The S&P 500 Index is starting the new month and quarter with a bounce from its rising 200-week moving average, a variable hurdle that in modern history has only been broken during periods of defined economic recession.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks rallied to start the new month and the new quarter as the market attempted to move past the negativity that dominated the month of September. The S&P 500 Index jumped by 2.59%, moving back above recently broken support at 3636. Momentum indicators continue to show early signs of rebounding from oversold territory with the Relative Strength Index moving back above 30 and the MACD histogram continuing to narrow. MACD itself is showing initial support around the May/June lows, not providing the confirmation that last weeks breakdown in price below the equivalent level was definitive. Major moving averages, including the 50-day, are still pointed lower, which, until the trajectory shifts, provide hurdles to sell into in order to lighten up on equity exposure in the near-term. The market has entered into the more profitable fourth quarter of the year, a period that typically sees volatility fall off from its third quarter ramp, and we remain on the lookout for evidence of a shift of the intermediate-term trajectory of the market, one that will lend itself to the back half of the year strength following first half of the year weakness that we have been forecasting since the year began.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

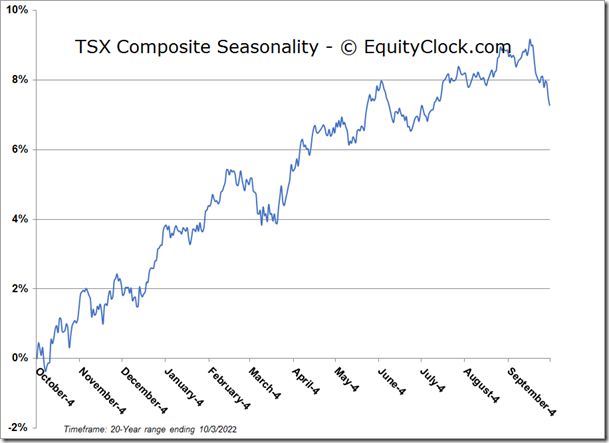

S&P 500 Index

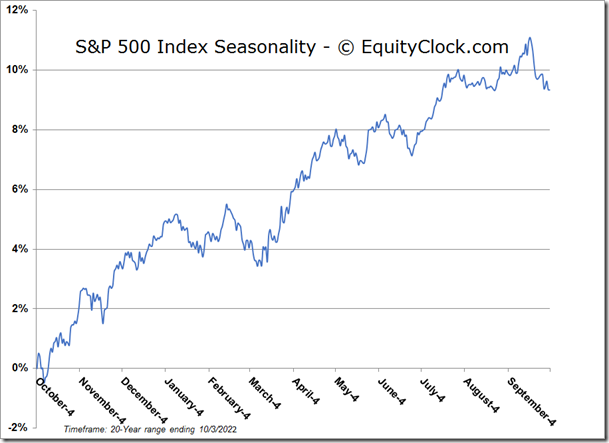

TSE Composite