The strongest time of the year for Wheat is upon us and the recent correction back to long-term rising trendline support has presented another opportunity to take a bite.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

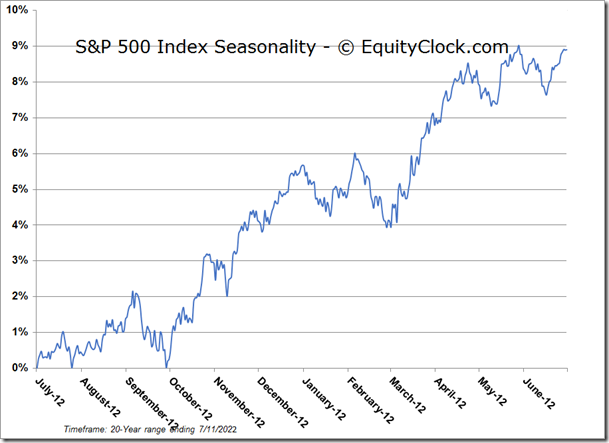

Stocks closed lower on Monday as a jump in the US dollar and nervousness ahead of the start of earnings season had investors trimming risk. The S&P 500 Index ended lower by 1.15%, turning down from declining trendline resistance that currently hovers around 3900. The declining hurdle encompasses the upper limit of a declining wedge pattern, which is typically an indication of waning selling pressures, a precursor condition to the shift in the negative trend of the market. The positive divergence with respect to MACD continues to attest to the same. Assuming the pattern continues and extrapolating out the trends, the wedge points to an apex around 3500 by the start of September. The buy point to the setup is typically realized upon a breakout of the upper limit of the narrowing range, something that we are anticipating at some point during the third quarter, possibly as soon as this month. This market still has much work to do in order to move beyond its declining path that it has been in this year, but hints continue to emerge that we are closer to a low than not, which translates into improved risk-reward.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

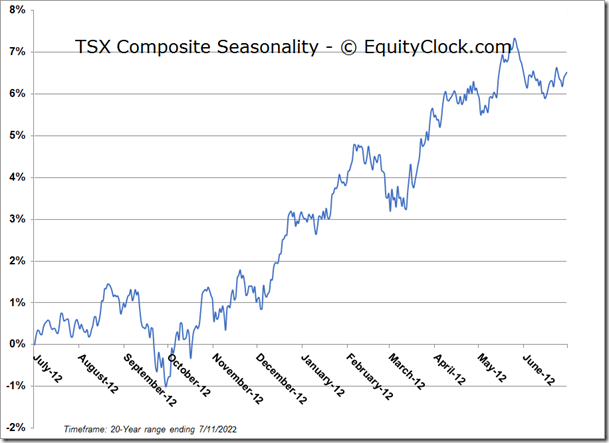

TSE Composite