As levels of resistance are broken, the bearish argument for the market becomes weaker and weaker.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

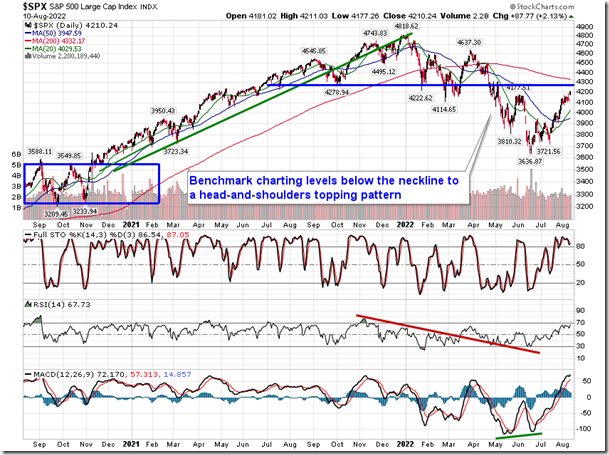

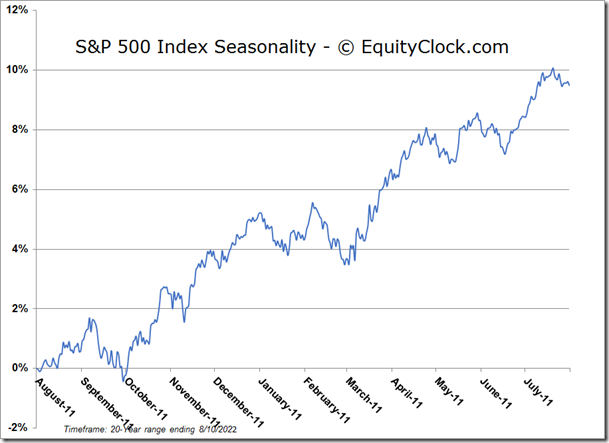

Stocks rallied on Wednesday as a weaker than expected read of consumer prices in the US increased optimism that inflationary pressures in the economy have peaked. The S&P 500 Index closed higher by 2.13%, jumping past the May/June highs around 4170 in what was the last line in the sand defining the intermediate-term trend of lower-lows and lower-highs. Increasingly, evidence is materializing that we are moving beyond this negative trajectory that we have been in since the year began as stocks fulfill the back half of the year strength that we have been forecasting since the year began. The next critical hurdle is the declining 200-day moving average at 4332, a level that closely aligns with declining trendline resistance derived by joining the peaks from the January and March highs. This would be the logical point for this market to pause and digest again, assuming the near-term trajectory continues unhindered. Momentum indicators are still showing signs of upside exhaustion in what is still expected to amount to a pullback/retracement through the middle of August. While we will remain stubborn to our somewhat downbeat near-term view, the ammunition for the bull case for the back half of the year rebound in the market just got that much stronger on Wednesday with the violation of the May/June highs and it has become difficult for the bears to defend their negative bias given that levels of resistance are easily being broken while levels of support are firming. The risk-reward in the near-term is still not present to be aggressively adding risk (stocks) at this juncture given the near-term pullback potential, but looking to buy the dip on the next pullback is the desired outcome.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

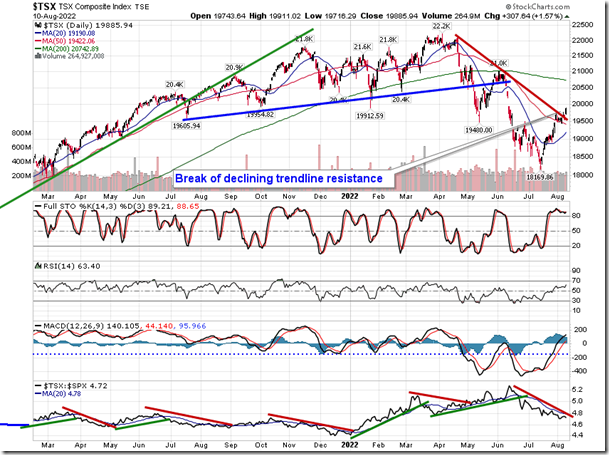

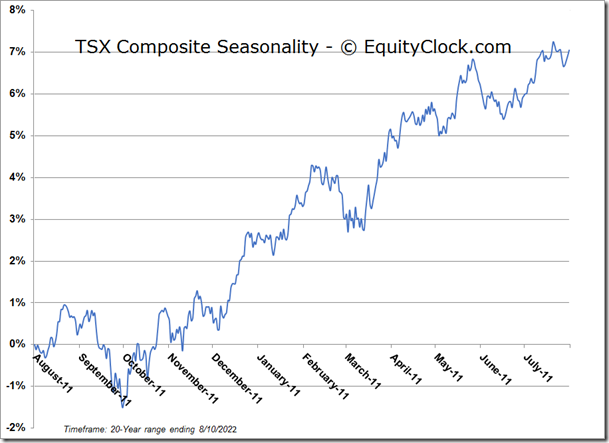

TSE Composite