The key to the breadth expansion in the market could rely on the banks, which are struggling around previous significant support, now resistance.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

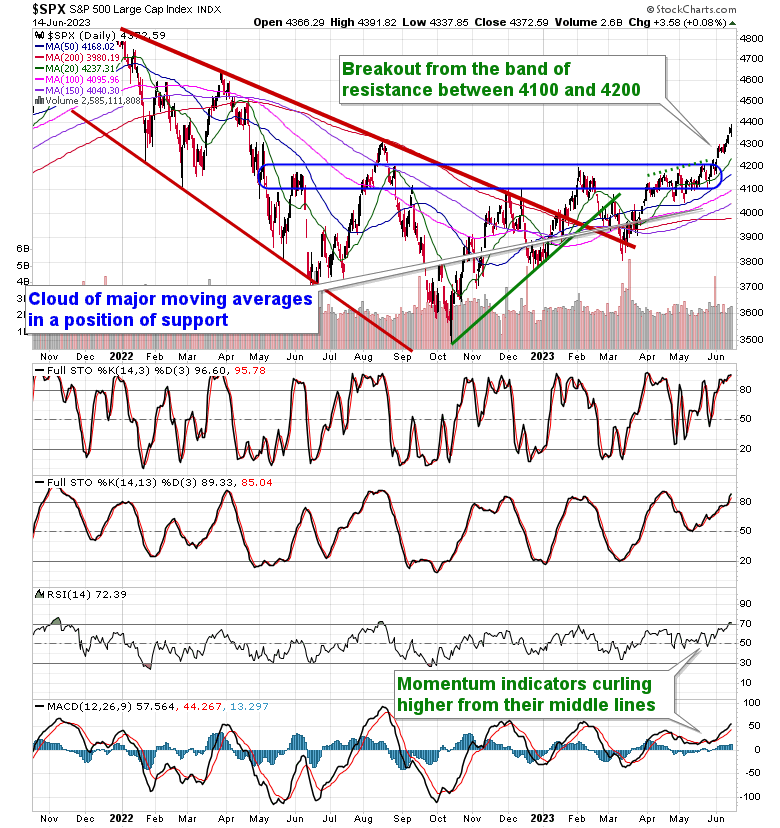

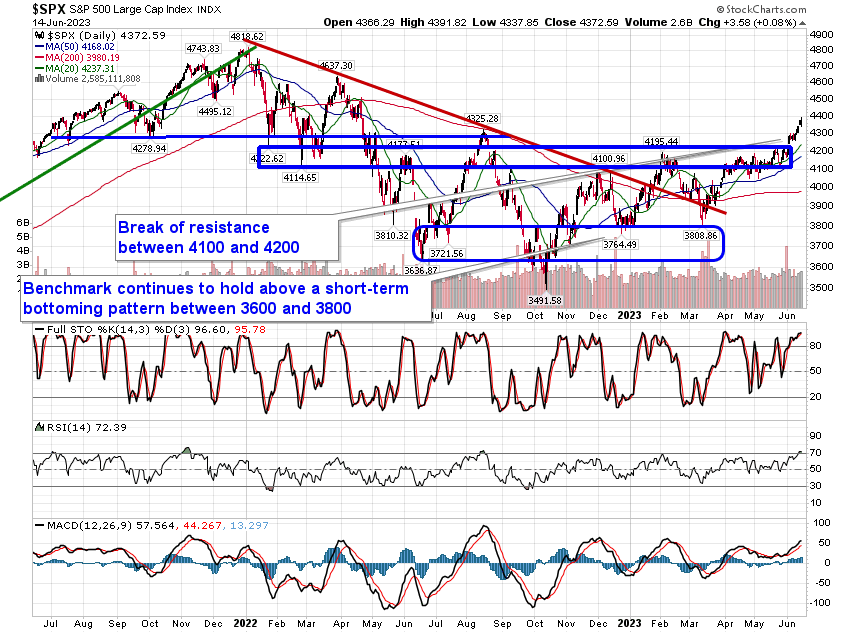

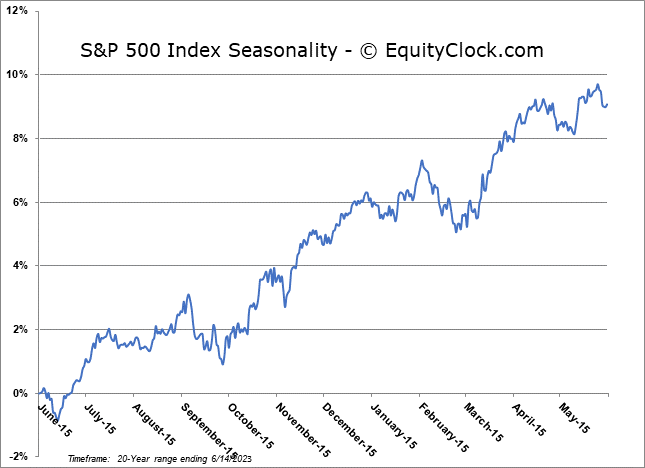

Stocks closed fairly mixed on Wednesday as traders reacted to the decision from the FOMC to keep rates unchanged following the aggressive hiking path of the past year. The S&P 500 Index closed higher by just less than a tenth of one percent, charting a rather indecisive doji candlestick as the short-term parabolic rise shows early hints of struggle. The benchmark remains the most overbought, according to the daily