As we near the period of seasonal strength for retail stocks heading into the holiday period, we are unable to check the fundamental prong to our approach to justify inclusion in seasonal portfolios.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

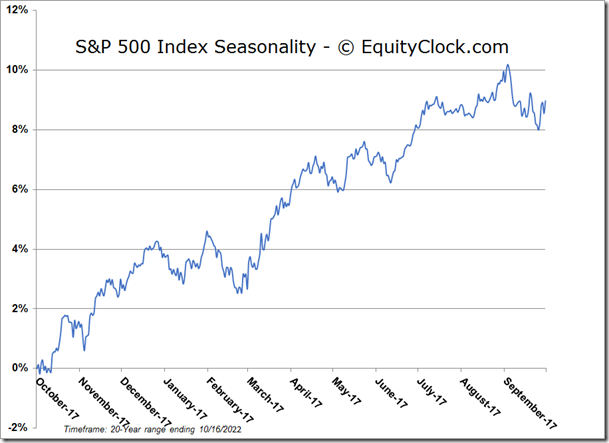

Stocks suffered through another tough session on Friday, giving back much of the prior session’s gain, as investors weighed ongoing inflation concerns and the threat of a recession ahead. The S&P 500 Index traded lower by 2.37% after being rejected again from its declining 20-day moving average at 3695. Declining moving averages at the 20 and 50-day continue to provide hurdles to sell into in order to alleviate equity exposure within portfolios until such point that the trajectory of the intermediate path of the market shifts. While momentum indicators continue to show characteristics of a bearish trend below their middle lines, a slight positive divergence versus price has developed over the past couple of weeks, signalling waning downside pressures. The revelation could potentially be signalling that the worst of this short-term down-leg in the market that has been underway since the middle of August is coming to an end, leading to the test of aforementioned resistance at the 50-day moving average, now at 3933.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

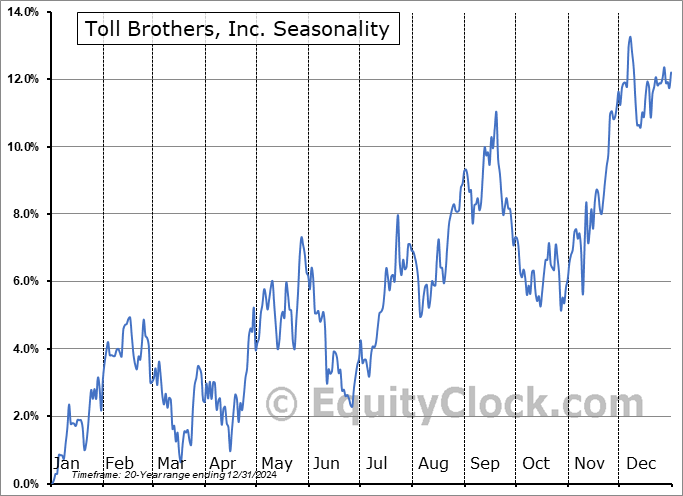

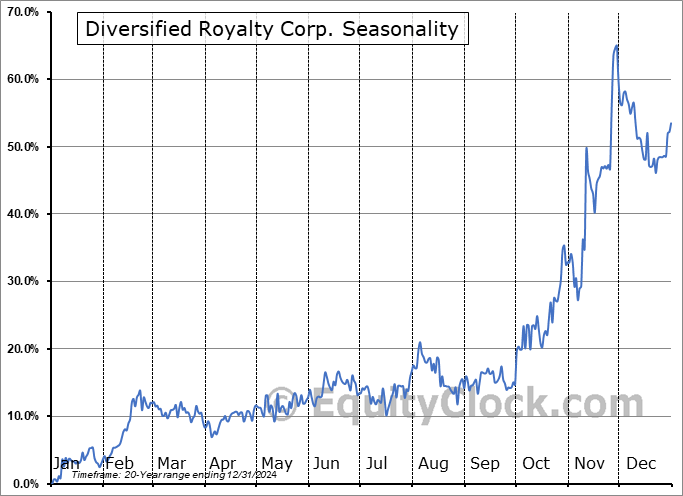

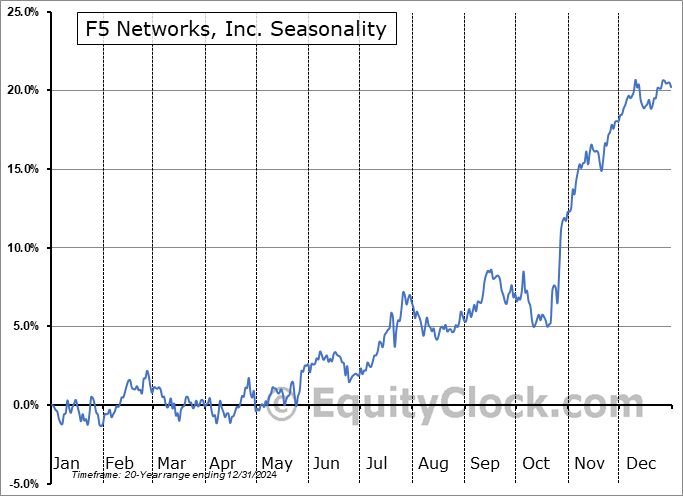

Seasonal charts of companies reporting earnings today:

S&P 500 Index

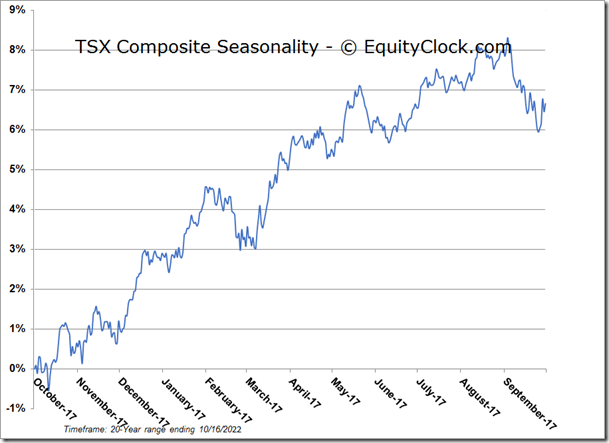

TSE Composite