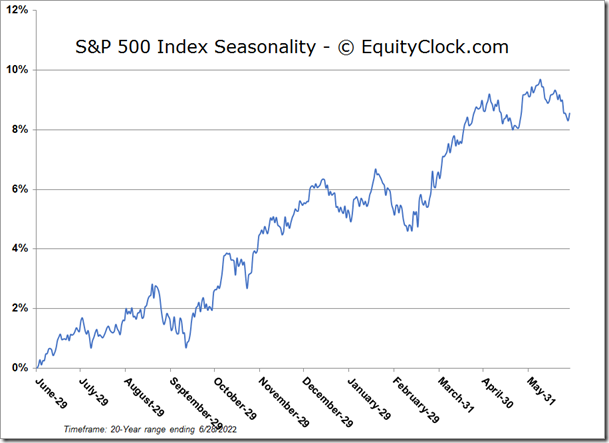

Stocks erased early morning gains to close solidly negative on Tuesday as recession concerns continue to proliferate. The S&P 500 Index dipped by 2.01%, turning lower from its declining 20-day moving average and turning back to Friday’s upside gap at 3800. While the gap between 3840 and 3900 has now been closed, the higher gap between 3975 and 4020 remains untested, threatening to keep a cap above the market intact, despite the positive seasonal framework that we find ourselves in over the next few weeks. The hope remains that evidence of waning selling pressures in recent weeks, as gauged by the positive momentum divergence with respect to MACD, allows the bulls to feel confident that the worst is behind us, at least for now. While major momentum indicators are still showing characteristics of a bearish trend below their middle lines, the divergence provides a hint that we are at or near a point of downside exhaustion, often conducive to a turning point in the negative trajectory of the market. This is, however, not the ideal setup that we had been forecasting/expecting for the end of the first half of the year, a timeframe that was seen as presenting the logical point to see a low to our forecasted first half of the year weakness. We continue to hold a stop of 3800 for our recently ramped up equity exposure in the Super Simple Seasonal Portfolio, but we also continue to hold a large amount of cash that we would love to deploy upon a stronger tenchical setup. While hints of downside exhaustion are conducive to take the step to incrementally increase risk, unfortunately we do not see the framework yet to take the plunge that seasonal tendencies suggest we do heading into the start of the new quarter. More work is required on the gap overhead to eliminate perceived hurdles that may cap a sustained rebound attempt into the third quarter, as various seasonal studies suggest we should see.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

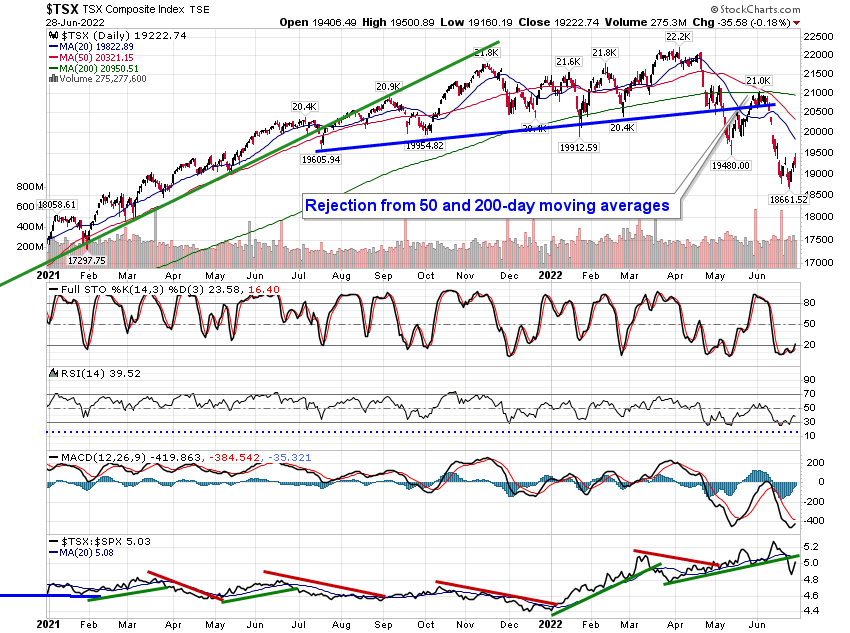

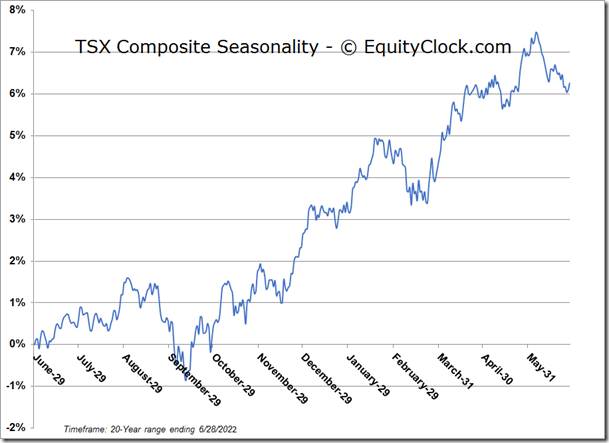

TSE Composite