The market is finding relief in the alleviation of producer inflationary pressures, however, the weakness in prices is consistent with past manufacturing recessions.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

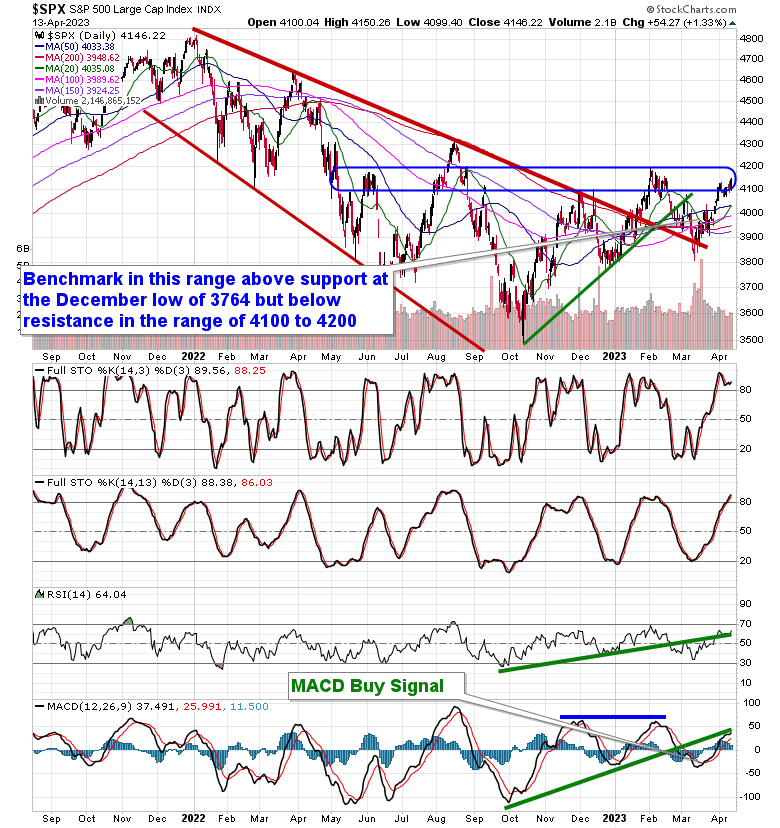

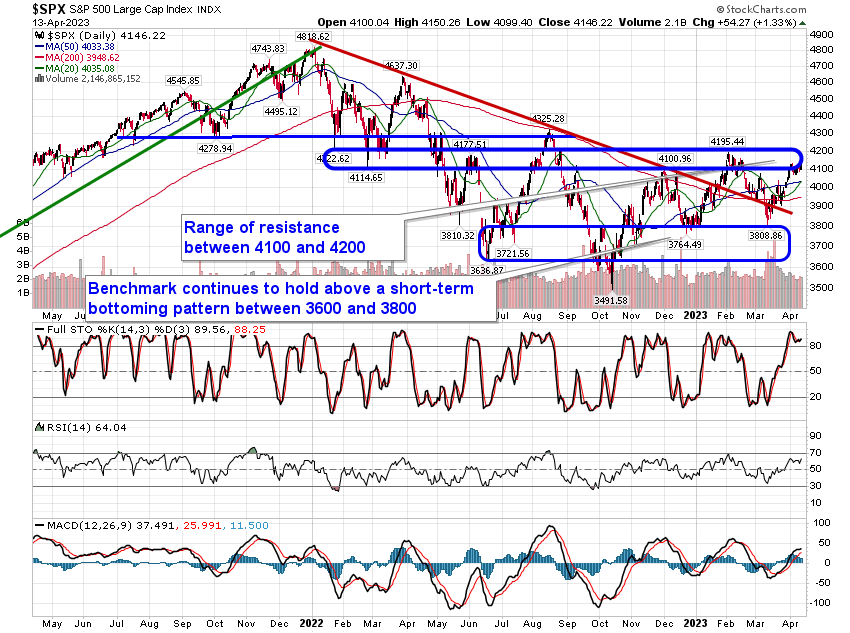

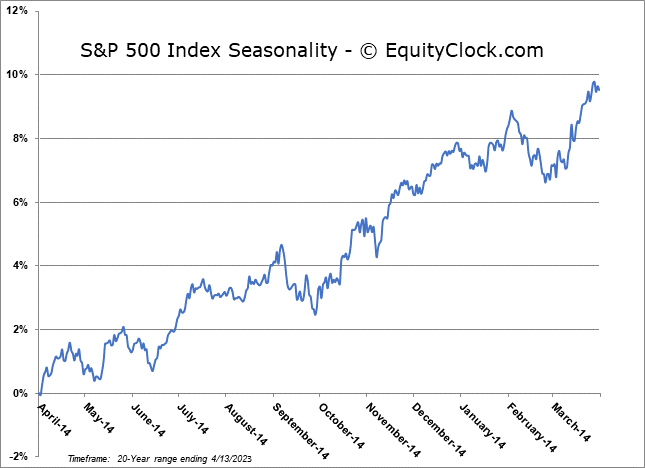

Stocks surged on Thursday as another gauge of inflationary pressures in the economy showed signs of alleviation, suggesting that the Fed’s aggression in normalizing policy is no longer necessary. The S&P 500 Index closed with a gain of 1.33%, remaining in this range of resistance between 4100 and 4200 that has capped the benchmark since May/June of last year. MACD received a reprieve from the rollover that was being observed in the prior session, but the contraction of the MACD histogram remains in place as the technical indicator converges with its signal line. Just a few more days remain to contribute to Investment Retirement Accounts (IRA) before the deadline on April 18th, a phenomenon that typically supports stocks in the weeks surrounding the event as new money is put to work and as investors position around