Despite FedEx’s dire warning pertaining to the state of the economy (and shipping activity), Cass Information Systems is noting a significant rebound in shipping volumes in August compared to seasonal norms.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

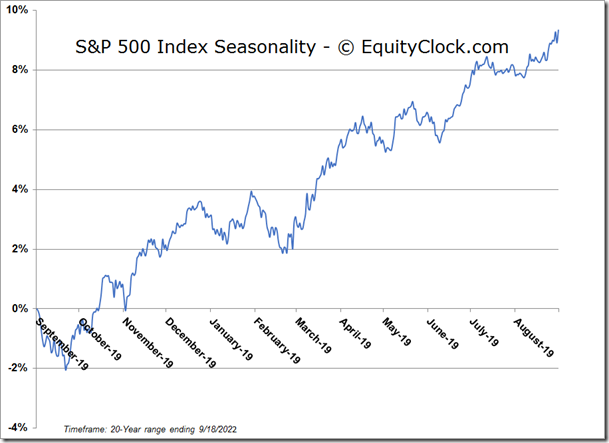

Stocks slipped on Friday following a stark earnings warning from economic bellwether, FedEx. The S&P 500 Index closed down by seven-tenths of one percent, losing support at the pivotal 3900 level and breaking rising trendline support that had been derived from the lows in June. Momentum indicators continue to push back lower with the Relative Strength Index (RSI) pressuring rising trendline support that has been in place for many months. Characteristics of a bearish trend are starting to be readopted as a near-term trend of lower-lows and lower-highs keeps stocks under pressure. The benchmark is hovering around the mid-point to its June/July consolidation range that led to the breakout summer rally that ran through the middle of August The range that is in a position of support spans all the way from 3636 to 3900, a zone that we are still on the lookout for a higher-low above the June bottom to confirm the shift of the intermediate-term trend of stocks.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

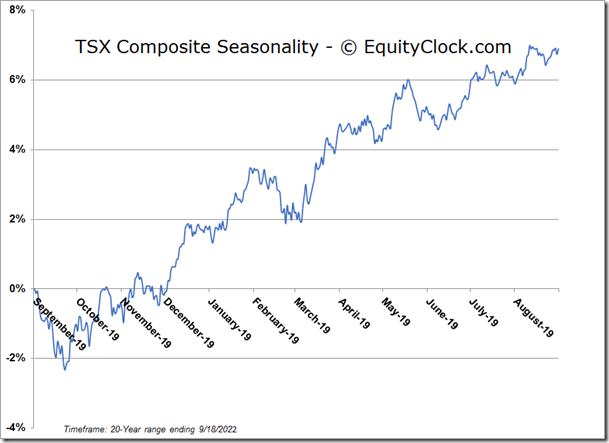

TSE Composite