Small-cap valuations are around the lowest level in the past two decades and seasonal tendencies are favourable for the group over the next month and a half, but, yet, buying demand remains absent.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

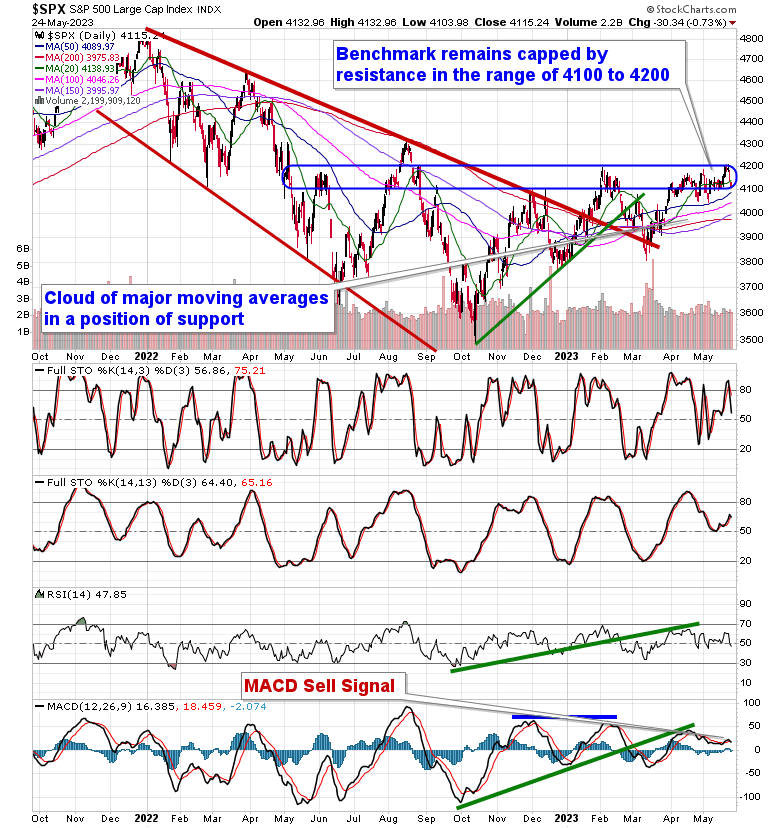

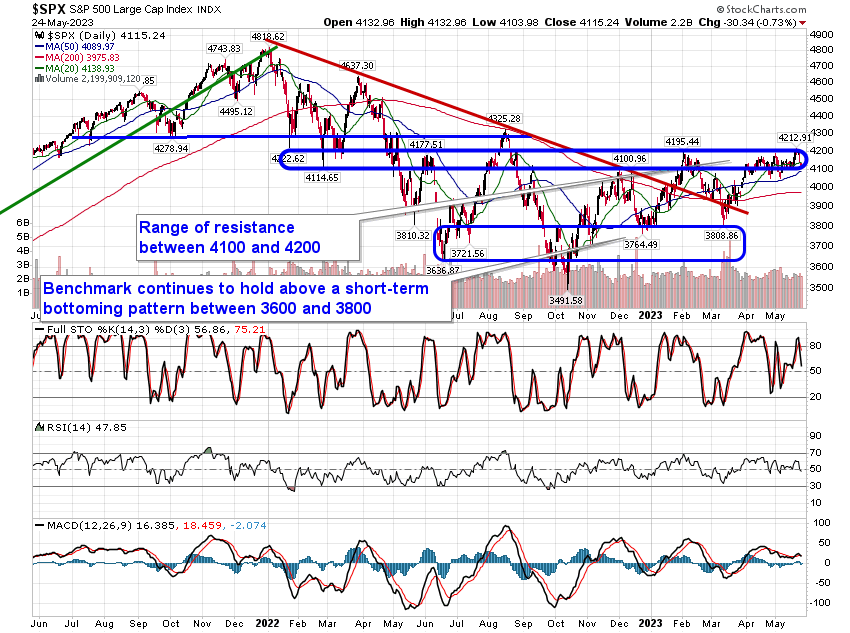

Stocks slipped for a second day as traders continue to monitor the progress of debt ceiling negotiations, which are reported to be at a stand-still. The S&P 500 Index slipped by nearly three-quarters of one percent, trading back to the lows that were recorded mid-month and erasing last week’s gain attributed to optimism that a debt ceiling deal would be reached in time to avoid default. The benchmark remains capped by the band of horizontal resistance between 4100 and 4200, the lower limit of which was touched at the lows of Wednesday’s session. Support remains implied around the congestion of major moving averages between 3980 and 4080. In a bit of a whipsaw action, a renewed MACD sell signal has been triggered, but, as highlighted in a recent report, the narrow, range-bound trend that the market has been in for a prolonged period of time make the signals that this momentum initiator generates almost irrelevant. Momentum indicators are still showing a rather negative slope since peaking in the middle of April, not showing anything reminiscent of a new uptrend getting underway. The market remains in need of a catalyst to fuel a sustained move and, unless there is a catastrophic debt default in the US (which seems improbable), its seems likely that any debt ceiling resolution will result only in a short-lived bounce. Seasonal tendencies for the market are positive in the days surrounding the Memorial Day holiday with the upbeat sentiment carrying into the new month of June, following which mean reversion and general portfolio re-allocations are the norm through the middle of June.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

