Metal prices are in focus as we prepare for the period of seasonal strength that runs through the month of July.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

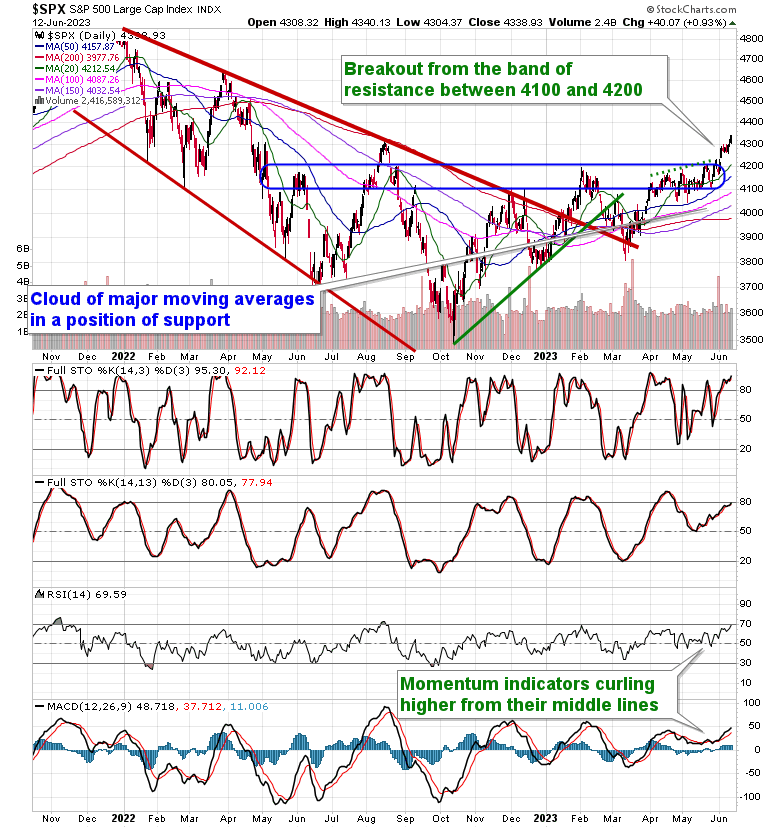

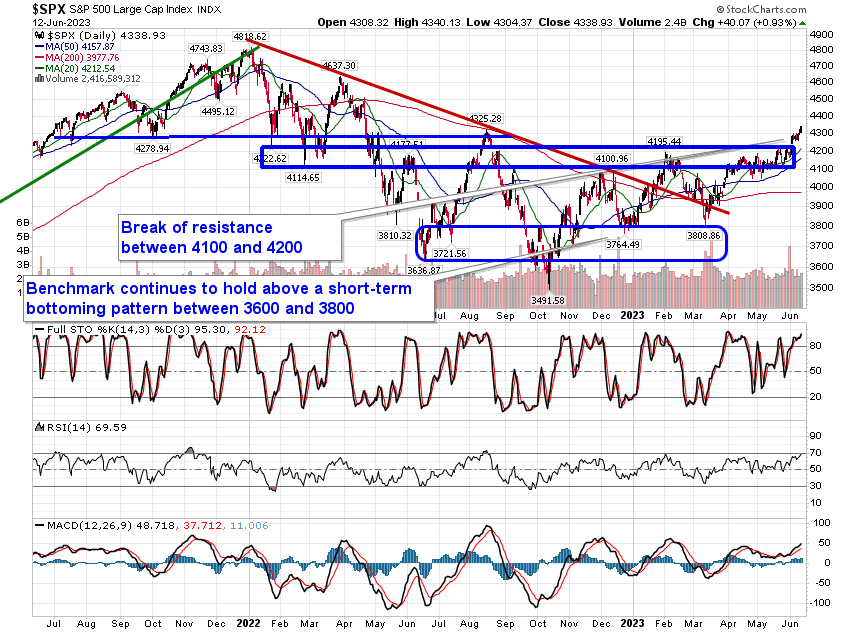

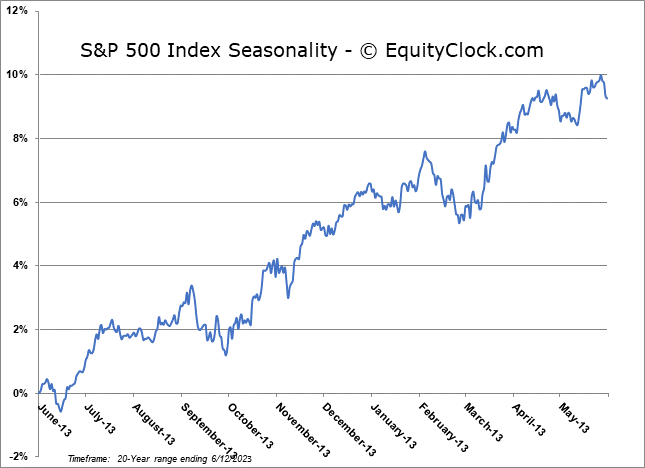

Stocks climbed to start the week as traders jockey for position around the FOMC meeting, the announcement from which will be made on Wednesday. The S&P 500 Index jumped by over nine-tenths of one percent, pushing through psychological resistance at 4300 and surpassing the last significant high charted in August of last year at 4325. The benchmark is on the verge of charting an