With a consumer under strain, loan growth is surging as this cohort of the economy seeks to plug the hole in their finances.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

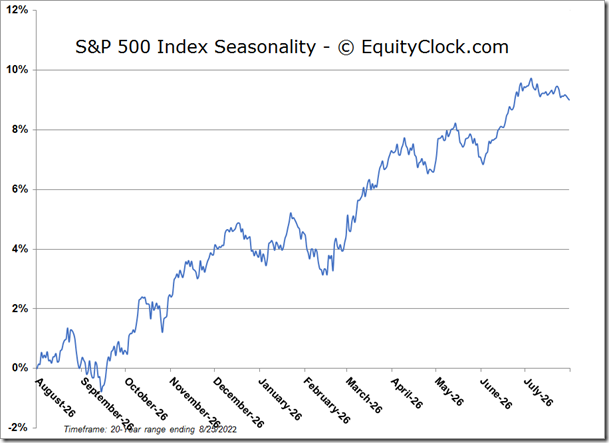

Stocks snapped back on Thursday as traders digested comments from a series of Fed speakers, ahead of the big speech by Jerome Powell on Friday. The S&P 500 Index closed higher by 1.41%, moving back above its 20-day moving average that was broken earlier in the week. The downside gap charted during Monday’s session between 4195 and 4218 is being tested as resistance, proving to be a pivotal point ahead of the big Fed event to end the week. The benchmark is recovering from short-term oversold lows seen earlier in the week, but hints of the re-adoption of characteristics of a short-term bearish trend remain. Downside risks are still down to the now rising 50-day moving average at 3990.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

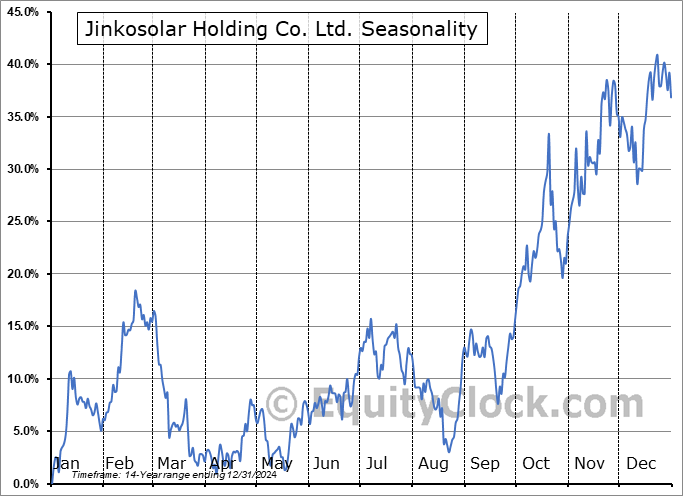

Seasonal charts of companies reporting earnings today:

S&P 500 Index

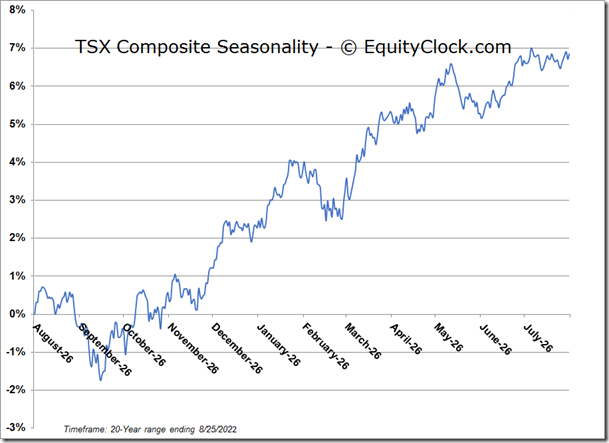

TSE Composite