Doubt pertaining to the demand backdrop in the energy market has led to the break of the trend of crack spreads, threatening our lone Accumulate candidate in the energy sector.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

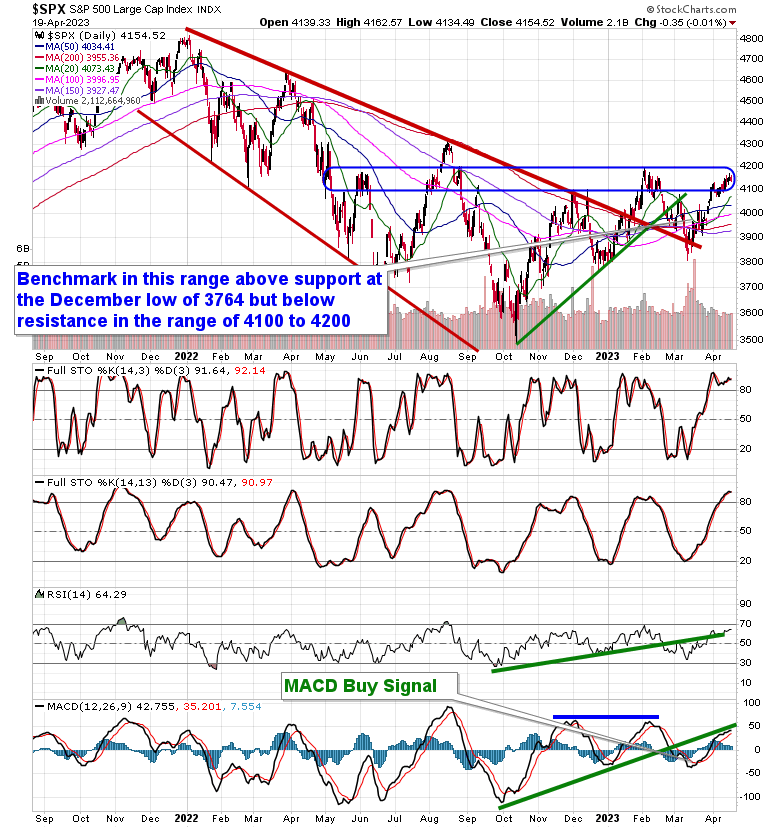

Stocks held around the flat-line on Wednesday as investors digest the earnings that have been released and anticipate the onslaught of results through the days ahead. The S&P 500 Index was essentially unchanged, remaining stuck in this range of resistance between 4100 and 4200. Momentum continues to struggle as the benchmark battles this overhead supply, leading to the ongoing contraction in the MACD histogram as the technical indicator converges on its signal line. The market is in need of a catalyst, whether it be positive or negative, in order to entice traders to take a position one way or the other. Until then, investors continue to sit on the fence given the fundamental uncertainties that are ongoing and as core-cyclical sectors struggle just below their year-to-date highs. The bulls have much to prove, but there is not enough, yet, technically to suggest abandoning risk, outright, as the market nears closer to the end of the best six months for stocks that peaks at the end of April/start of May.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

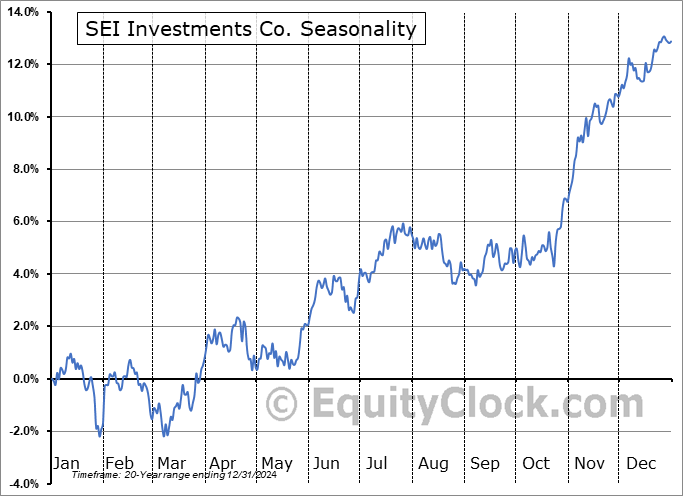

Seasonal charts of companies reporting earnings today:

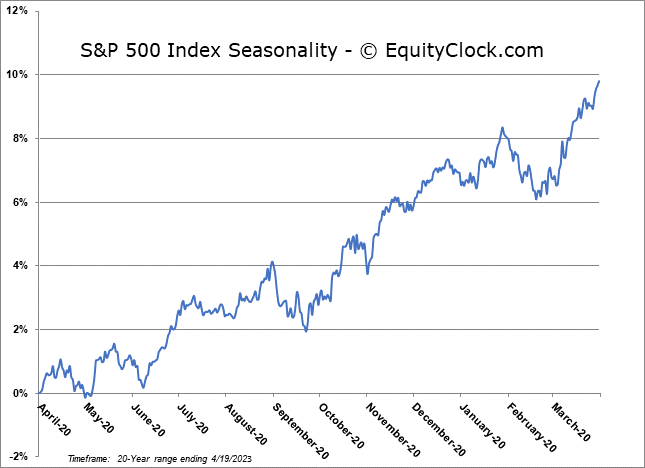

S&P 500 Index

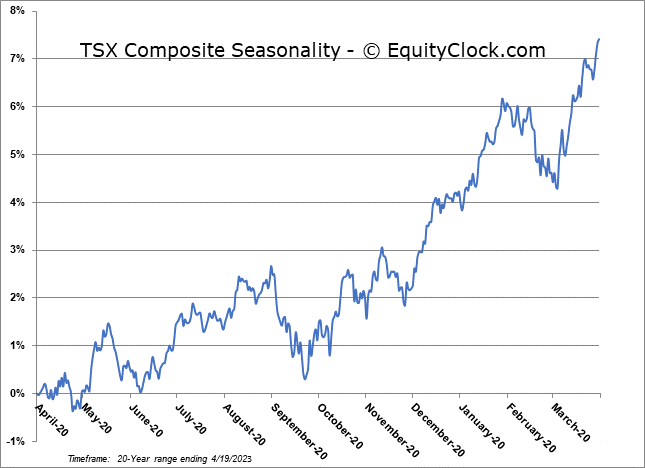

TSE Composite