The above average increase in payrolls last month and larger than average decline in wages may be exactly the kind of data the Fed desires as it continues to tighten monetary policy.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

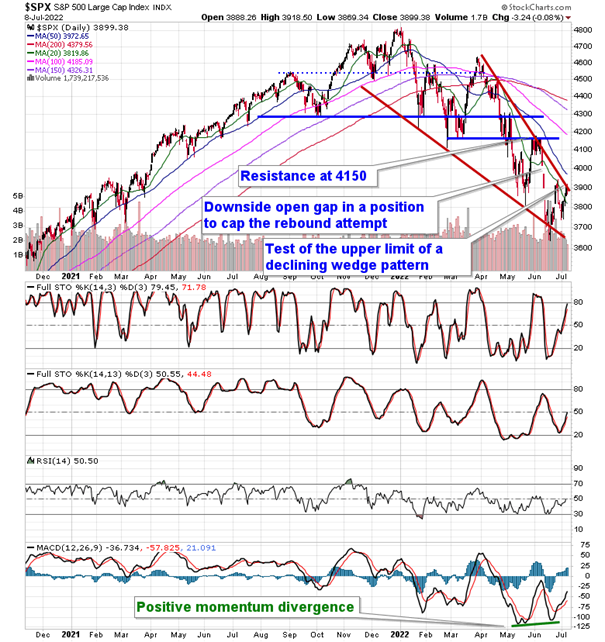

Stocks closed mixed on Friday as investors digested the latest read of employment in the US. The S&P 500 Index closed lower by just less than a tenth of one percent after gyrating between positive and negative values all session. The benchmark continues to hold below declining trendline resistance and the upper limit to a declining wedge pattern, which we have pegged at 3900. The setup is typically indicative of waning selling pressures, something that the divergence with respect to MACD also attests to. A breakout above the upper limit of the narrowing range could unleash the broad market participation that we have been looking for heading into the third quarter. The short-term higher-low above the June low presents the basis for seeing this upward bias, but, as highlighted in a recent report, a violation of short-term support at 3750 would defeat this potentially bullish setup. The market still has a lot of work ahead to pull out of the prevailing negative path, but, so long as inflation concerns and recession fears subside, as they have been in recent weeks, there is a backdrop that is building to allow for the alleviation of the overwhelming negative sentiment in the market that has led to the recent subsidence of selling pressures.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

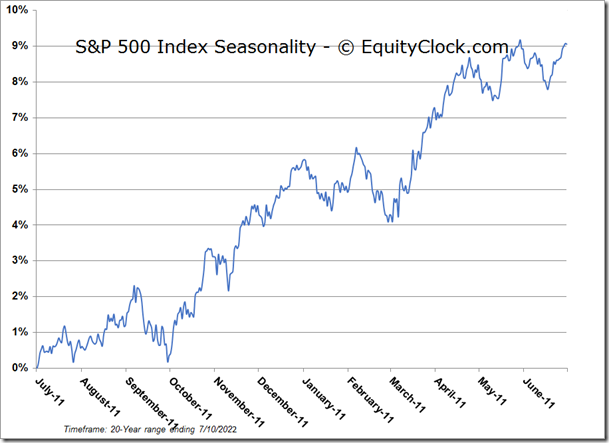

S&P 500 Index

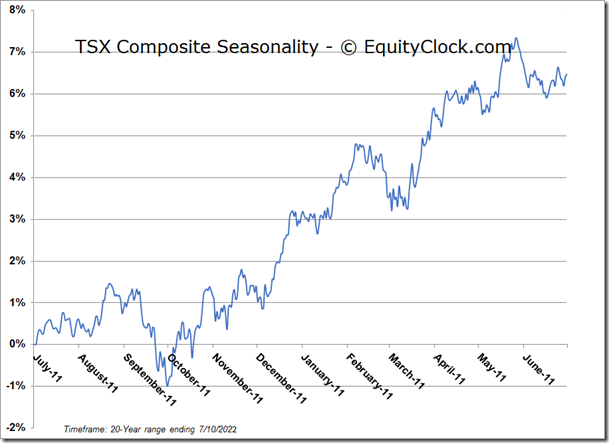

TSE Composite