Relative Strength Index (RSI), since August of last year, a condition that threatens to exhaust near-term buying demand. Support for the benchmark remains implied around the congestion of major moving averages between 4000 and 4160. This is still a market that remains in a rising intermediate-term trend, but, during the weak phase for the market over the next couple of weeks, one that is known for mean reversion into the end of the quarter, a retracement back to the benchmark’s breakout point at 4200 is a fair argument before we reach the summer rally period for stocks at month-end.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

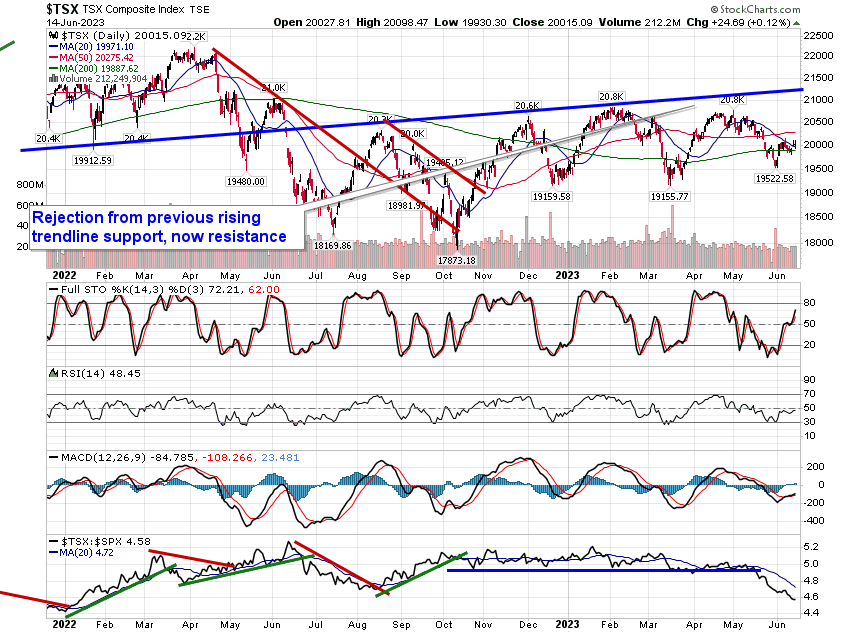

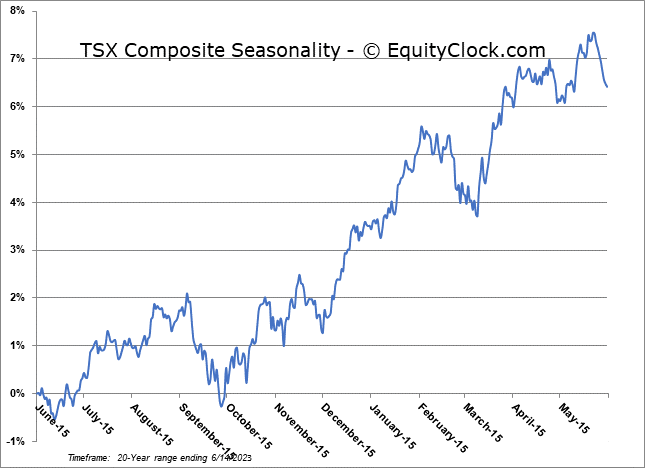

TSE Composite