Emerging market equities presenting a rotation candidate as they start to move higher from bottoming patterns.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

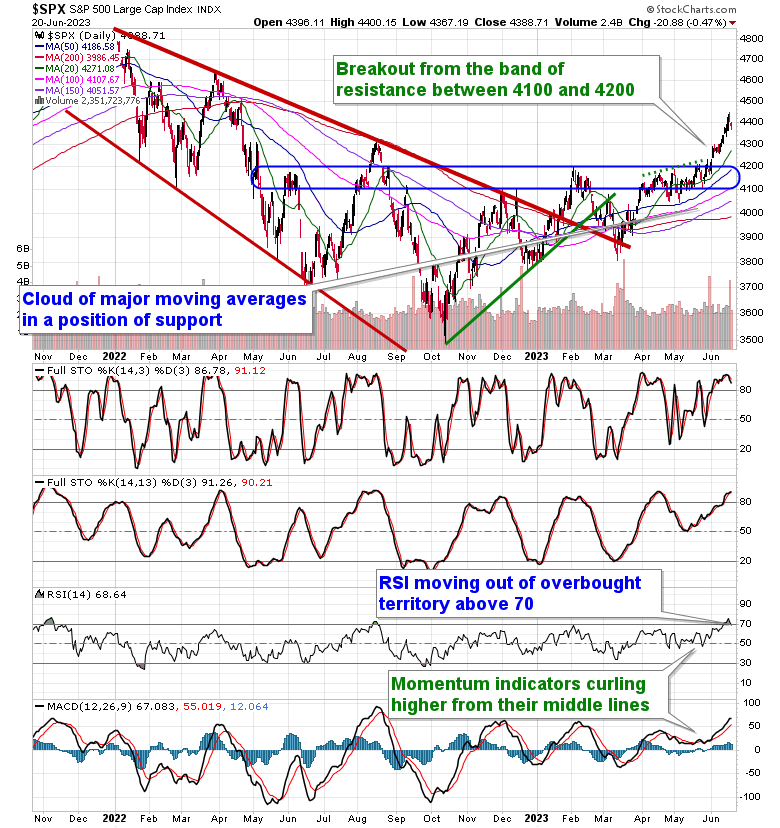

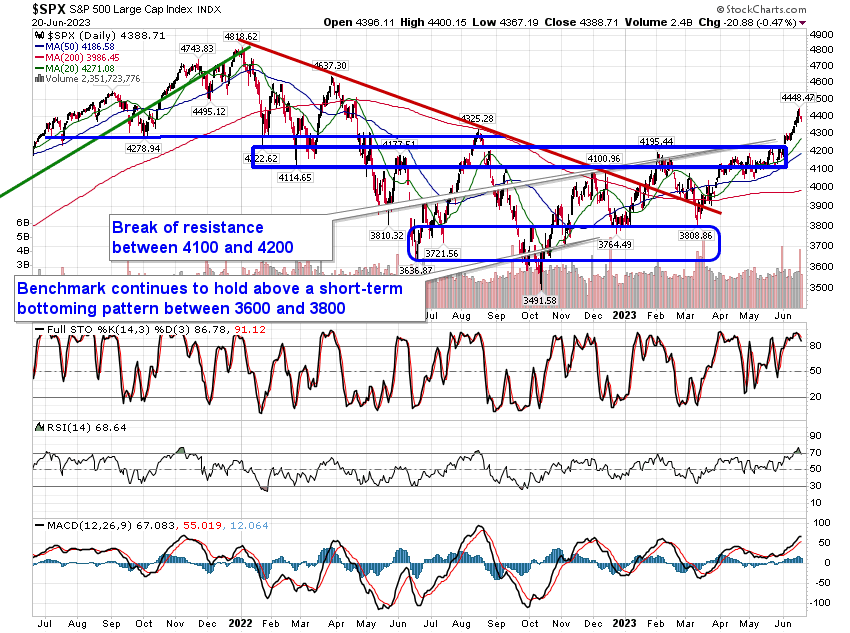

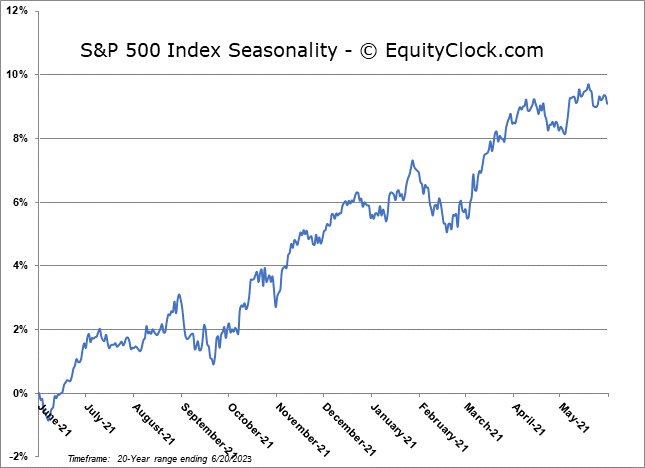

Stocks closed mildly lower on Tuesday as market participants start to digest the parabolic move higher from the past few weeks. The S&P 500 Index drifted lower by just less than half of one percent, peeling back on some of the strength that had been recorded in recent weeks that led to the most overbought reading according to the Relative Strength Index (RSI) since November of 2021. With Tuesday’s decline, the momentum indicator has slipped