The trend of manufacturers’ orders in the US remains strong, but the pockets of strength below the surface highlight the areas to target within investment portfolios.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

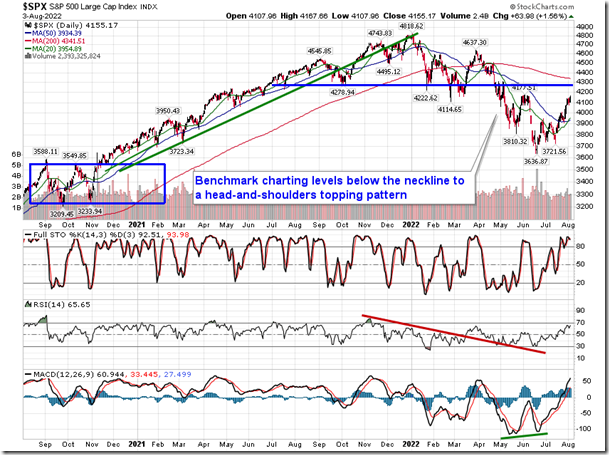

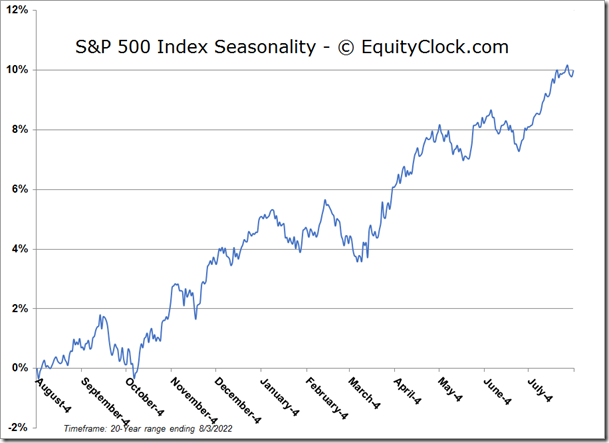

Stocks rallied on Wednesday as traders continue to let down their guard in the equity market following the weakness that was realized through the first half of the year. The S&P 500 Index gained 1.56%, continuing to push towards the May highs and resistance at 4170. The 20 and 50-day moving averages are increasingly curling higher, defining positive short and intermediate-term trends as the strains from the first half of 2022 unwind. Intermediate support continues to be pegged at the aforementioned 50-day moving average level, now at 3934. Momentum indicators are showing signs of upside exhaustion in what could result in a rejection from resistance at 4170 in the days ahead. We continue to entertain that this hurdle could form the neckline to a head-and-shoulders bottoming pattern, a setup that would project an upside target back to the March highs around 4637. The most important part of the setup remains uncharted, however, which is the right shoulder to the setup revealing a higher low. This is something that we will be looking to play out over the weeks ahead, potentially brining the market back down to levels around the 50-day moving average before the more sustainable move higher is revealed. This path would align with many of our historical studies, including how the equity market performs following bear market declines through the first half of the year, mid-term election year tendencies, and years that end in “2”. Things could always change and we don’t want to be caught up too much in the coincidences between the price action of the current timeframe to what has been the average based on our historical studies, but the guidelines that they have provided have been highly effective. As has been highlighted, this back half of the year rebound in the market is seen as the last opportunity to position for a more substantial peak in the market in the year(s) to come, coinciding with the onset of a recession, and we will be seeking to guide subscribers through these gyrations, according to our approach, as time progresses.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

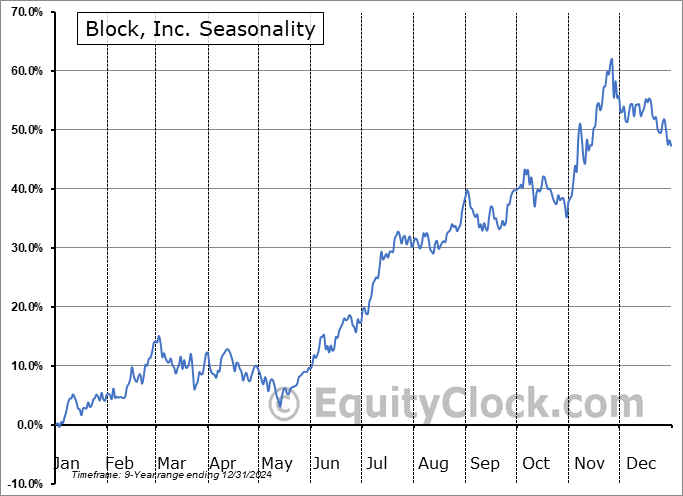

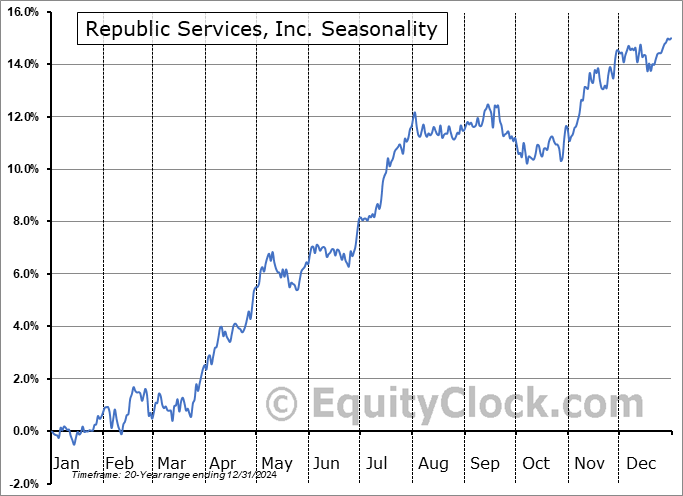

Seasonal charts of companies reporting earnings today:

S&P 500 Index

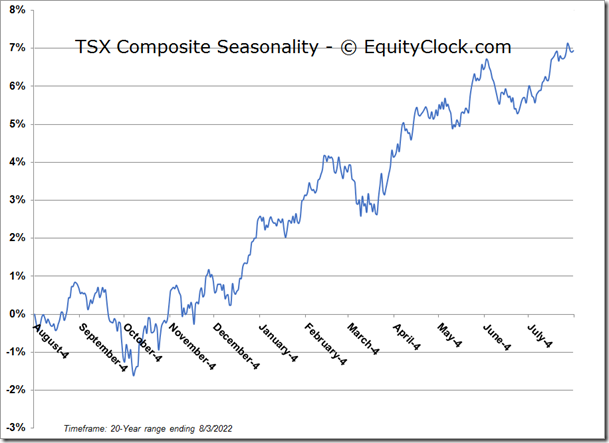

TSE Composite