The report of factory orders continues to tell a compelling story of which segments of the market to Accumulate and which areas to Avoid.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

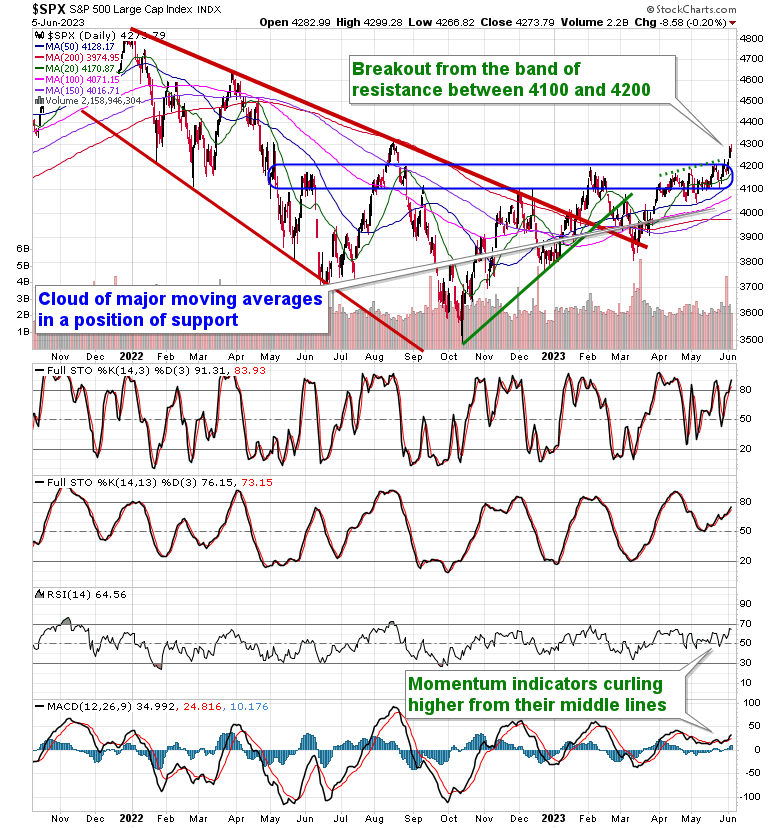

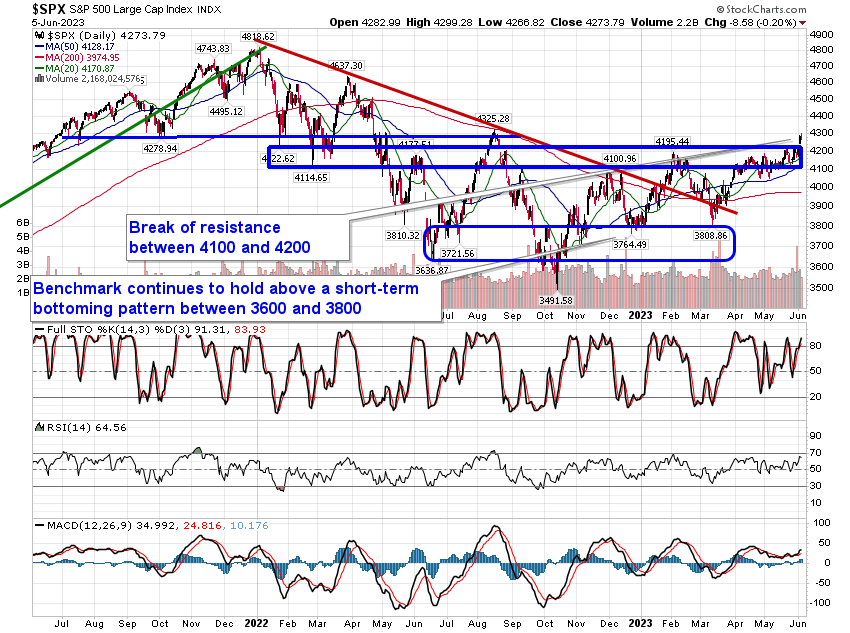

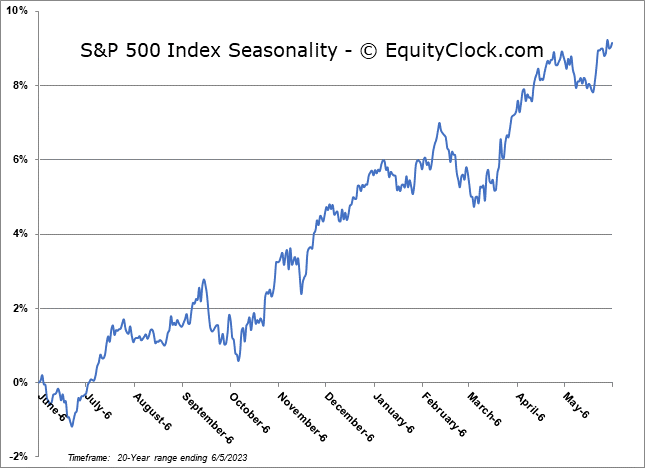

Stocks closed down on Monday following a reversal in the technology sector as shares of Apple (AAPL) gave up their gain following the the company’s Worldwide Developer Conference. The S&P 500 Index ended down by two-tenths of one percent, remaining above the band of resistance between 4100 and 4200 that was broken around the end of last week. Support remains apparent around the