After today’s session, you may need a drink and this industry that we just upgraded will cater to your need.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

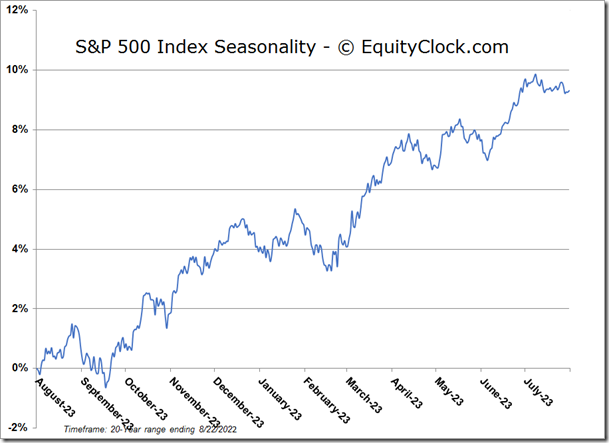

Stocks fell on Monday as the rollover of major market benchmarks from levels around declining 200-day moving averages continues. The S&P 500 Index shed 2.14%, breaking below previous horizontal support/resistance at 4170, along with its rising 20-day moving average around the same hurdle. Momentum indicators are increasingly triggering sell signals with MACD crossing below its signal line on Monday, joining the sell signal that was triggered last week with respect to the Relative Strength Index (RSI). Sell signals across the board and and rejection/failure around major moving averages suggest that the correction/pullback in the market following the early summer rally is well underway. We continue to look towards the 50-day moving average (~3969) as a logical zone of intermediate support, one that, if confirmed, would derive a higher intermediate low above the June bottom, thereby definitively shifting the trend of the market to that of higher-highs and higher-lows.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

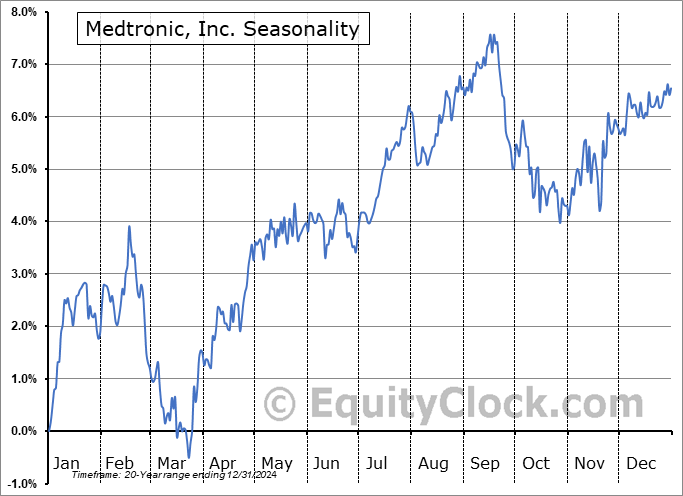

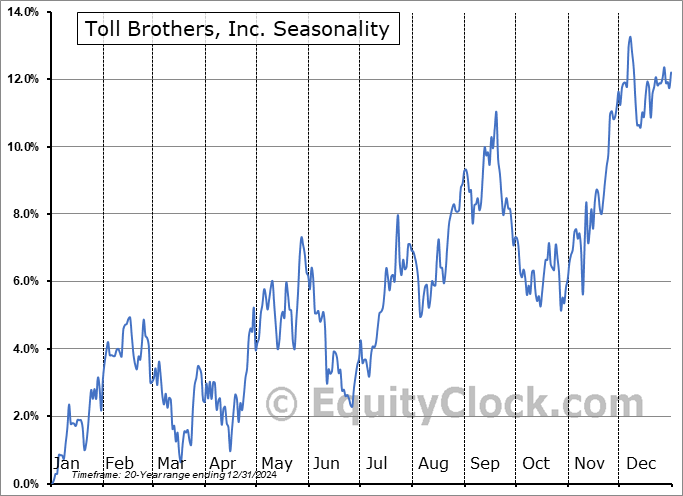

Seasonal charts of companies reporting earnings today:

S&P 500 Index

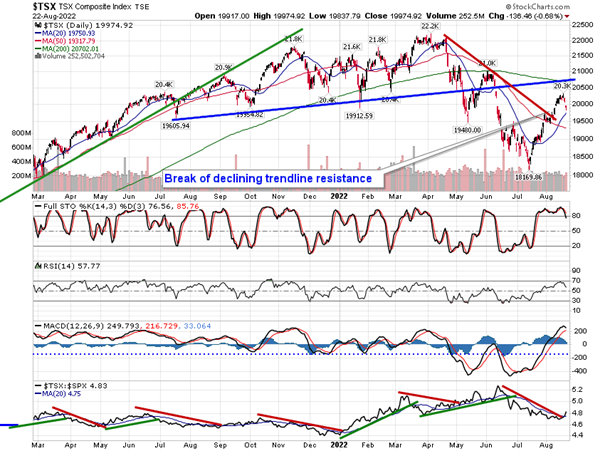

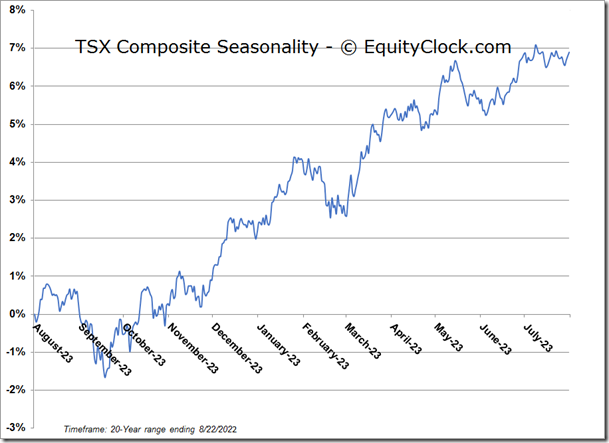

TSE Composite