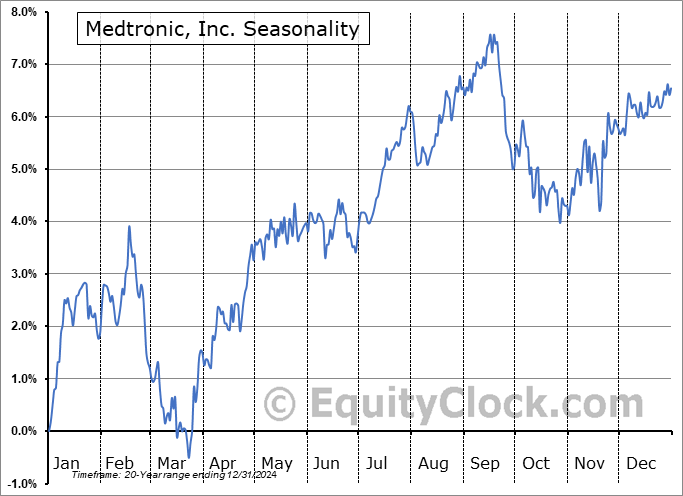

Seasonal charts of companies reporting earnings today:

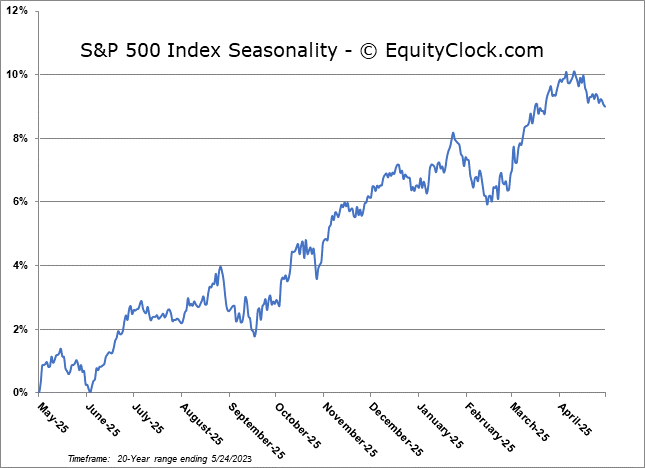

S&P 500 Index

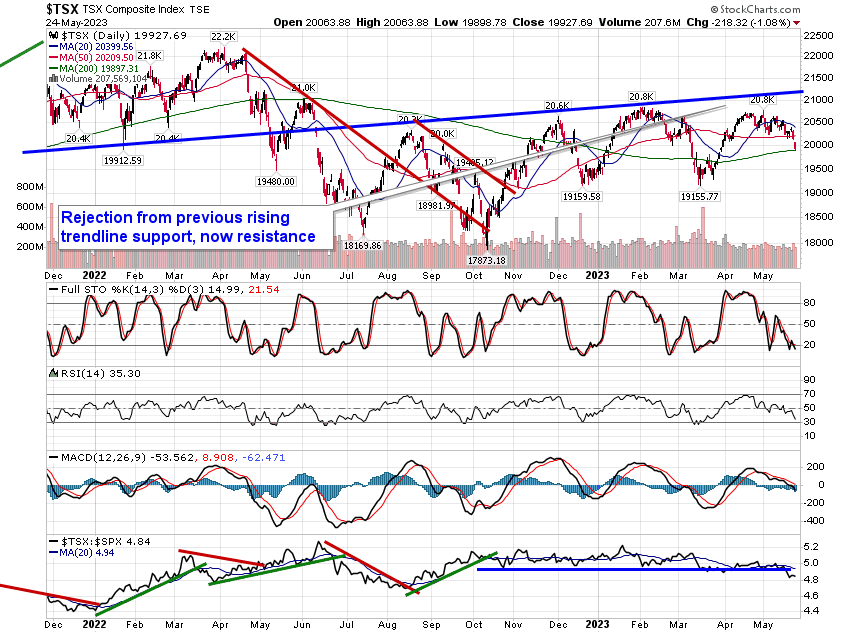

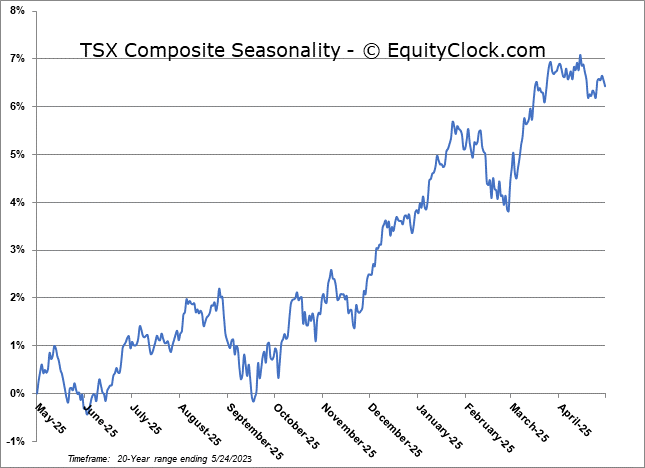

TSE Composite