The path of the S&P 500 Index is still tracking well with the performance seen in 1962, a year that also realized a drawdown of over 20% through the first half of the year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

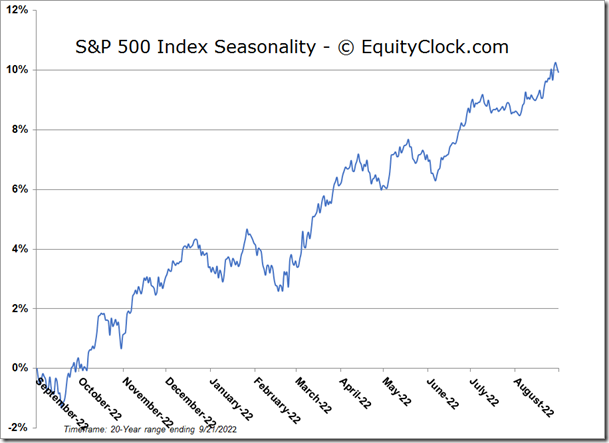

Stocks closed sharply lower on Wednesday as traders reacted to the Fed rate decision, which resulted in another 75-basis point increase in the overnight lending rate. The S&P 500 Index dropped by 1.71%, reaching further towards the June lows that are being heavily scrutinized as to whether they will in fact hold as the lows of the year. Resistance remains at the 20 and 50-day moving averages at 3976 and 4041 and the slope of the intermediate moving average continues to feel the drag of of prices below the variable hurdle. The benchmark remains in the June/July consolidation zone between 3636 and 3900, a range that continues to be pegged as support to the intermediate-term trend until, quite simply, it is broken. The intermediate turn that we have been seeking in order to become aggressive in stocks obviously remains absent at this point, but there is still not enough to pullback the reins again in the Super Simple Seasonal portfolio to lower beta back below neutral again, but we are watching our stops to our equity exposure closely, presented by the lows set at the start of September. The market has entered the heart of the traditional mean-reversion period attributed to end-of-quarter and end-of-month rebalancing, but with stocks reaching back to the unchanged mark on the quarter and firmly negative on the month, it has to be expected that much of the negativity that normally plays out through the last two weeks of September has played out. This could actually present a stabilizing effect in the near-term. In this period of volatility that is typical into the start of October, we won’t take anything as guaranteed, however, and sit with a healthy allocation to short/intermediate term bonds/cash and low volatility equities until such point that we can become confident that being aggressive again in stocks is warranted.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

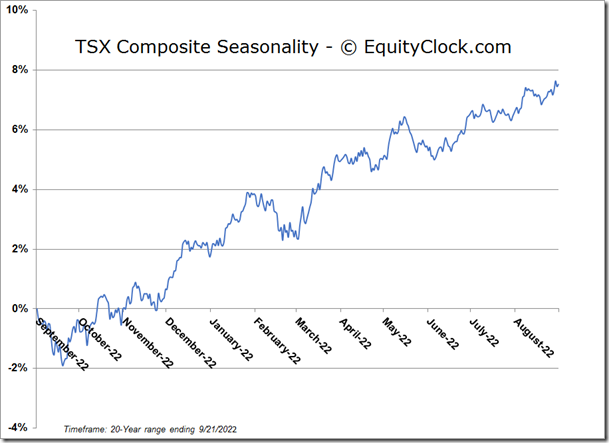

TSE Composite