A rare event for the market as the VIX gained over 4% on a day when the S&P 500 Index closed higher by over one percent. Past occurrences have been seen around significant equity market lows.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

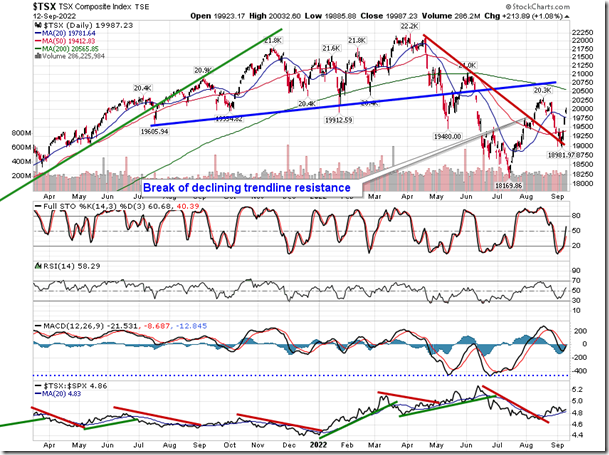

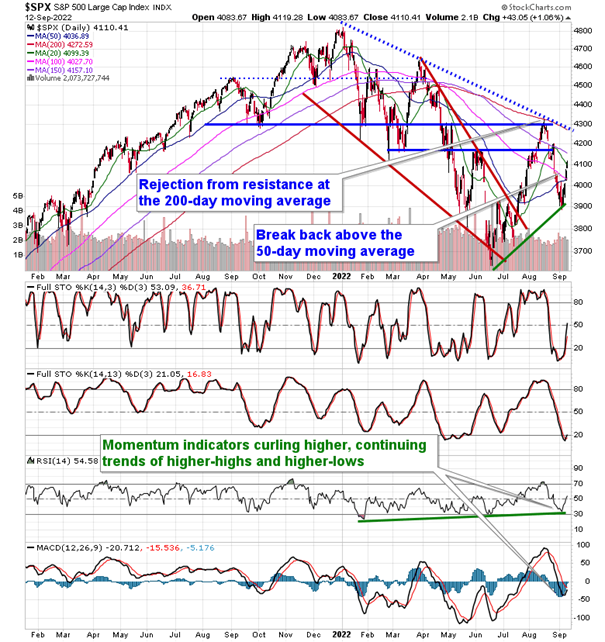

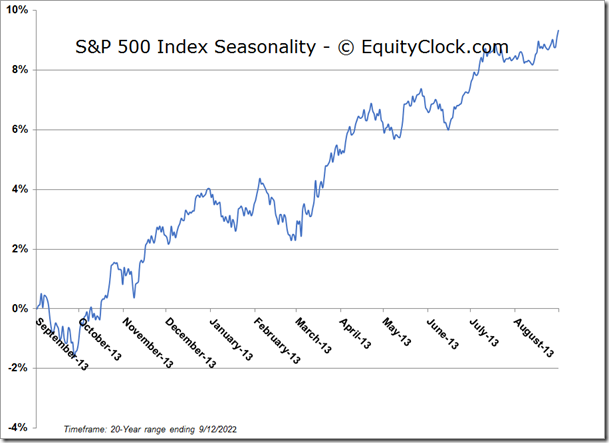

Stocks followed through with last week’s gains as traders jockey for position ahead of the pivotal Consumer Price Index (CPI) report that is slated to be released on Tuesday. The S&P 500 Index added 1.06%, continuing to make progress above horizontal support at 3900. The suggestion of the progression of an intermediate trend of higher-highs and higher-lows is implied given the ongoing positive slope of the 50-day moving average that was broken to the upside on Friday. Momentum indicators continue to curl higher after bouncing from support of their own. Horizontal resistance at 4170 is the near-term threat, but the more dominant burden remains the declining 200-day moving average and trendline resistance at 4272 given the implications that is suggests pertaining to the longer-term path of the market. Confirmation of the shift of the intermediate path of lower-lows and lower-highs realized though the first half of the year to higher-highs and higher-lows through the back half would be the kind of momentum required to break the significant barriers overhead, but it would not be surprising to realize a pause around this zone before the quarter comes to a close as part of the weakest time of year for stocks in the back half of September. This month is notorious for its volatility, therefore, while the technicals are giving plenty to be encouraged by, best to keep tight stops on allocations for what could still be some tough sledding before the more profitable fourth quarter begins in a few weeks from now.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

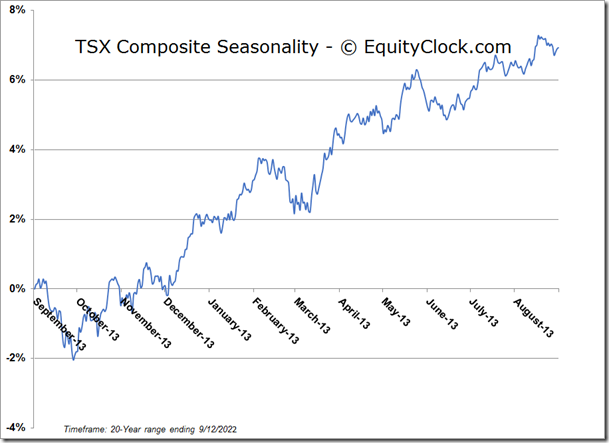

TSE Composite