The concerning economic data-points continue to stack up, this time with US Construction Spending showing a very rare July decline.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

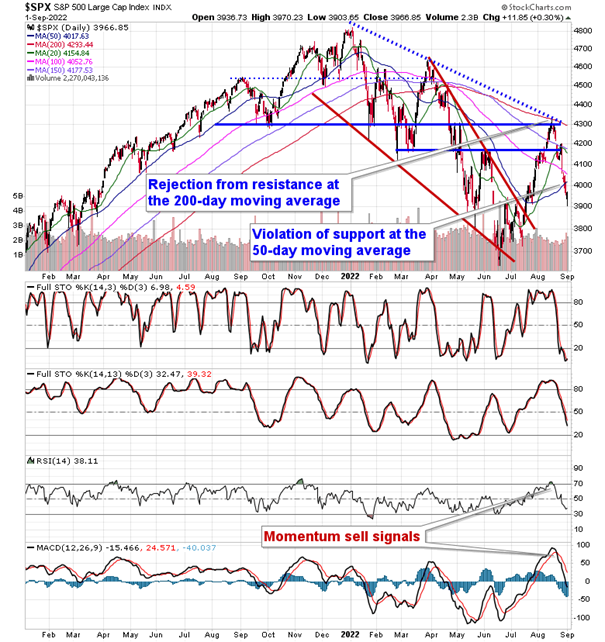

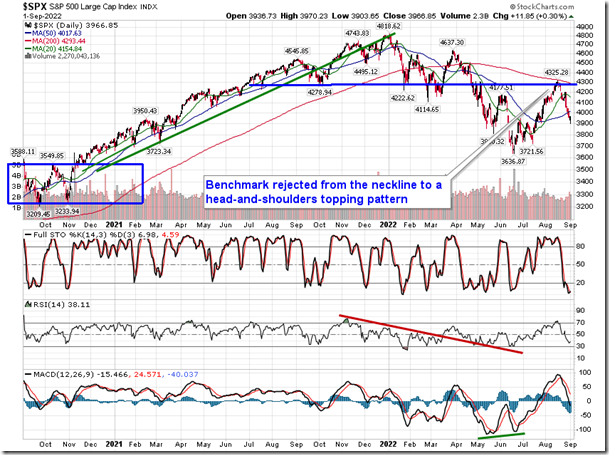

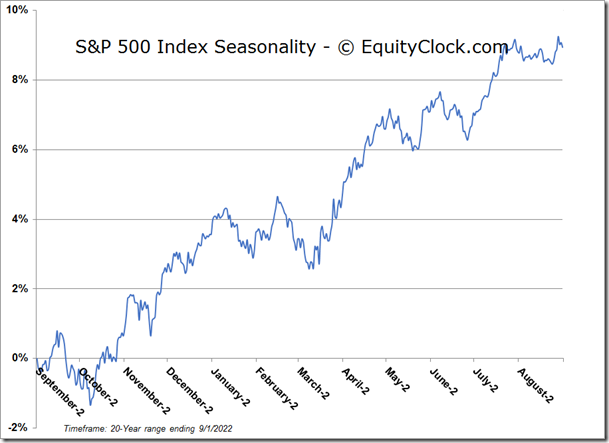

Stocks shook off concerns pertaining to higher rates and a stronger US Dollar on Thursday to close mildly higher. The S&P 500 Index closed with a gain of three-tenths of one percent, reversing a decline of over one percent at the lows of the session that saw the benchmark intersect with the psychologically important 3900 level. The benchmark remains below major moving averages and the fact that it has failed to close at or near the 20 or 50-day moving averages given the uncertainty pertaining to Friday’s payroll report is telling of the negative sentiment that has materialized in recent weeks. Typically, ahead of an uncertain/pivotal event, stocks will tend to pin themselves towards a major moving average. Momentum indicators are still pointing lower after rolling over from overbought territory just a few weeks ago and the MACD histogram continues to expand negatively, suggesting that we not yet near a new buy signal. We remain on the lookout for higher-lows with respect to RSI and MACD, along with price, above the June low, something that would provide a powerful signal that an intermediate bottom to the market is in, one that would be conducive to fuel a sustained multi-month rally. We are anxious to put our cash hoard back to work after pulling a large chunk of equity exposure upon the rejection of the S&P 500 Index from the 200-day moving average, some 250 points or so ago.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

- No significant earnings scheduled for today

S&P 500 Index

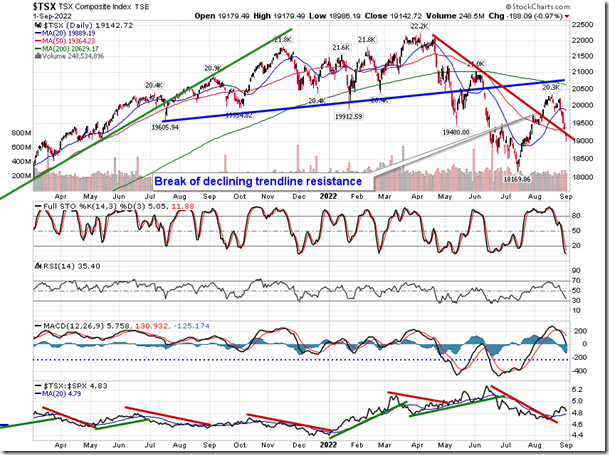

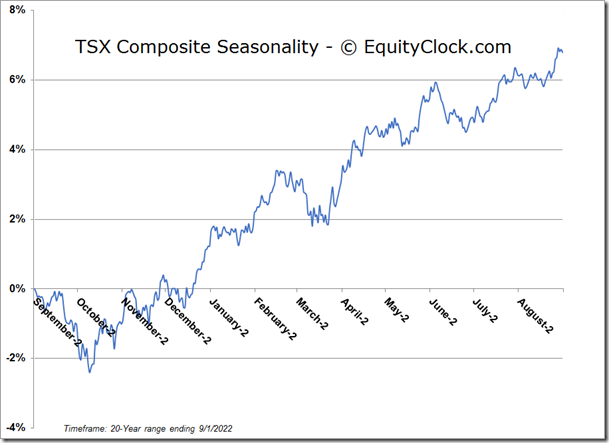

TSE Composite