The lack of concern in the bond market following the latest Consumer Price Index report suggests that we may be at a turning point in the prevailing negative trend of bond prices.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks slipped on Wednesday as traders digested a much hotter than expected read of consumer prices in the US. The S&P 500 Index fell by less than half of one percent, ending at the pivotal 3800 level that we have highlighted exhaustively over the past few months. The upper limit to a declining wedge pattern continues to act as the cap to the recent wave higher in this ongoing trend of lower-lows and lower-highs. The start of July lows around 3750 remains our stop level to recently ramped up equity exposure in order to participate in this summer rally period that we are still giving some leeway towards. Momentum indicators are rolling over again below their middle lines, keeping the characteristics of a negative trend intact. The buy point to the narrowing declining range continues to be pegged at trendline resistance that is just below 3900. Between here and there, we are stuck in this rather neutral state for this summer rally period that has been rather lacklustre, thus far.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

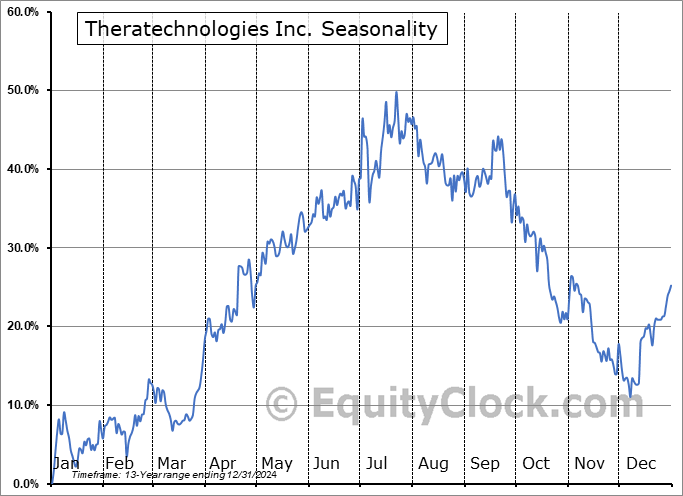

Seasonal charts of companies reporting earnings today:

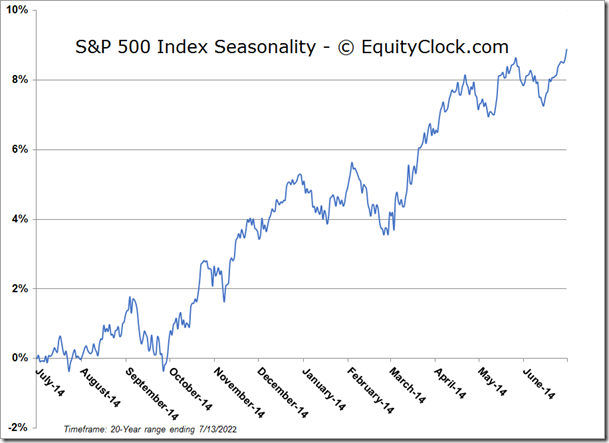

S&P 500 Index

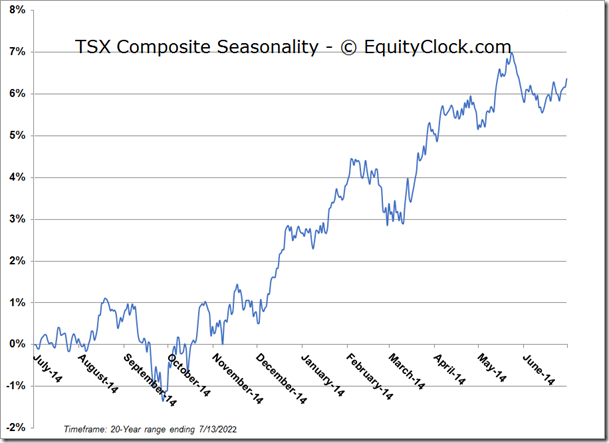

TSE Composite