congestion of major moving averages between 4000 and 4100, keeping the trajectory on a positive tilt. So far, the strength that has been seen surrounding the Memorial Day holiday and into the new month is aligned with the normal pattern for stocks in any given year, but, through the month of June, as the quarter winds down, reversion back to the mean is the norm before the summer summer rally period lifts all boats into the middle of July.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

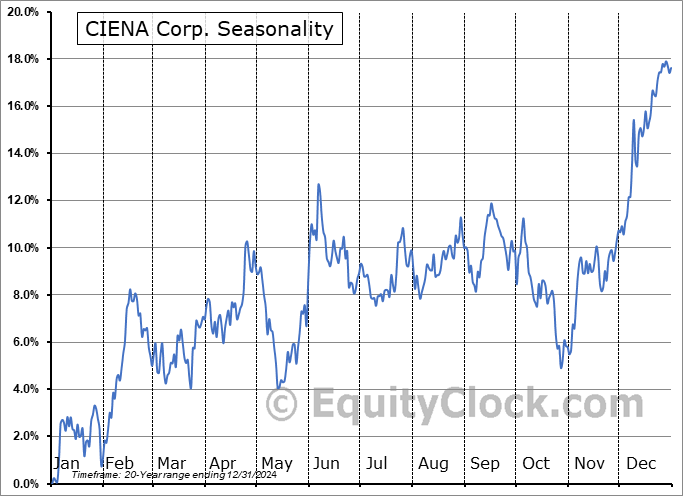

Seasonal charts of companies reporting earnings today:

S&P 500 Index

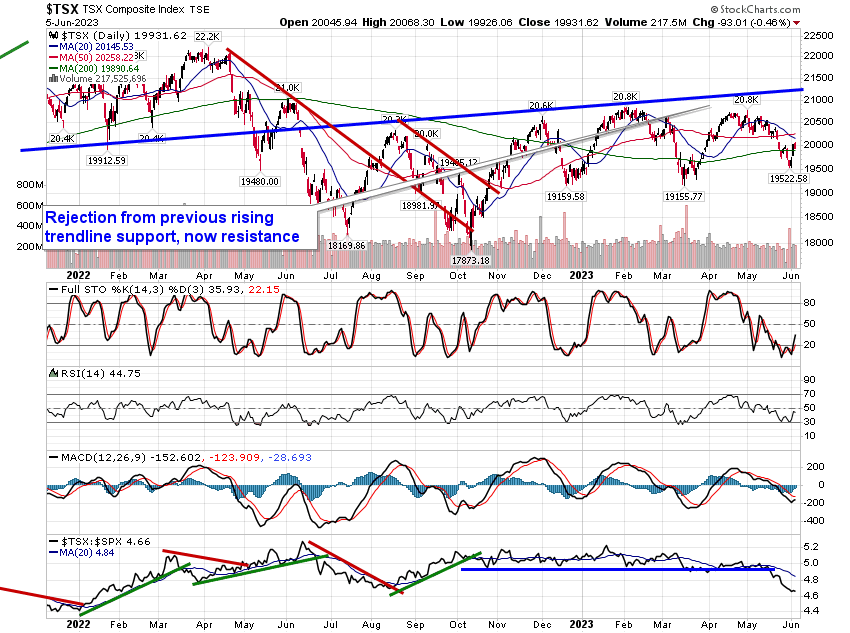

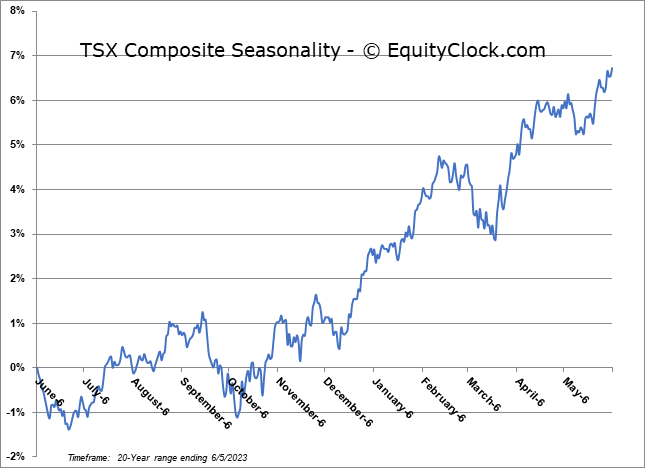

TSE Composite