The recent uptick in energy commodity prices from levels of significant support risk re-flaring inflationary concerns in the market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

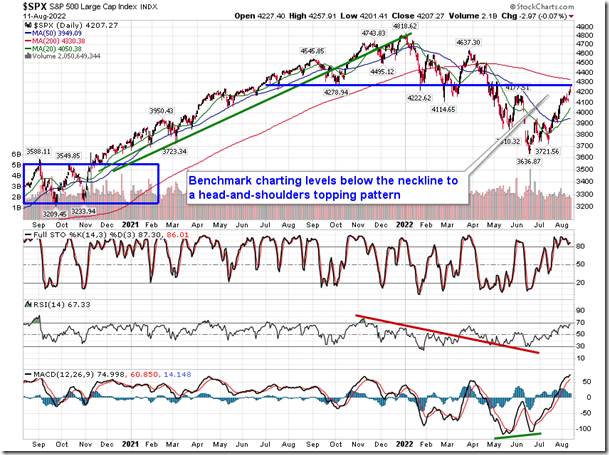

Stocks reversed course on Thursday in a sign of buying exhaustion as traders digest the gains of weeks past. The S&P 500 Index closed lower by just less than a tenth of one percent, giving up a gain of over one percent that followed a weaker than expected read of producer prices in the US. The reversal comes as the benchmark reaches up to previous horizontal support, now resistance, at 4280, a level that we previously indicated marked the neckline to the substantial head-and-shoulders topping pattern that was charted between last July and this past April. The downside target of the topping pattern was more than fulfilled by the lows charted in June and the benchmark is still deemed to be on a new rising intermediate path, until evidence suggests otherwise. Momentum indicators continue to show signs of upside exhaustion in what looks to be the precursor of a near-term pullback that still has a high probability of playing out through the remainder of this month. Support continues to be pegged around the rising 50-day moving average now at 3949. Confirmation of support in this zone is likely to warrant buying, but, until then, traders should prepare for some digestion following the impressive gains that have been charted since the June lows.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

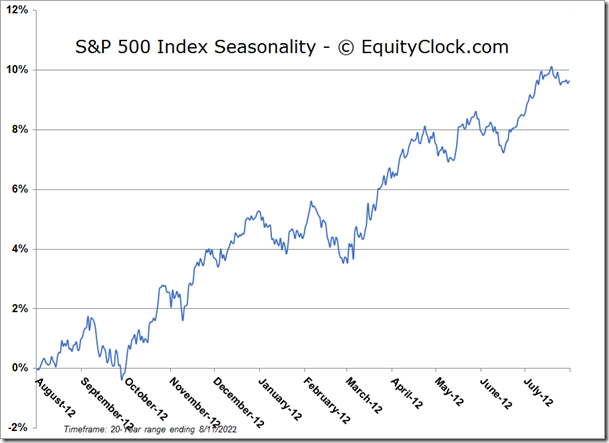

S&P 500 Index

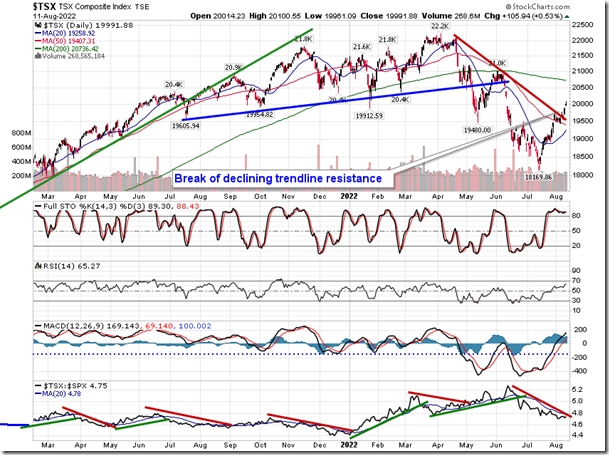

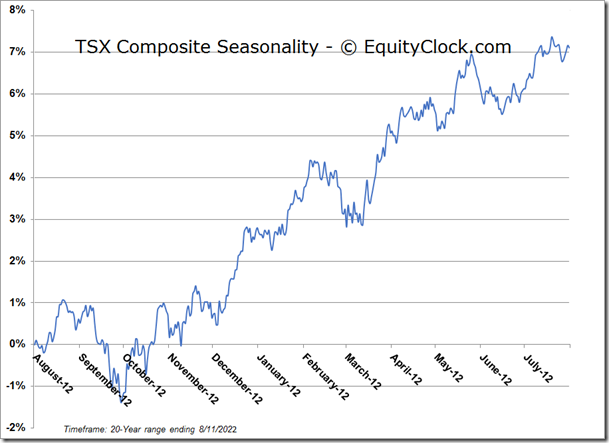

TSE Composite