Defensive sectors are bouncing from defined levels of horizontal support, providing levels to shoot off of amidst a risk-off shift in the market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

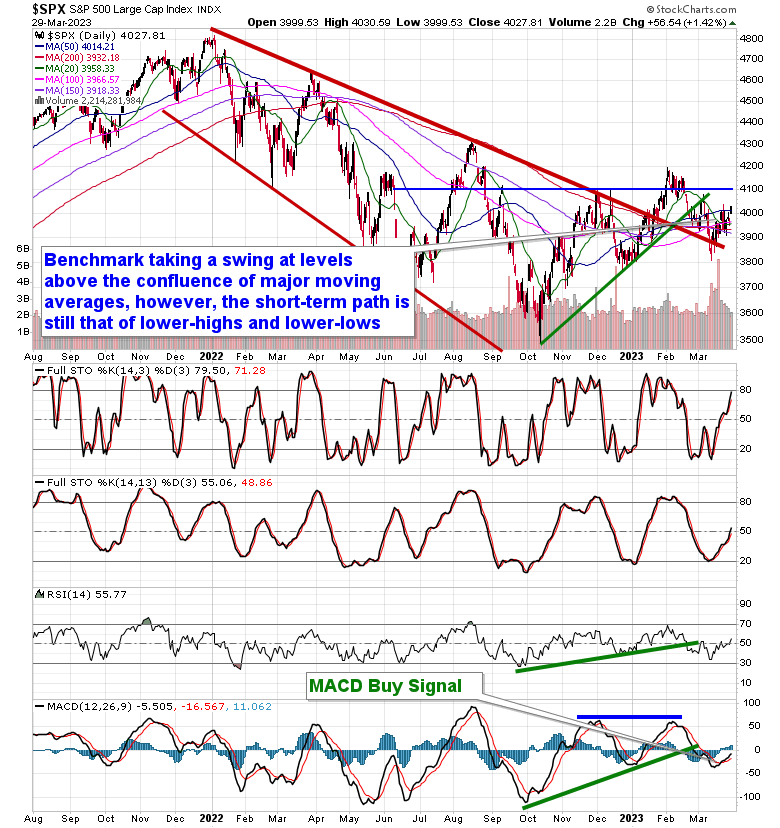

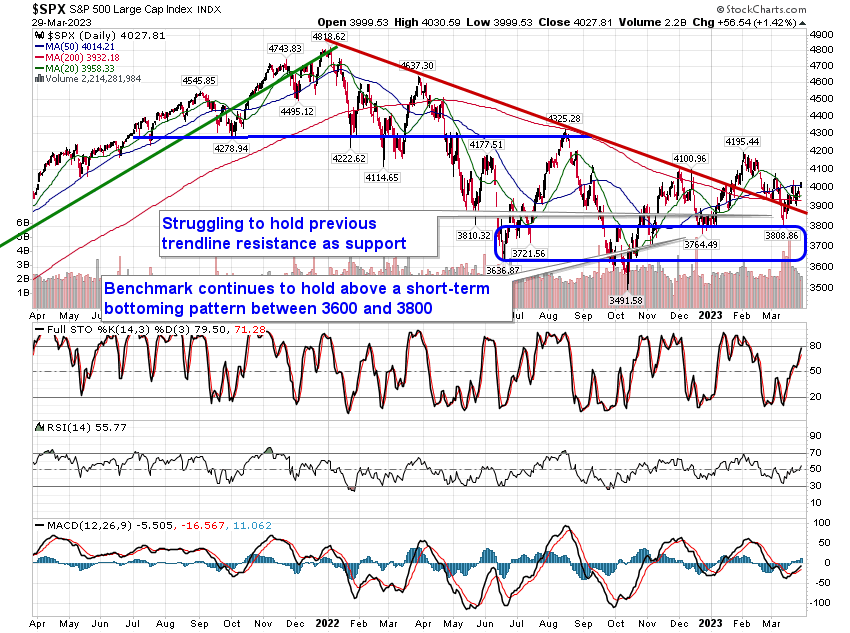

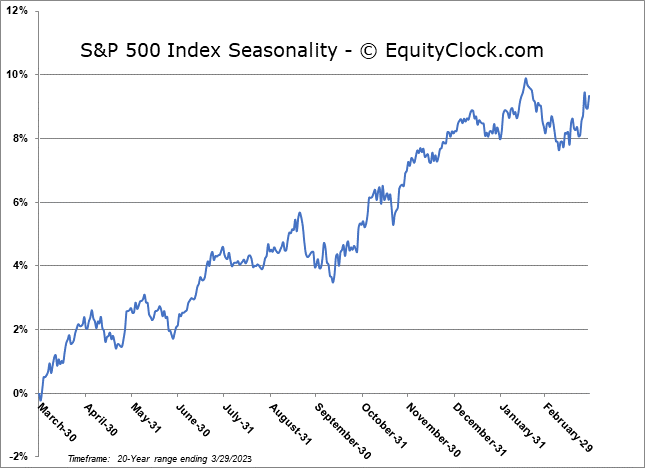

Stocks rallied on Wednesday as portfolio managers padded their books with some of this quarter’s winners in the technology sector. The S&P 500 Index closed with a gain of 1.42%, inching above intermediate resistance at the 50-day moving average at 4014 and moving marginally above the confluence of resistance at major moving averages in the range of 3900 to 4000. Despite the break, a short-term trend of lower-lows and lower-highs remains stemming from the peak charted in February. A similar path of lower-lows and