The new 52-week high list of stocks has stopped falling, hinting of the conclusion of the near-term declining trend of the equity market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

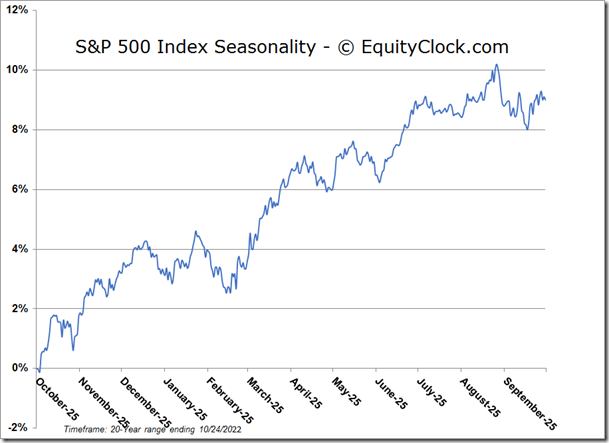

Stocks rallied to open the week as ongoing hints of a peak in yields and a peak in the dollar is sending investors back into the equity market. The S&P 500 Index gained 1.19%, moving back towards the early October high and increasingly carving out a short-term bottoming pattern around this summer’s lows. Support continues to be pegged at the 20-day moving average, while resistance is viewed at the declining 50-day moving average, a level that, until broken, provides a hurdle to sell into in order to reduce equity exposure. Positive momentum divergences versus price remain intact, something that alerted us to the waning selling pressures prior to this multi-day rally attempt. The best six months for stocks running from November to April is directly ahead, a logical time, at least through the end of the year, to see stability return to the market following a treacherous year for price.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

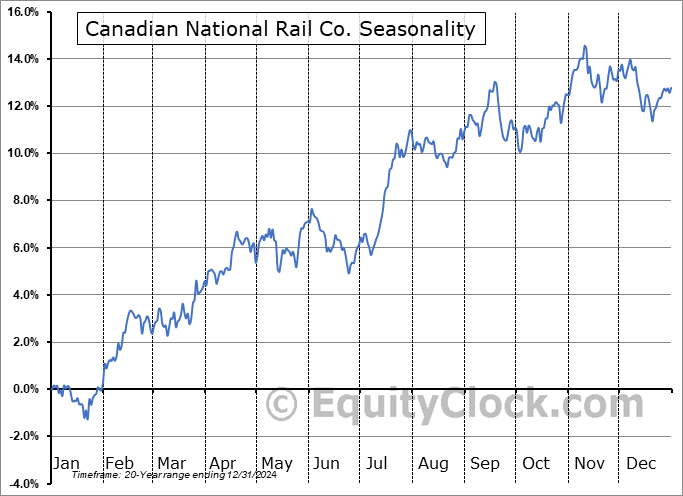

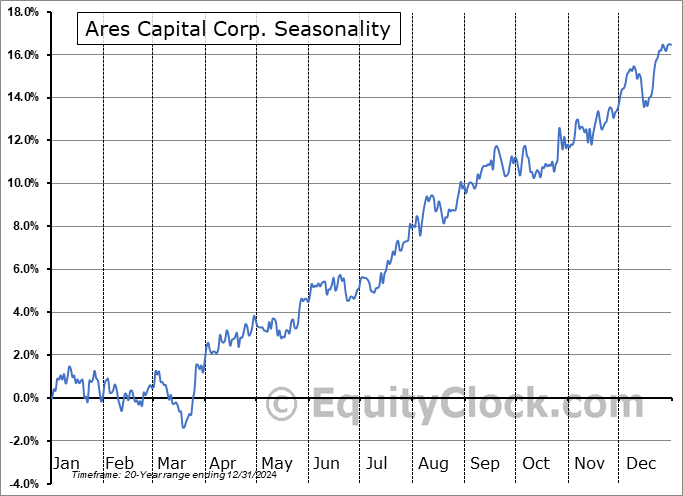

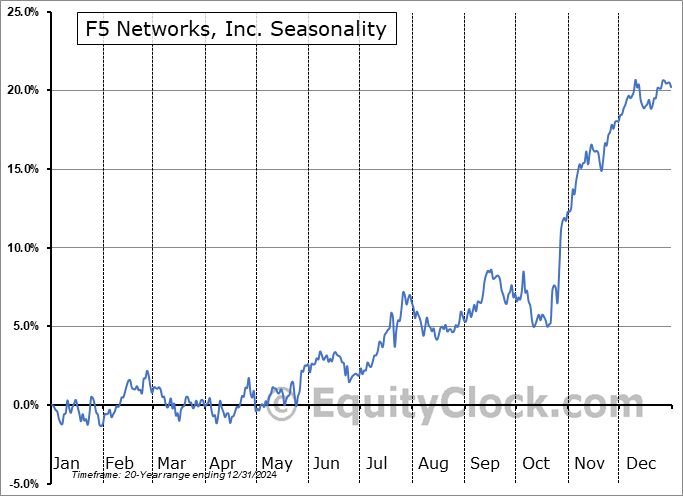

Seasonal charts of companies reporting earnings today:

S&P 500 Index

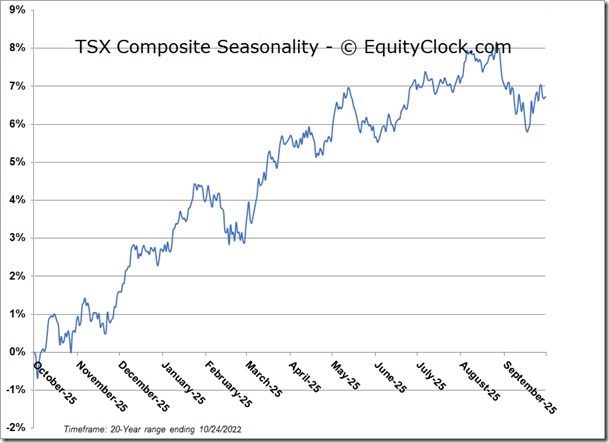

TSE Composite