Retail stocks closed higher despite a weaker than average read of sales for August, but our interest in the group is more as a gauge of sentiment in the market as a low above the June bottom attempts to be pegged.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

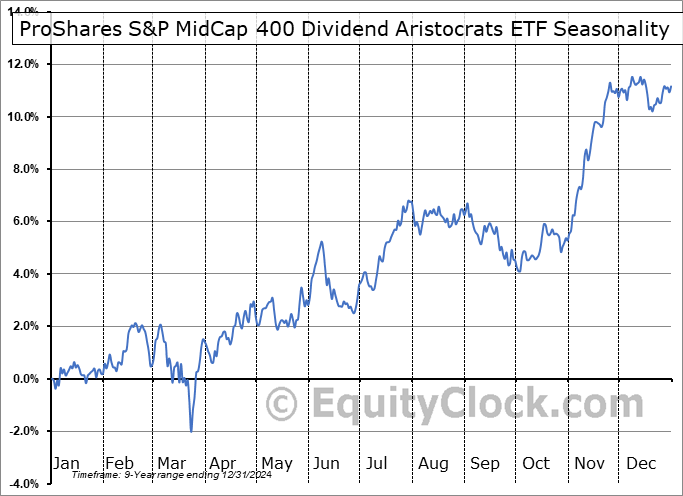

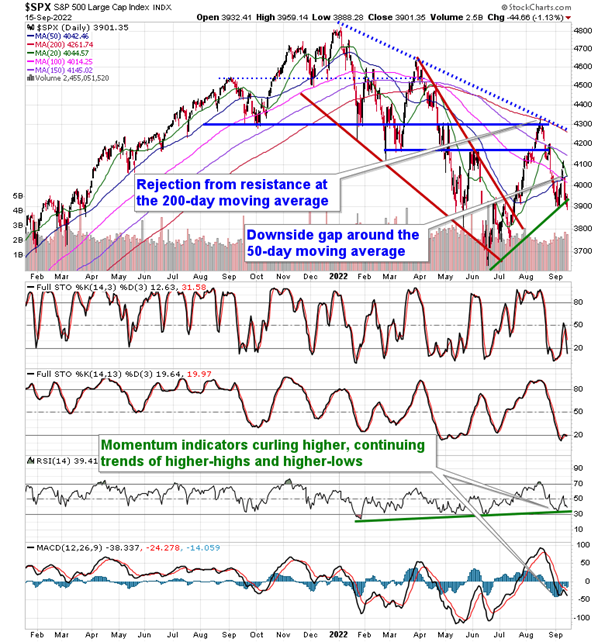

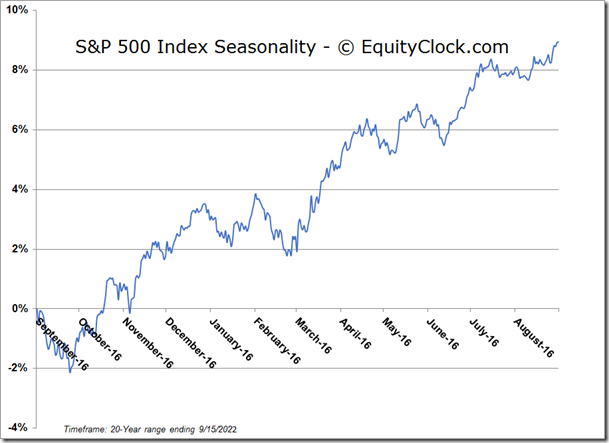

Stocks closed lower on Thursday as the market attempts to find a footing following Tuesday’s hotter than expected report on inflation in the economy. The S&P 500 Index closed down by 1.13%, ending right at the psychologically important 3900 level that has proven to be so pivotal in the past couple of weeks. Momentum indicators continue to attempt to extend their slide that started in the middle of August, although they still have a long way to go to return to levels that were recorded at the lows of the year in May, as is the case for MACD. Positive momentum divergences remain implied, signalling that selling pressures have faded since the downfall of the first half of the year, often a precursor event to the shift of the intermediate-term trend. We remain on the lookout for signs that this shift is becoming apparent, coinciding with the rise of the intermediate moving average at the 50-day, but, obviously, recent weakness has elevated the risk that this turn may not be realized anytime in the near-term. Stocks remain in their most volatile time of the year that spans the remainder of September and the month is certainly living up to its erratic history. October starts the strongest time of the year for stocks, therefore, when and if we see an turn of the intermediate-term trend of stocks, you are likely going to want to be a buyer for strength that spans the last few months of the year. For now, our core dividend holding in our Super Simple Seasonal Portfolio is providing the refuge that is desired in this volatile tape, but this is likely to provide the source of funds for higher-beta exposure to the market come the flip of the calendar into the fourth quarter.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

- No significant earnings scheduled for today

S&P 500 Index

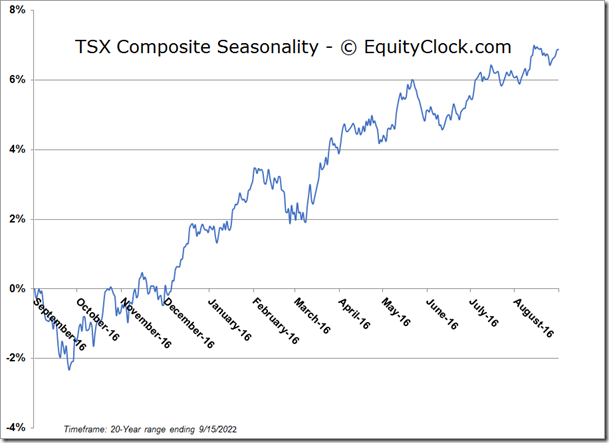

TSE Composite