the start of the first quarter earnings season that gets underway on Friday. We still don’t have the signals to outright abandon risk from investment portfolios, despite the fundamental risks that continue to grow, and we continue to be attracted to those groups in our weekly chart books that are listed with an Accumulate ratings. Inevitably, April strength is still viewed to likely be the last opportunity to transition towards a more defensive portfolio for the potential of a recessionary decline in the market that could be realized through the months ahead. The next turning point in our forecasted general direction of stocks that we proposed at the end of last year is between April 26th and May 8th, following which the trend that is expected of the equity market is negative until we get later into the summer. As always, we will follow the three prongs to our approach (seasonal, technical, and fundamental) to act as the catalyst to determine what and which areas are appropriate under the circumstances.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

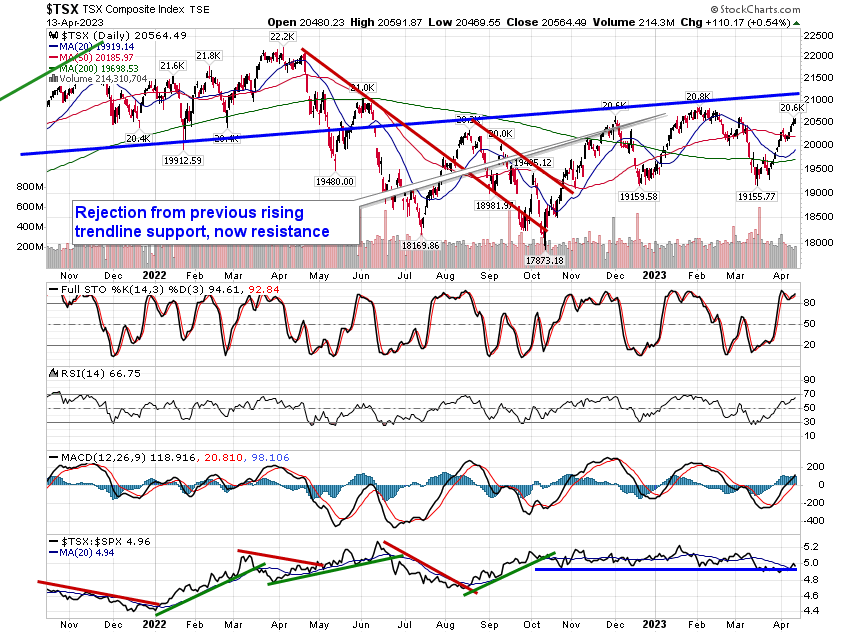

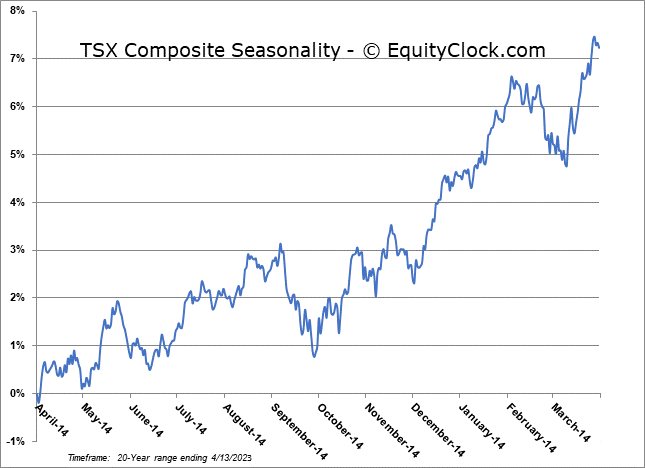

TSE Composite