The trends of employment continue to point to the degradation of the consumer economy, something that threatens an economic recession in the year(s) ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

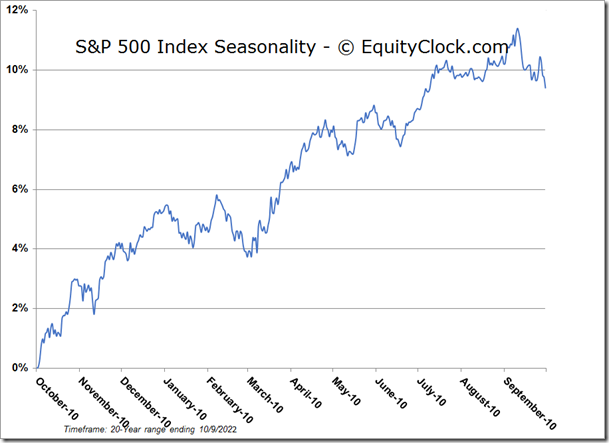

Stocks ended the week on a sour note as a stronger than expected payroll report for September stoked renewed fears that the Fed would continue to aggressively raise rates for the foreseeable future. The S&P 500 Index slid by 2.80%, closing right at the June low that has been so pivotal to the market over the past couple of months. Momentum indicators are quickly losing any positivity that had been derived by early week strength, although MACD has yet to cross back below its signal line in what would amount to a renewed sell signal. Characteristics of a bearish trend remain firmly entrenched. Friday’s downfall gaps back below the upside gap that was charted on Tuesday at 3700, emphasizing the significance of this zone and what was a level to shoot off of on the long side now becomes a hurdle to shoot off of on the short side. Major moving averages remain in positions of resistance, including the 20-day moving average at 3782 and, more importantly, the 50-day at 3985. As has been highlighted, using the major moving averages to sell into in order to lighten up on equity exposure remains the prudent course of action until the intermediate path of the market definitively shifts. Friday’s gap lower has once again confirmed that this is a market that is more willing to ignore levels of support while holding firm at levels of resistance, which is not the technical backdrop to be aggressive in portfolio positioning.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

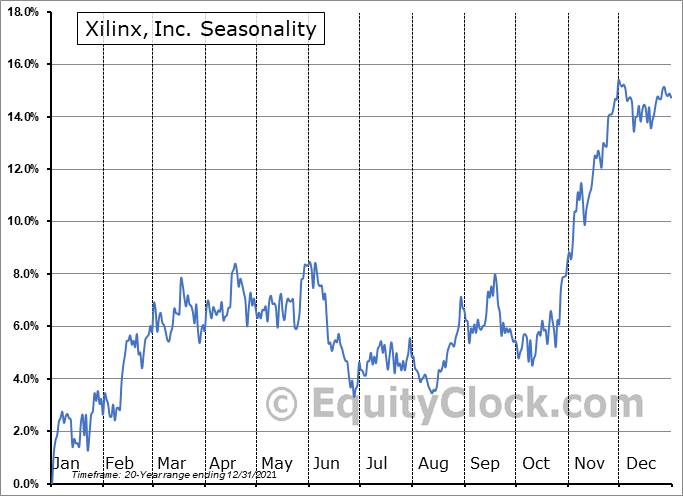

Seasonal charts of companies reporting earnings today:

- No significant earnings scheduled for today

S&P 500 Index

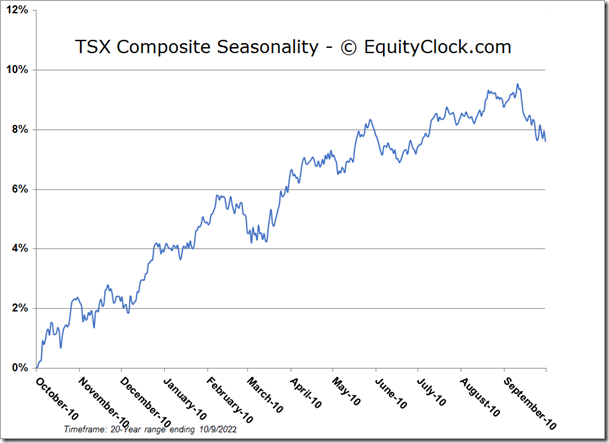

TSE Composite