The Fed may be pushing us out of bond ETFs, for now, but, as the economy falls into recession, this asset class will require a core allocation in portfolios again.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed lower again on Thursday as treasury yields soared following the Fed’s rate announcement on Wednesday. The S&P 500 Index traded down by just over eight-tenths of one percent, continuing to make progress below the 3800 level that we have been scrutinizing for months. The big test of the June/July lows is now underway, presenting the critical barrier to keep the prospect of a higher intermediate low alive that could be conducive to the back half of the year rebound that we have been seeking. The recent hotter than expected inflationary data and the more aggressive trajectory to normalize rates presented by the Fed certainly elevates the risk that the June lows will be broken as investors reset their expectations of corporate and economic fundamentals. The 50-day moving average is now showing clear signs of rolling over, presenting a blow to our positive intermediate bias that we had been attempting to latch on to in recent weeks. This intermediate hurdle remains in a position of resistance, presenting a logical level to sell into as long as the benchmark remains below. The weakest two-week span for the equity market comes to an end next week coinciding with the end of the third quarter, therefore we must still be on our toes until this period of volatility passes, but the belief remains that much of the negative mean-reversion phenomena that typically results from the last couple of weeks of the quarter has already played out. Stocks are short-term oversold, but a bear-flag pattern on the hourly chart derived by the sharp downdraft that followed the Fed statement and Thursday’s consolidation range hints that there might be another shoe to fall. Short-term oversold lows prevent us from suggesting selling equities at this point, but the technicals are certainly not at the point where we want to be aggressive as part of our forecast for the back half of the year rebound following the first half of the year downfall. Fortunately, the market can set aside the rogue tape bombs of the past couple of weeks and focus on something other than inflation and interest rates as earnings season gets underway soon, a period that can lead to early and late October strength encompassing the periods before and after the start of this pivotal timeframe.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

- No significant earnings scheduled for today.

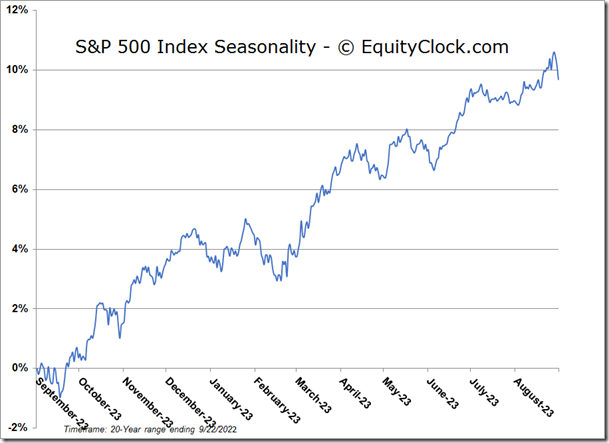

S&P 500 Index

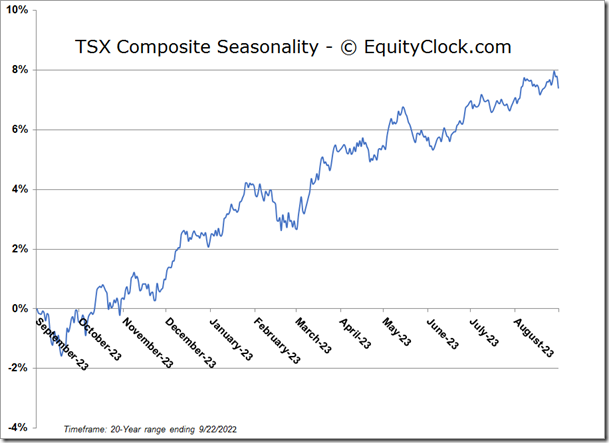

TSE Composite