The parabolic trend in the technology sector is prone to mean-reverting before the end of the quarter.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

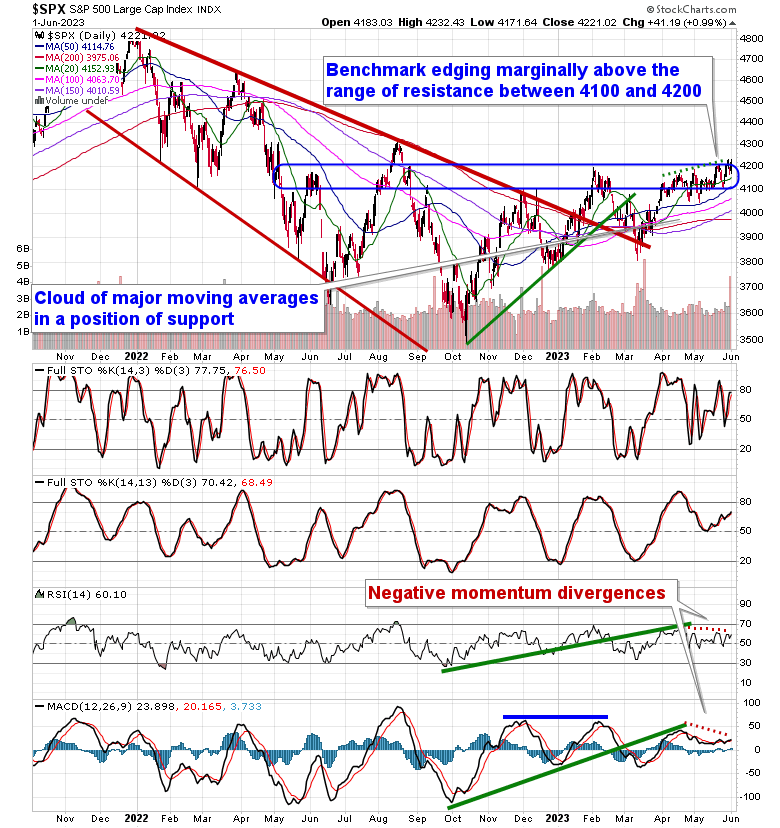

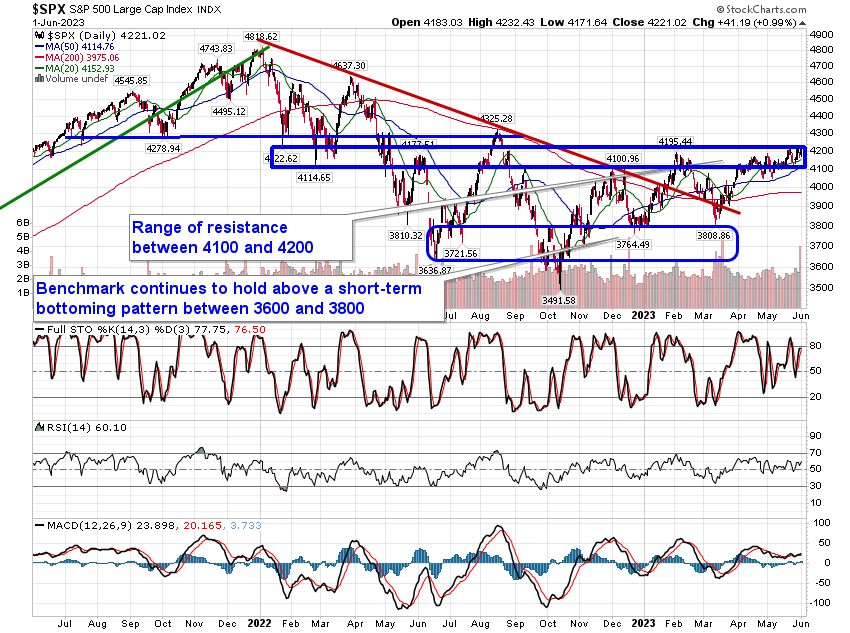

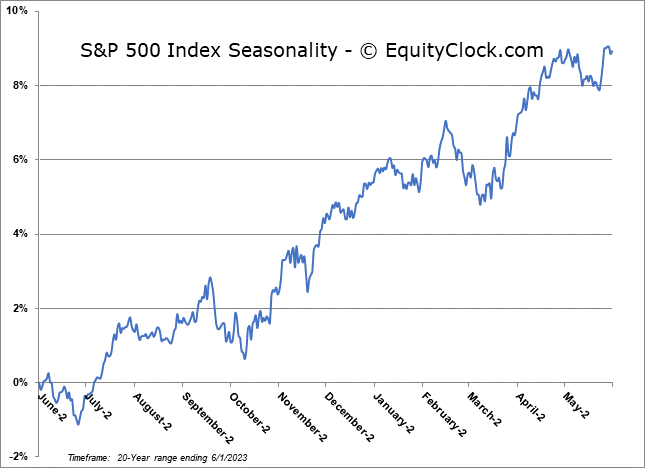

Stocks gained in the first session of June as monthly fund inflows injected a bid to equity markets. The S&P 500 Index gained just less than one percent, pushing, once again, marginally above resistance at 4200 and reaching towards the May 30th peak at 4231. Support remains persistent at the congestion of major moving averages, now between 4000 and 4100. Weak