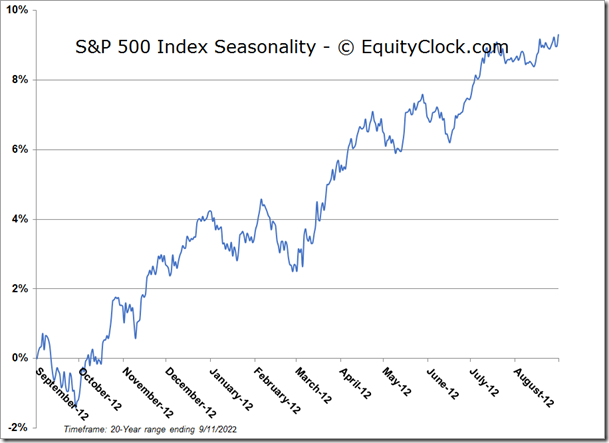

The market is providing a number of encouraging signals to suggest that an intermediate-term trend for stocks of higher-highs and higher-lows is underway.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

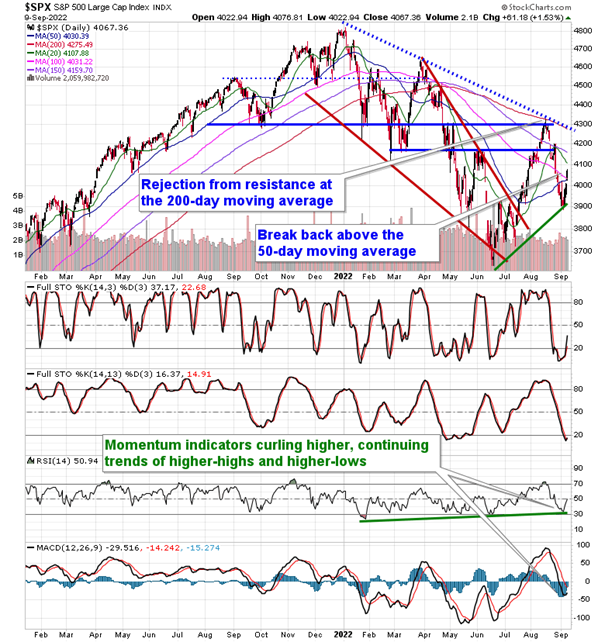

Markets jumped on Friday as a reprieve in the strength of the US Dollar and stabilization of treasury yields enticed traders back into stocks. The S&P 500 Index gained 1.53%, moving back above its still rising 50-day moving average and hinting of a higher intermediate-term low above the June bottom. The direction of this variable hurdle is often highly indicative of the direction of the intermediate-term trend and is an important input to the technical prong of our seasonal process. Momentum indicators continue to curl higher with MACD rebounding from levels around its middle line and the Relative Strength Index (RSI) rebounding from rising trendline support. Both have been trending higher for months, indicative of the waning selling pressures and reflective of a market that is moving beyond the bearish trend that dominated the first half of the year. The declining 200-day moving average at 4275 remains a threatening level overhead and evidence of the shift of the intermediate-term trend to that of higher-highs and higher-lows is likely to put this hurdle to the test.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

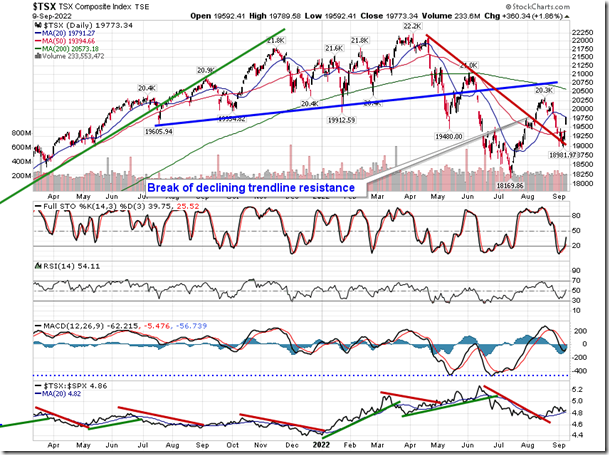

TSE Composite