“Stay the course with this low volatility bet, despite Tuesday’s abrupt turn”

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

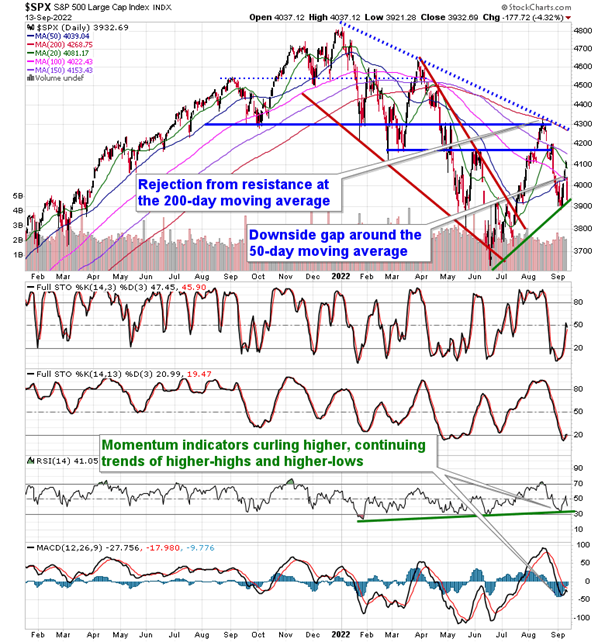

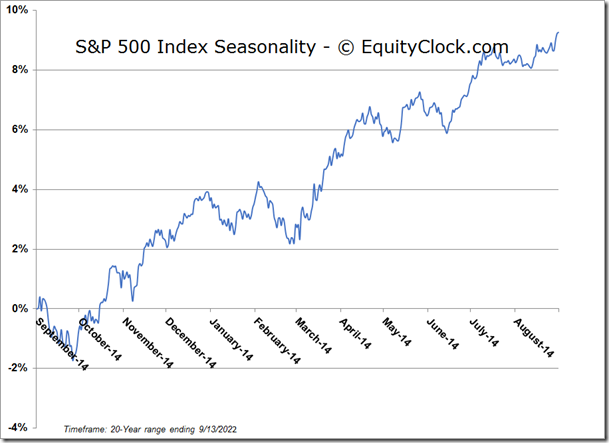

Stocks faltered on Tuesday as concerns pertaining to the state of inflationary pressures in the economy had traders selling stocks. The S&P 500 Index dropped by 4.32%, gapping back below the rising 50-day moving average that had been broken to the upside in recent days. The downside gap can be seen between 4037 and 4100, instantly creating a level of resistance for traders to shoot off of as the resumption of the positive intermediate trend realizes its first significant threat. Momentum indicators had been converging on their middle lines in recent days with MACD even on the verge of charting a bullish crossover above its signal line as positive trends continue to develop, but Tuesday’s downturn certainly gives pause to this favourable path. Horizontal support continues to be pegged around the lows of last week around 3900, providing a logical point, if broken, to re-examine our near-term positive bias of stocks given some of the favourable revelations that had materialized over the past week. September is the most volatile month of the year for the equity market, therefore wild swings, like this, are not out of the realm of possibility and we must stay on our toes until the start of the fourth quarter at the start of October when the more profitable period for stocks typically begins.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

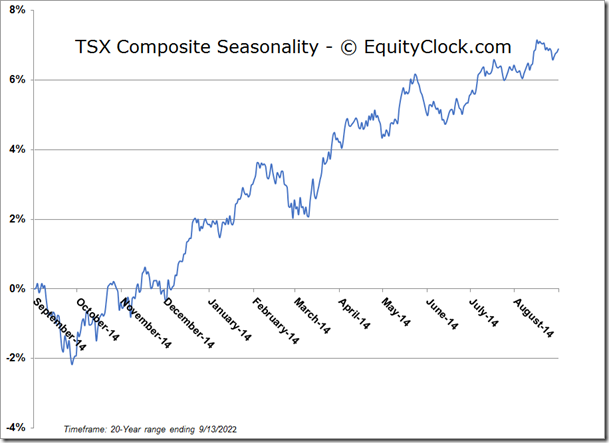

TSE Composite