upside momentum remains apparent as the benchmark continues along with this grinding path that remains highly tenuous, driven solely by the growth/technology side of the market. Seasonally, beyond the first couple of days of June, tendencies turn gradually negative through the bulk of this last month of the quarter and the end of the first half of the year, giving us little to be enticed by from a broad market perspective until we get into the traditional summer rally period at the end of June.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

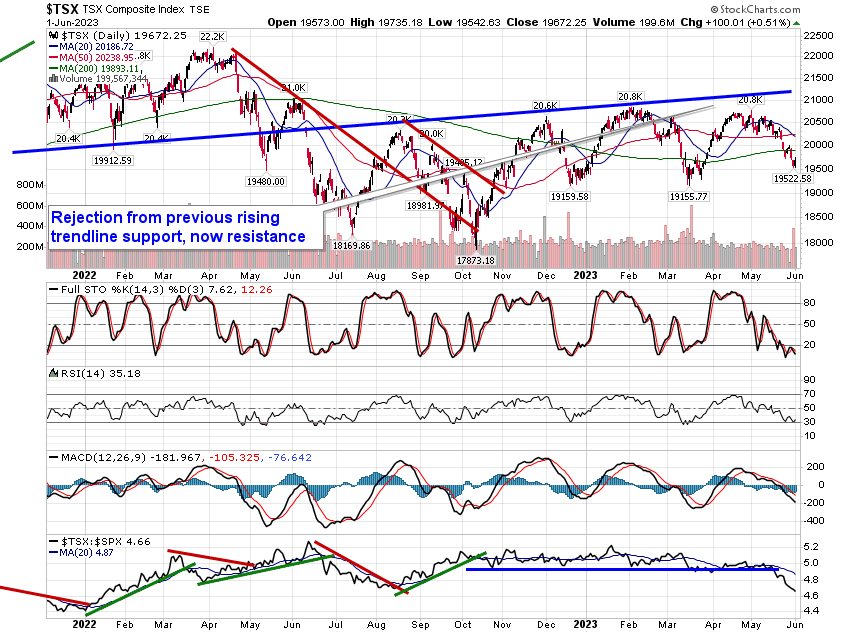

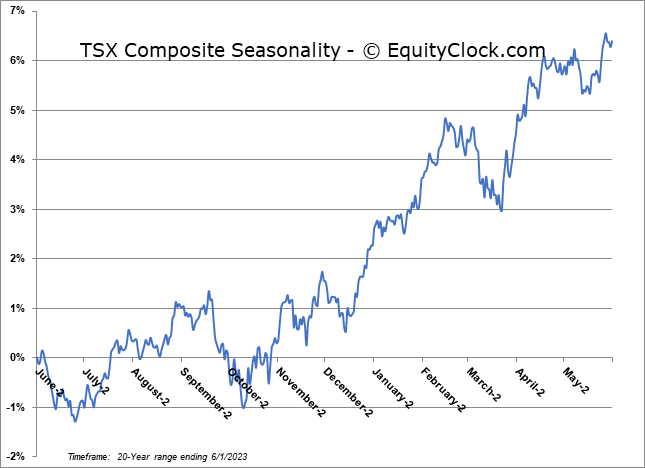

TSE Composite