Looking for rotation during the quarter ahead into some of this year’s laggards in the most cyclically sensitive segments of the market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

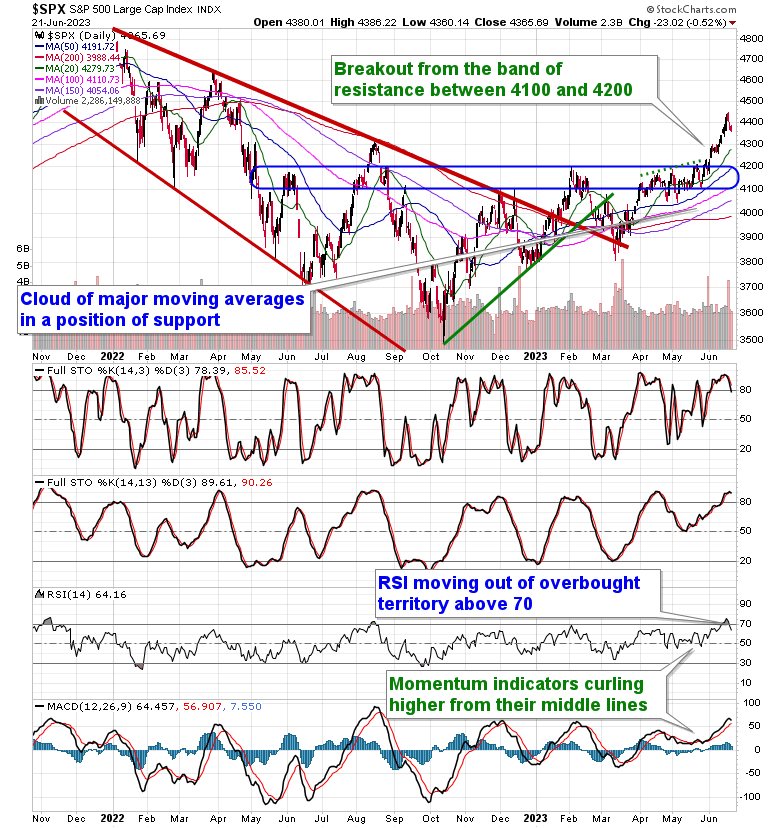

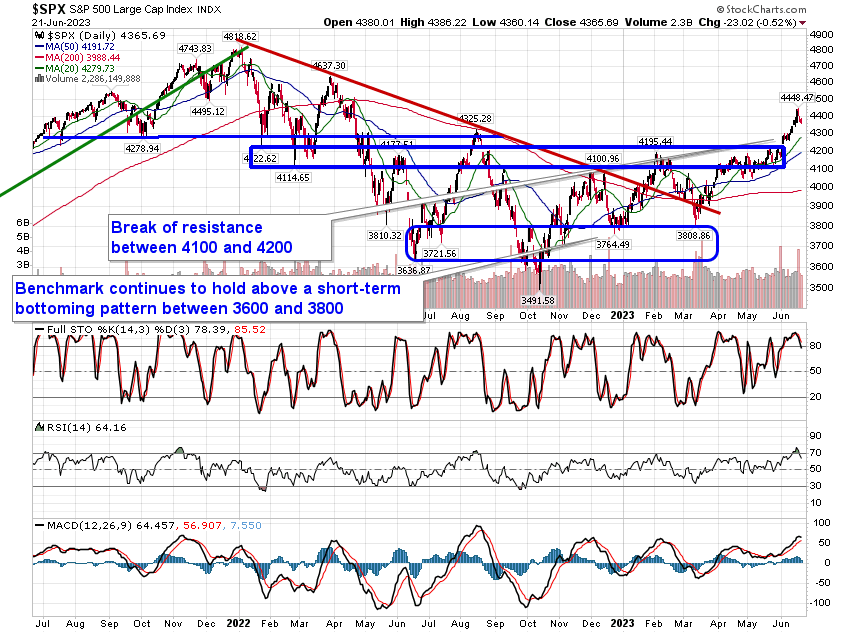

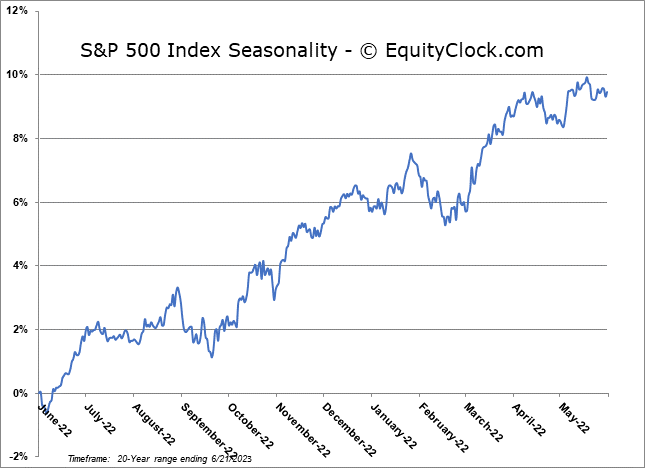

Stocks closed generally mixed on Wednesday as portfolio managers conducted rebalancing trades before the end of the quarter. The S&P 500 Index ended down by just over half of one percent, continuing to retrace the recent parabolic rise that followed the breakout above 4200 in recent weeks. Support remains embedded around major moving averages, including the 20-day at 4279 and the 50-day at 4191. Momentum indicators