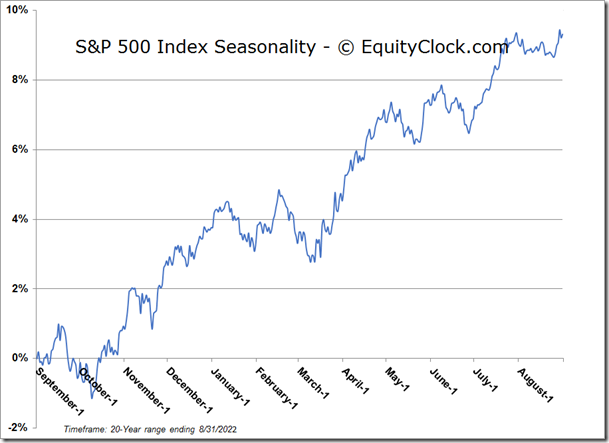

September is the most volatile month of the year, resulting in an average decline for the S&P 500 Index of 0.6% over the past two decades.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

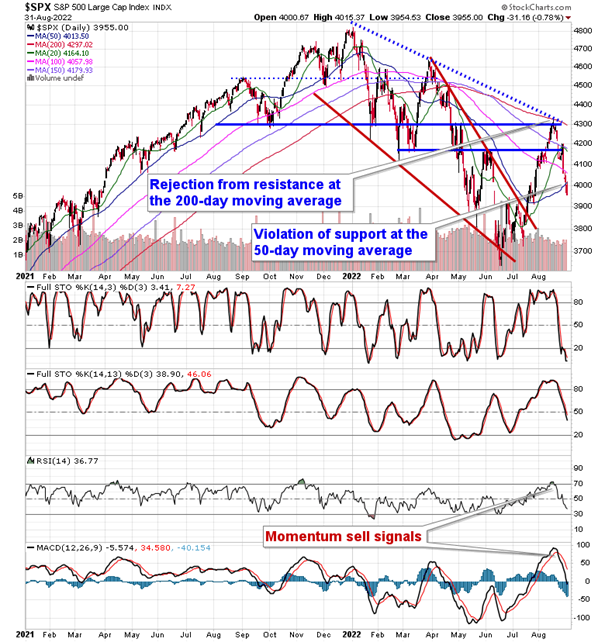

Stocks dipped in the final session of August as the giveback of the strength attributed to the summer rally continues. The S&P 500 Index closed down by nearly eight-tenths of one percent, making further progress below support at its 50-day moving average. There are still no signs that the selling momentum is fading with the MACD histogram continuing to expand negatively. This a market that is on edge and until major benchmark make a definitive turn above the June low, thereby carving out a higher intermediate low, a cautious bias in portfolio positioning remains prudent.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

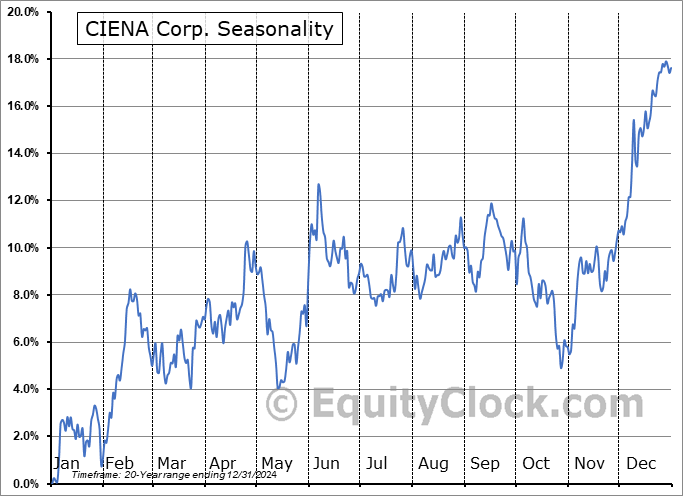

Seasonal charts of companies reporting earnings today:

S&P 500 Index

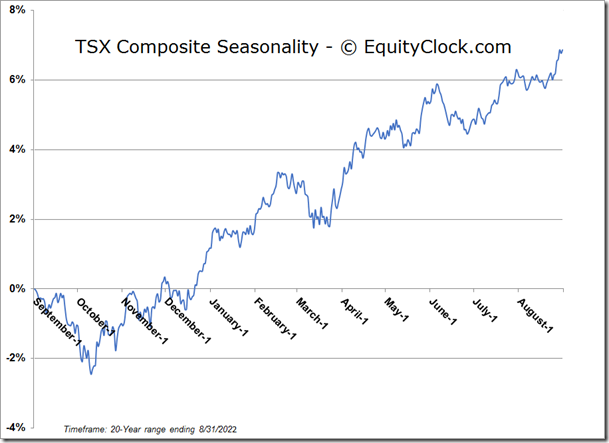

TSE Composite