Intermediate techncials of the market remain undamaged heading into the new quarter.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

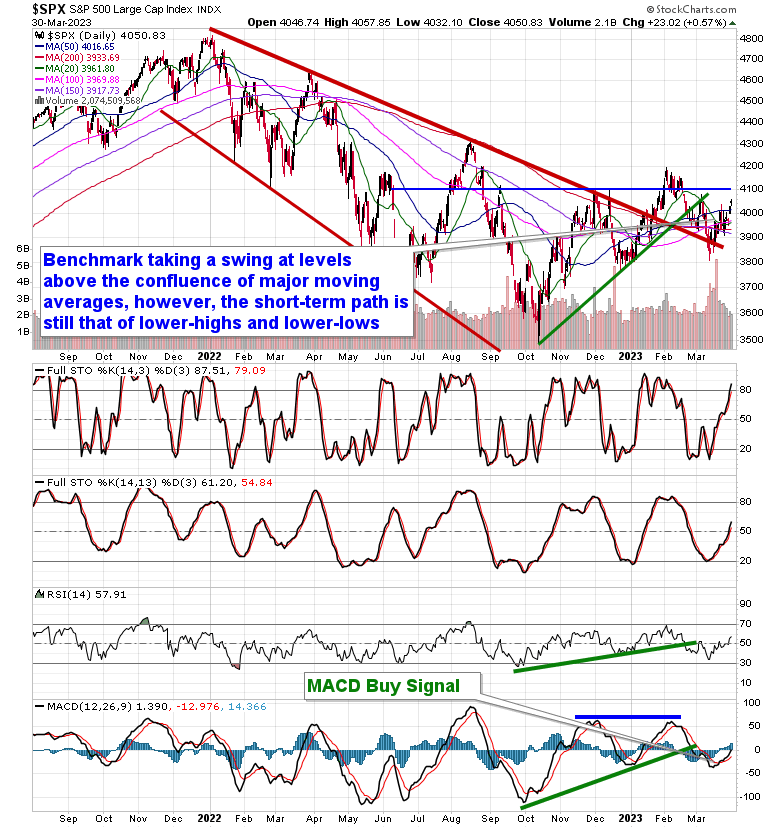

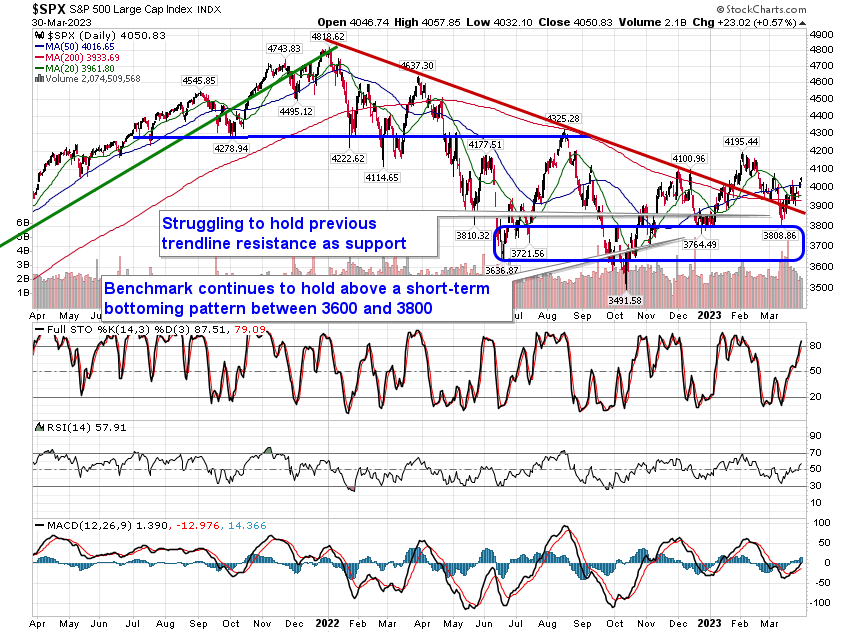

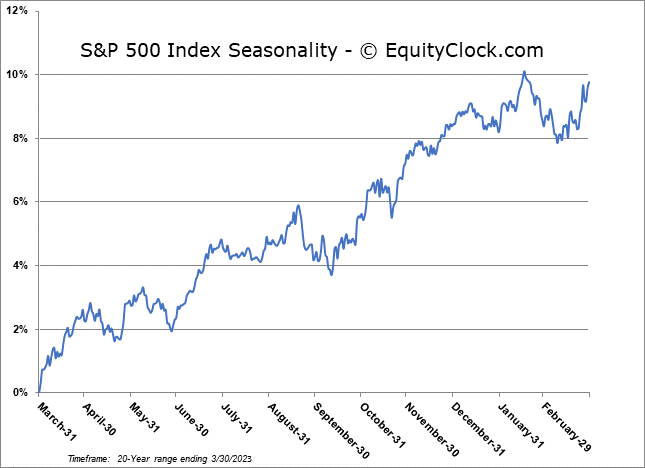

Stocks continued to push higher into the end of the quarter as investment managers pad portfolios with many of this quarters winners in the Technology sector. The S&P 500 Index posted a gain of just less than six-tenths of one percent, charting a rather indecisive doji candlestick above resistance at the 50-day moving average. The benchmark is making incremental progress above the recently highlighted confluence of major moving averages between 