continue to roll over from overbought territory with MACD seemingly setup to produce a bearish crossover of its signal line in the days ahead. This mean reversion pattern that was readily apparent during the Wednesday session continues through to the last three days of June, after which the summer rally period for stocks begins, running through the middle of July. Short-term headwinds as part of the mean reversion phase will be looked upon as providing a buying opportunity for the subsequent bullish seasonal pattern that carries markets into the start of the third quarter.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

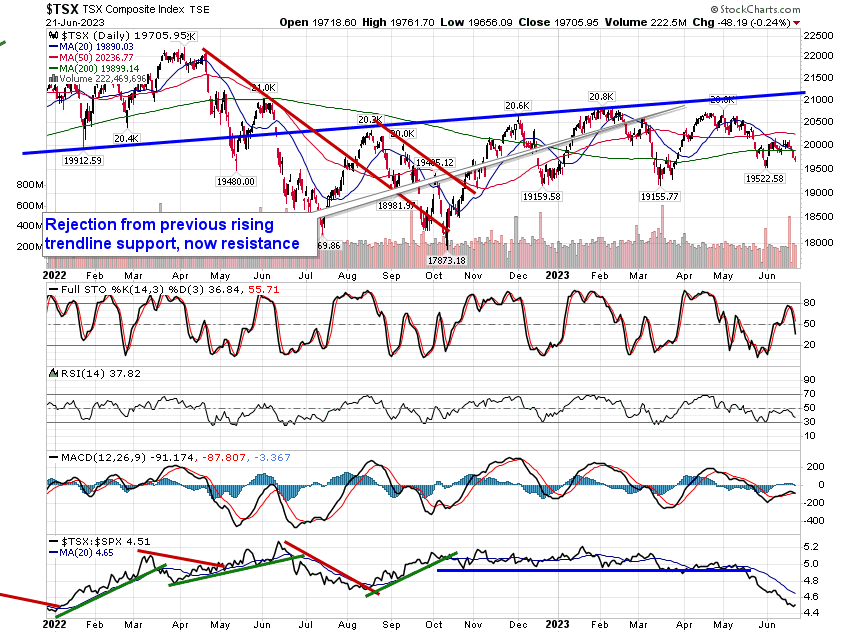

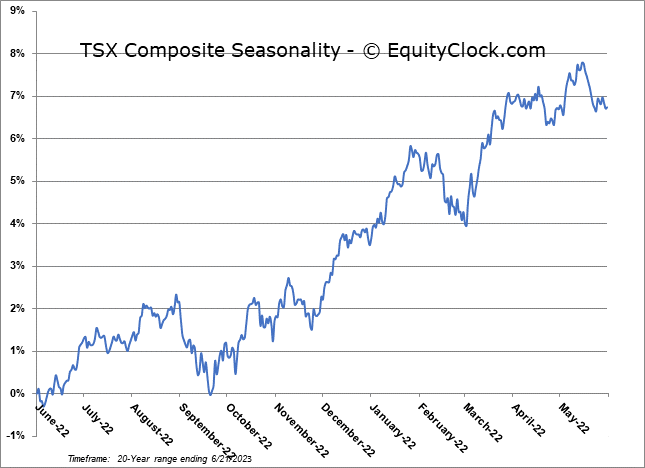

TSE Composite