out of overbought territory above 70, which some may take as a signal to sell. Ongoing support at major moving averages and the fact that the benchmark was able to reach an overbought extreme following a surge of buying demand are characteristics of a bullish trend that can have longer-term positive implications. The market remains in this mean-reversion phase over the next week or so, before the normal summer rally period begins at month-end, and downside risks over this succinct negative seasonal timeframe that is upon us are down to the previous breakout point at 4200.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

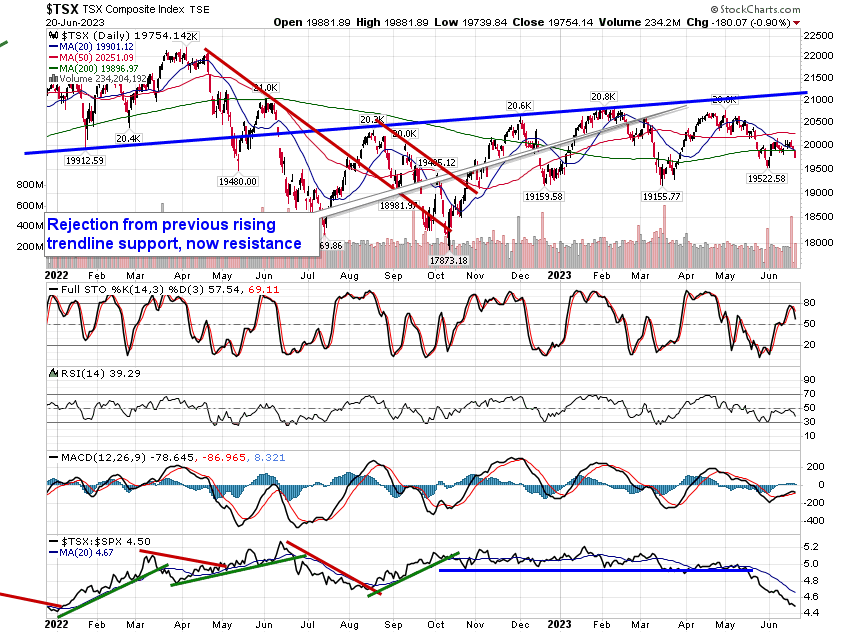

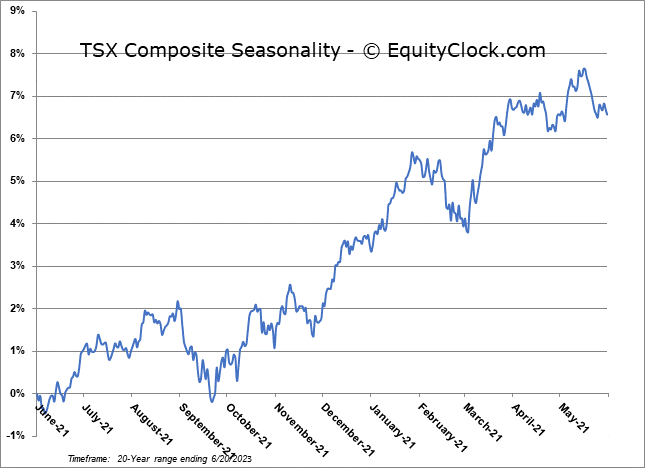

TSE Composite