Are Banks providing yet another leading indication that the intermediate-term trend of the broader market is shifting?

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

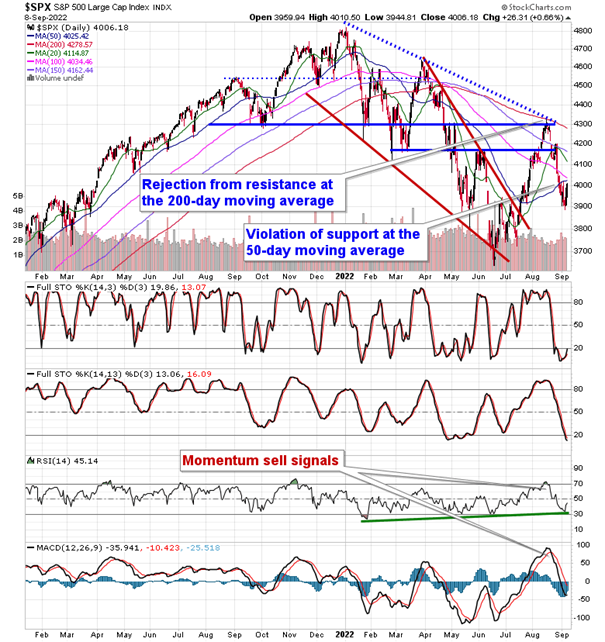

Stocks drifted higher on Thursday as strength in financials and health care helped to support the market. The S&P 500 Index closed higher by two-thirds of one percent, continuing to reach back to the still rising 50-day moving average, a pivotal hurdle to the intermediate-term trend. Momentum indicators continue curl back higher with the relative strength index (RSI) maintaining progress above rising trendline support that is presenting a significant positive divergence versus price, an indication of waning selling pressures. The MACD histogram continues to narrow in what is suggesting to be a looming buy signal with respect to this momentum indicator in the weeks ahead. Watch this test of the 50-day moving average closely as it could either make or break the recent short-term retracement lower in stocks over the past few weeks.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Upcoming Event…

Saturday, September 17, 2022 | 3:00 pm – 3:45 pm EDT

Some leading indicators are hinting that we are on the path towards an economic recession, traditionally an ideal time to abandon risk in portfolios. Jon Vialoux will show you what he’s looking at and how to best position your portfolio using seasonal analysis.

Click on the following registration link to book your FREE spot to our presentation: Register Now

Seasonal charts of companies reporting earnings today:

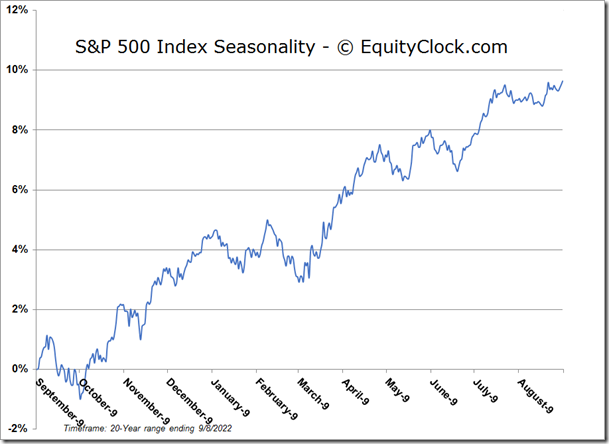

S&P 500 Index

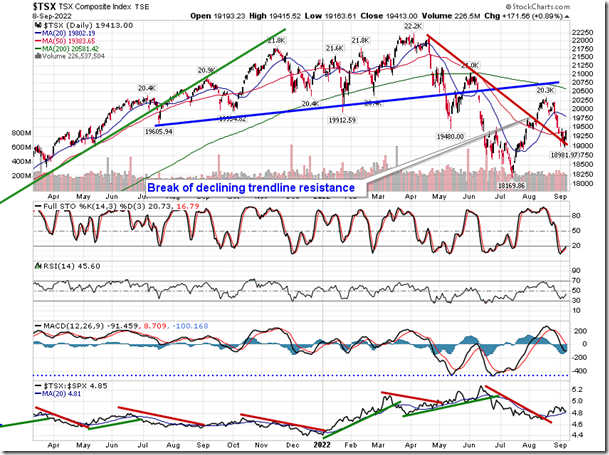

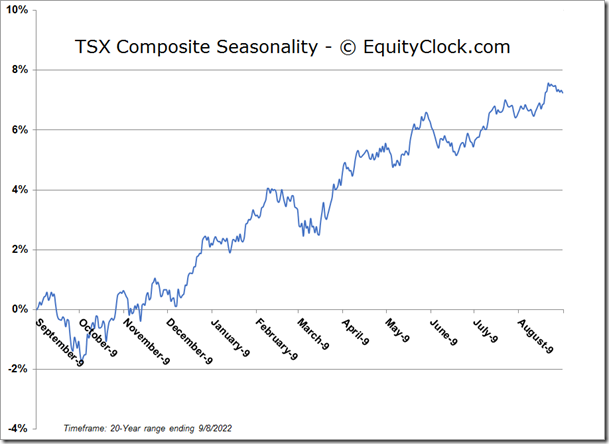

TSE Composite