Dollar strength roiling commodity bulls, but it is providing welcome relief to the depressed growth trade that typically flourishes at this time of the year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

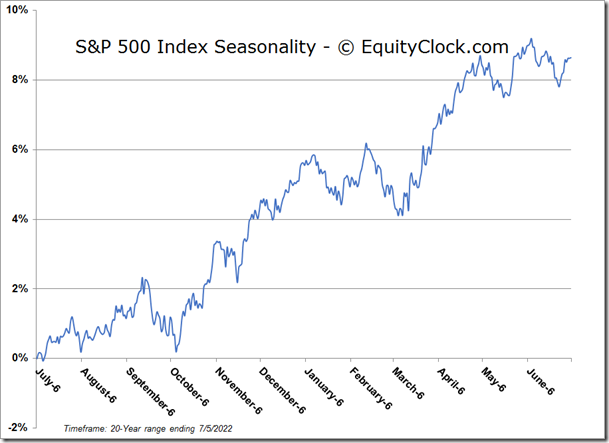

Stocks shook off sharp early morning declines on Tuesday to close higher as traders start to rotate from the once beloved commodity trade to the beaten down growth segments of the market now that inflation expectations and the cost of borrowing are peaking. The S&P 500 Index closed higher by just less than two-tenths of one percent, reversing an over 2% decline realized at the lows of the session as recession concerns gripped the market. The benchmark presently sits above the 3800 level that we have been pegging ramped up equity exposure against and the reversal from levels around this hurdle is enough to suggest some interest in stocks around this level. Declining trendline resistance at 3900 is the significant hurdle that we are watching overhead, a definitive break above which may allow us to increase equity exposure further for the summer rally period in the equity market that is upon us. Upside follow-through to Tuesday’s gain and confirmation of a higher short-term low above the June bottom around 3640 would be enough to entice broad participation in a rebound attempt, thereby alleviating the overly bearish sentiment that has proliferated in the market in recent weeks. Momentum indicators continue to positively diverge from price, a suggestion of waning selling pressures, often a precursor to a shift in the prevailing negative trend.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

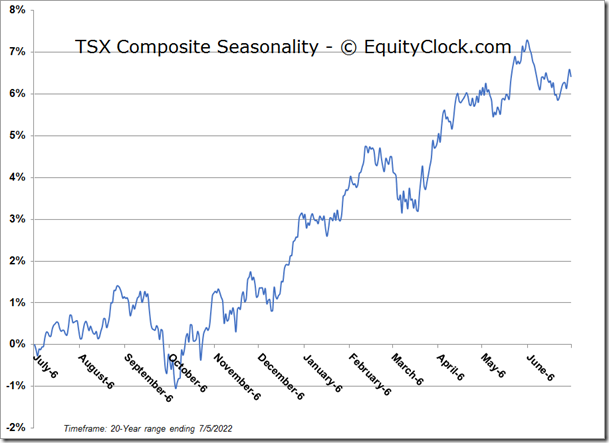

TSE Composite