3900 and 4000, but the bulls are clearly showing hesitation running away with the ball with the fundamental uncertainties that persist. The end of the first quarter notoriously has an upside bias for stocks, a phenomenon that leads into another strong month in April, but our concern is how stocks will perform when they do not have these seasonal tailwinds behind them as we get later into April and into the month of May. Keep tabs on our weekly chart books for segments that warrant buying as constituents on our Accumulate list continue to perform very well.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

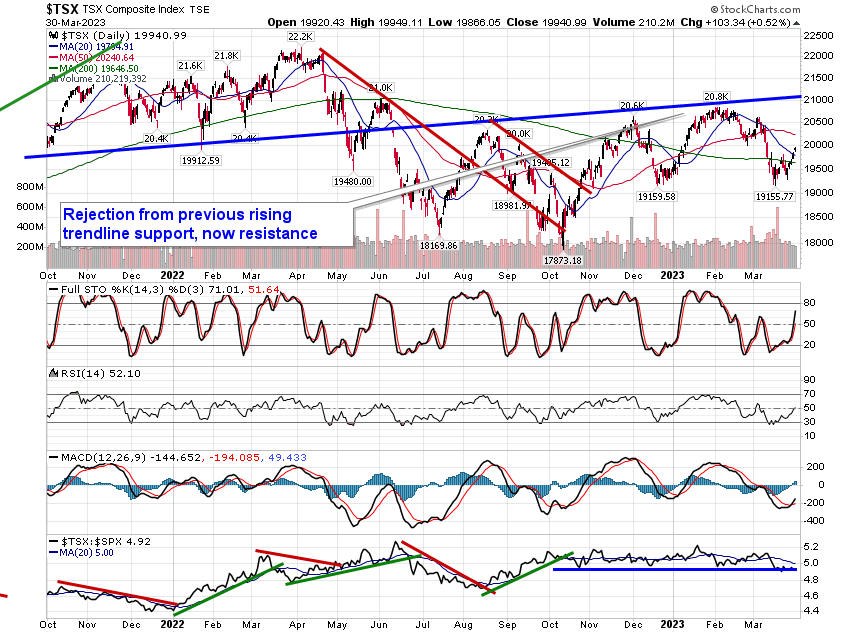

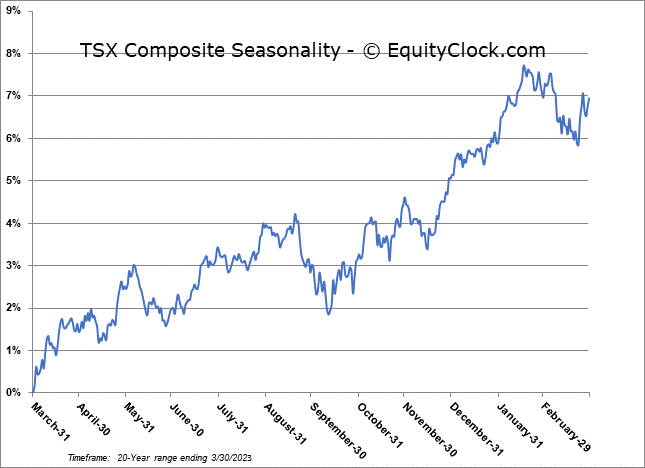

TSE Composite