As the market prices in the risk of recession, inflation expectations are peaking.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

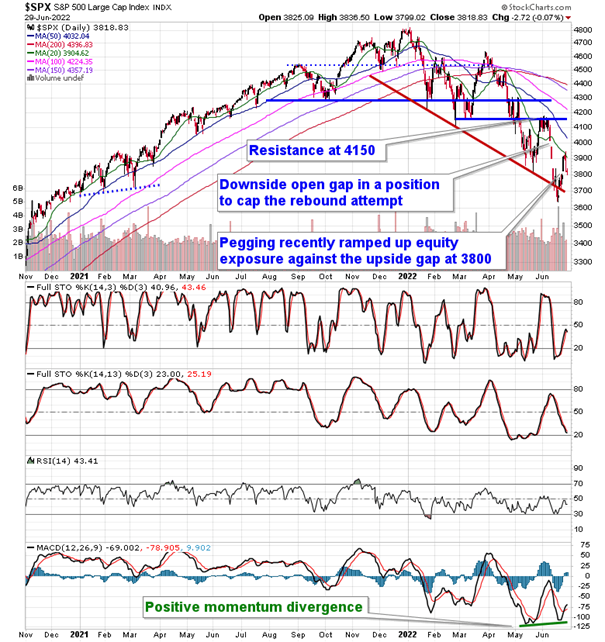

Stocks gyrated around the unchanged mark on Wednesday as portfolio managers continue to rebalance their books into quarter-end while scrutinizing the risks of an economic recession later this year. The S&P 500 Index closed down by just less than a tenth of one percent, charting a rather indecisive doji candlestick on the day. Friday’s upside gap at 3800 that we have been pegging recently ramped up equity exposure off of was tested as support at the lows of the session. The declining 20-day moving average continues to act as a near-term cap, while the downside open gap between 3975 and 4020 threatens to stand in the way of the upside potential suggested of the summer rally period for stocks that is upon us. Momentum indicators continue to show characteristics of a bearish trend, however, a positive divergence with respect to MACD is hinting of waning selling pressures, often a pre-cursor to a change of trend. This market is still in need of a sentiment reset in order to keep the longer-term downside trajectory of the market intact and the likelihood of realizing that reset higher through the weeks ahead, during the average summer rally period for stocks, is still fairly good, but the highly tenuous trading action keeps us with an elevated level of caution until we obtain the technical backdrop that is required to draw in broader participation to fuel a more sustainable upside move.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

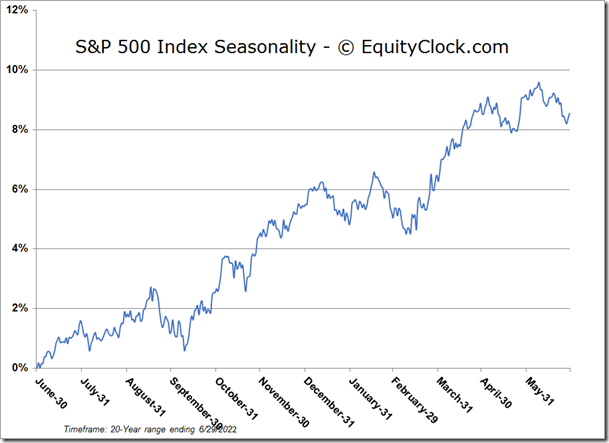

S&P 500 Index

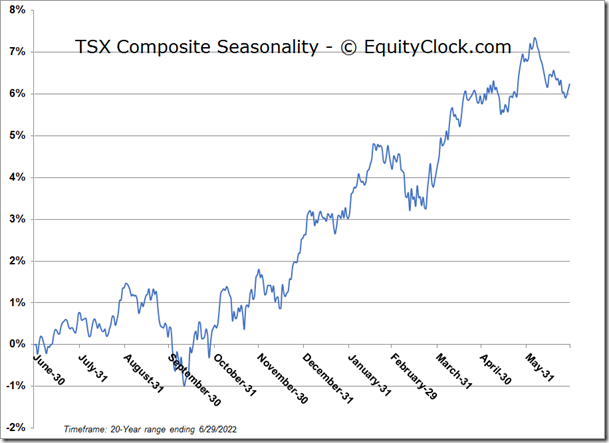

TSE Composite