While the technicals are suggesting a shift of trend in the market, the fundamentals point to the fact that the economy has yet to do the same.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

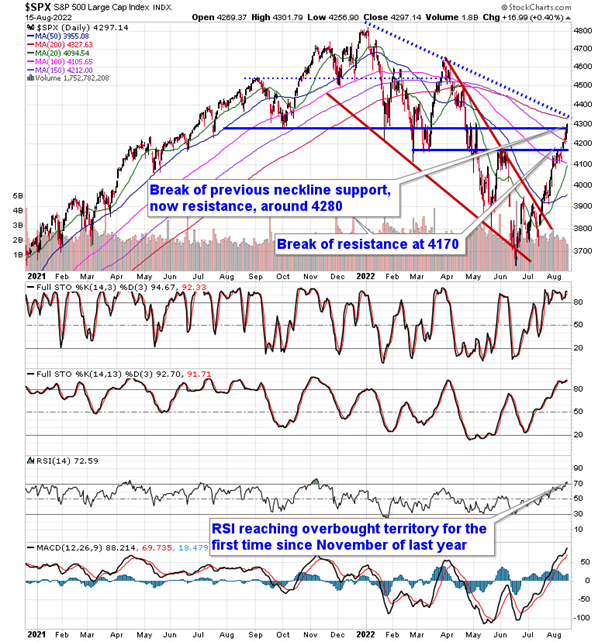

Stocks closed mildly higher on Monday as this relentless rally from the lows charted in July continues. The S&P 500 Index gained four-tenths of one percent, increasingly converging on its declining 200-day moving average at 4327. The benchmark has edged past the level that we deemed as representing the neckline to the substantial head-and-shoulders topping pattern that led to the collapse in the market during the second quarter. That former barrier was seen around 4280. The benchmark has become significantly overbought in recent days, risking upside exhaustion in the near-term, something that is keeping us cautious of putting new money to work at the present time. The Relative Strength Index (RSI) has moved firmly above 70, a milestone that was last seen at the start of November of last year. Intermediate support continues to be pegged at the 50-day moving average, which continues to show a slow grind higher from the lows seen a few weeks ago. A retracement/digestion of the recent strength back to the variable intermediate hurdle is still seen as presenting the more ideal time to be adding risk exposure to portfolios.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

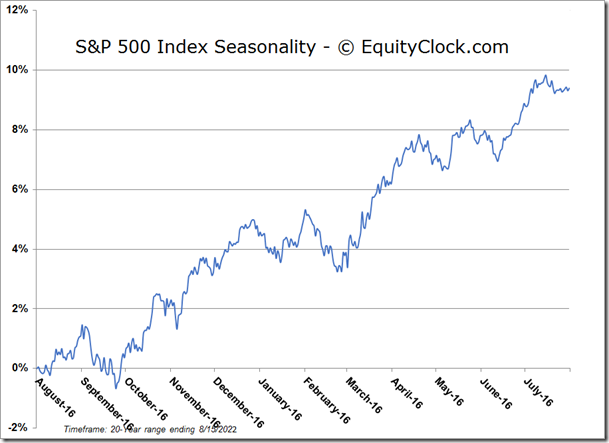

S&P 500 Index

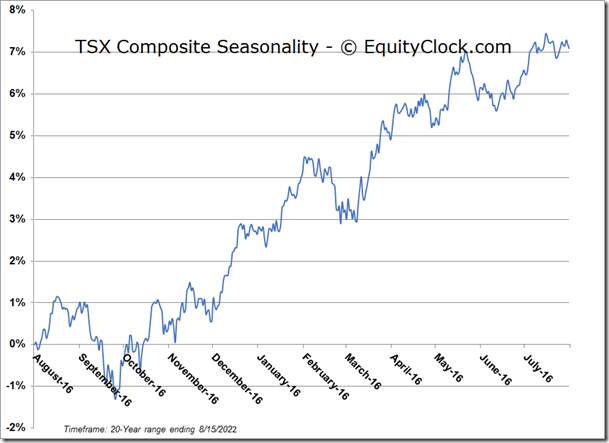

TSE Composite