overbought condition according to the Relative Strength Index (RSI) as the short-term parabolic trend becomes extended. While we are no longer seeing the benchmark correlate well with our speculated forecast direction for stocks this year, it continues to show the strong pace that is normal of pre-election years, a backdrop that tends to see funds continue to support the equity market into the middle of September.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

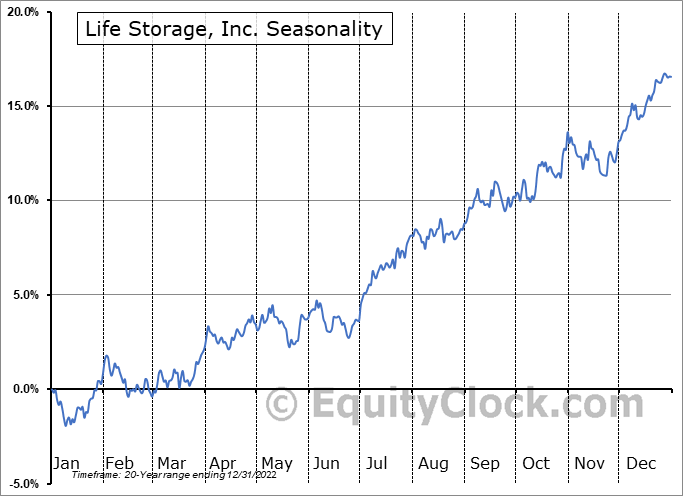

Seasonal charts of companies reporting earnings today:

S&P 500 Index

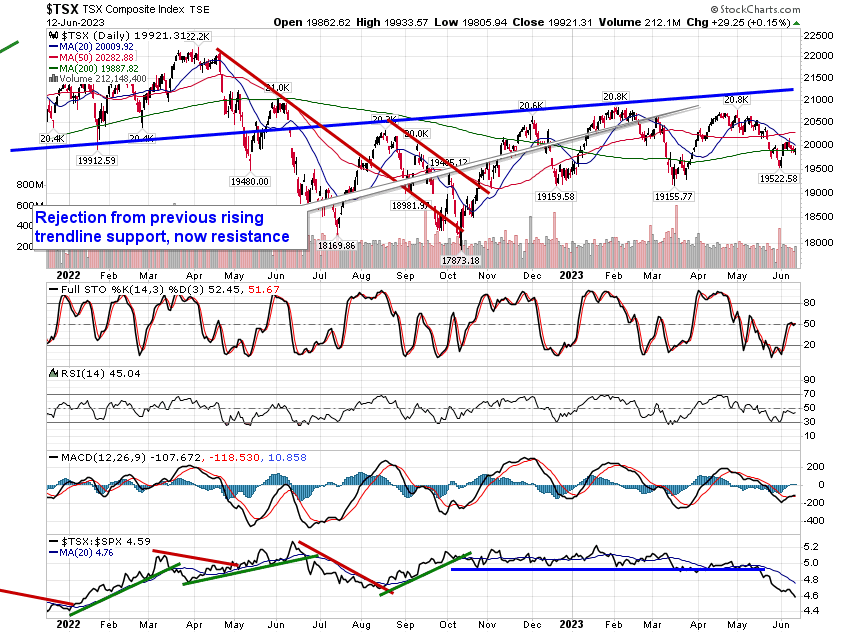

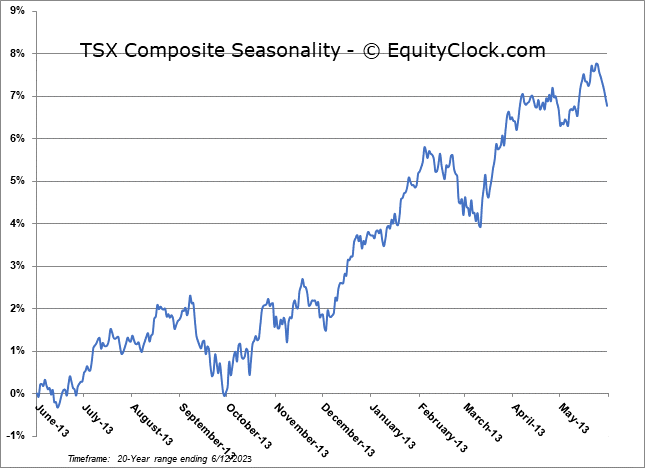

TSE Composite