lower-highs can be seen of the MACD indicator, highlighting the lack of momentum in the market amidst macro fundamental strains. Concerns on the fundamental and technical front have kept us cautious, but we still don’t have reason to deny the potential of the strength in the equity market that is normal for March and April. In the Super Simple Seasonal portfolio, we have a healthy balance of offence (stocks) and defence (bonds), but any strength that is revealed in stocks through the month ahead will likely provide the opportunity to peel back on our risk exposure and hunker down for what seems probable to be a weak period for equities during the traditional off-season for the market.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

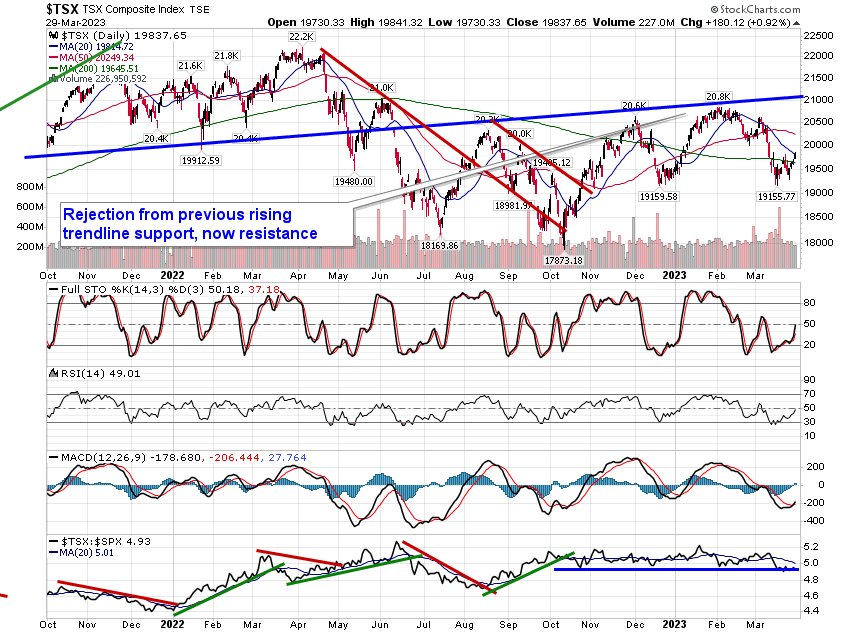

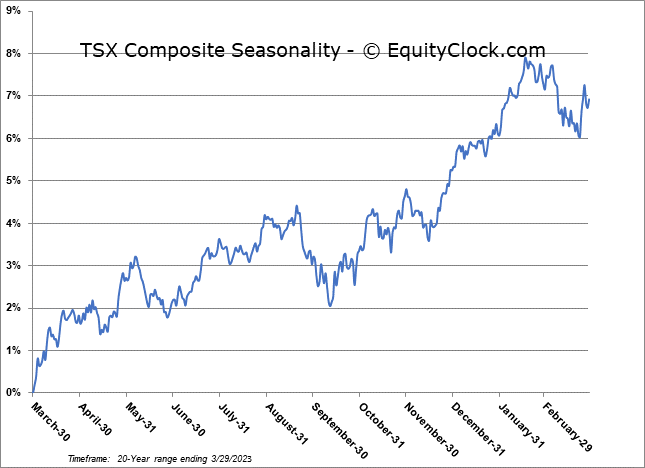

TSE Composite