Waning demand and inventories that are out of control point to a consumer economy that threatens to bring upon a recession.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

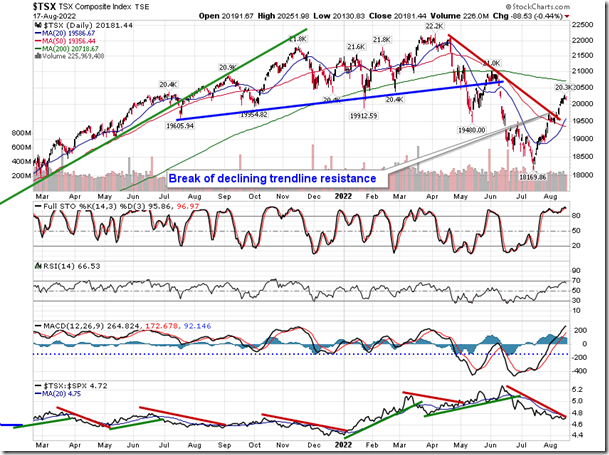

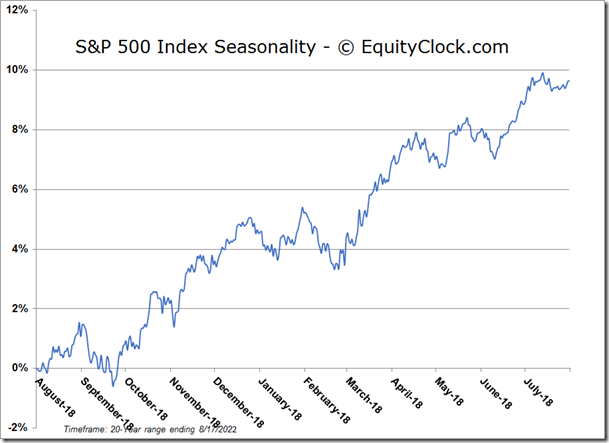

Stocks closed lower on Wednesday as major market benchmarks start to react to resistance around their 200-day moving averages. The S&P 500 Index shed just over seven-tenths of one percent after reaching within one point of its long-term hurdle in the prior session. A digestion of the recent gains is deemed to be underway, one that could see the retest of levels of support below, such as the 20 and 50-day moving averages at 4128 and 3962, respectively. The relative strength index (RSI) has rolled over from overbought territory, falling below 70 and triggering a momentum sell signal. MACD is converging on its signal line in what could amount to a similar sell signal with respect to this indicator in the days ahead. But while these momentum indicators are rolling over, they are no longer showing characteristics of a bearish trend that dominated the first half of the year and the suggestion remains that a new intermediate trend has begun, one where buying the dip will likely prove to be appropriate.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

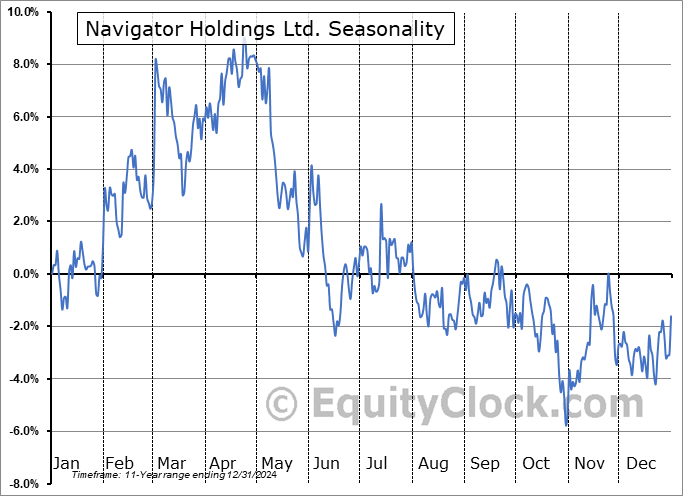

Seasonal charts of companies reporting earnings today:

S&P 500 Index

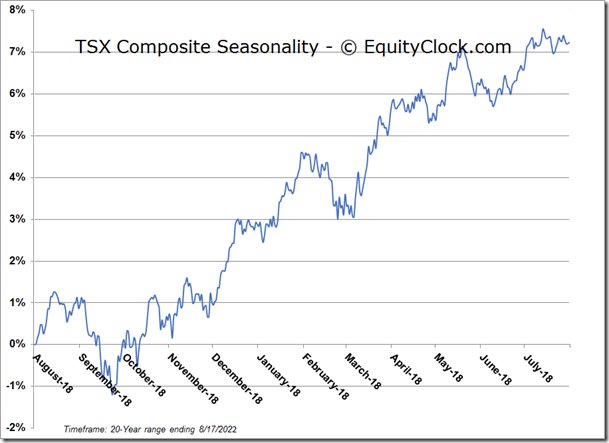

TSE Composite