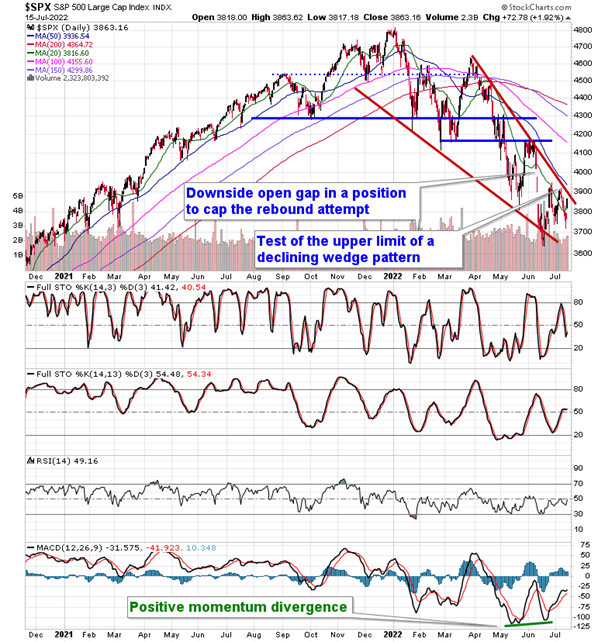

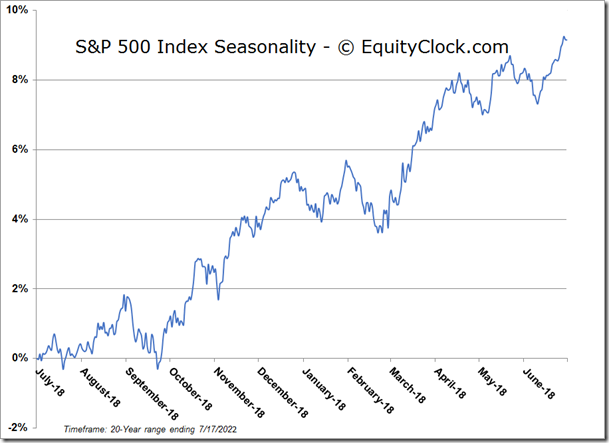

Until one of the limits break, either higher above resistance around 3900 or lower below support at 3750, we will choose to sit with a neutral bias of stocks now that the summer rally period has reached its average peak as of the 17th of July.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

And the game of guessing how aggressive the Fed will be tightening monetary policy at its next meeting continues following a stronger than expected read of retail sales in the US. The S&P 500 Index gapped higher in Friday’s session to close with a gain of 1.92%, trading back to levels around declining trendline resistance that has acted as a cap to the now concluded summer rally period for stocks. We continue to peg declining trendline resistance around 3900, a level that, if broken, would start to indicate a shift of the intermediate trend away from the path of lower-lows and lower-highs that it has been in all year. The benchmark will have to overcome the recent shorter-term path of lower-lows and lower-highs first in what appears to be a consolidation of the sharp June decline, something that could still end up being a bear-flag setup, a pattern that would suggest a resolution lower in prices upon a definitive break of the recent consolidation span. Until one of the limits break, either higher above resistance around 3900 or lower below support at 3750, we will choose to sit with a neutral bias now that the summer rally period has reached its average peak as of the 17th of July. The gambling of how the Fed may react to the data-points that come in is not a game for us and we will continue to react to what the three-prongs to our approach are telling us.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

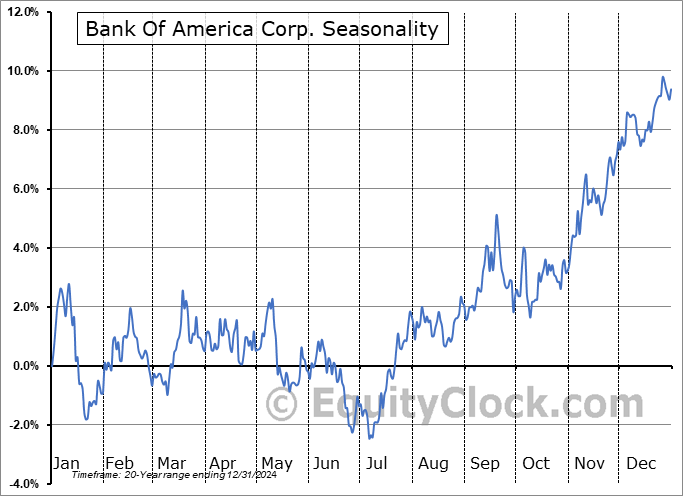

Seasonal charts of companies reporting earnings today:

S&P 500 Index

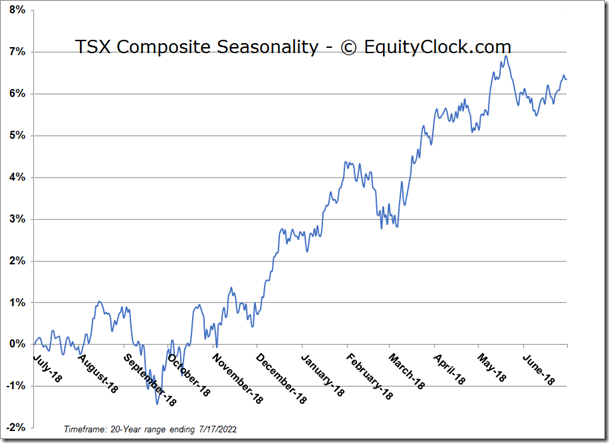

TSE Composite