The average summer rally period is at our doorstep.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

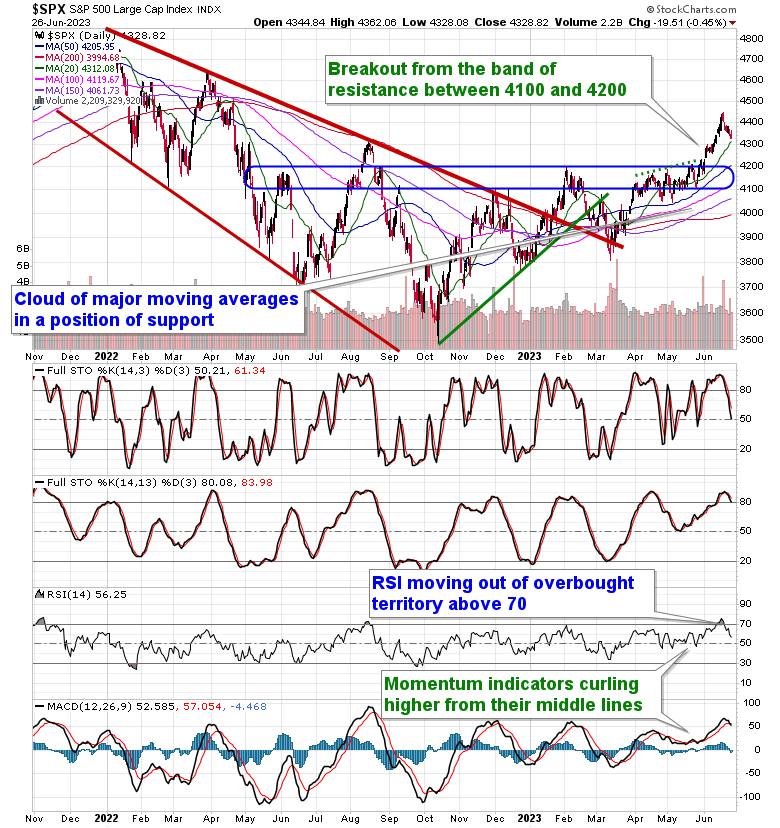

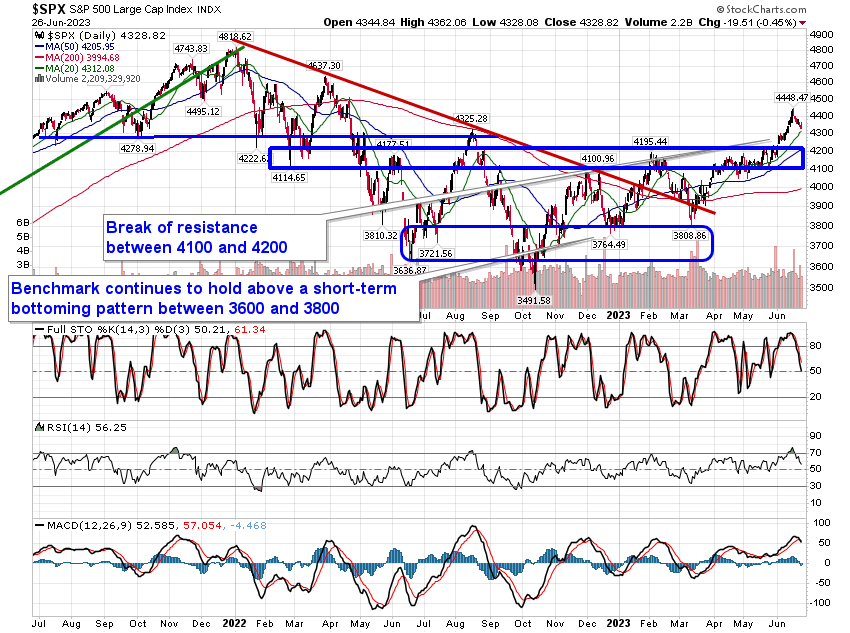

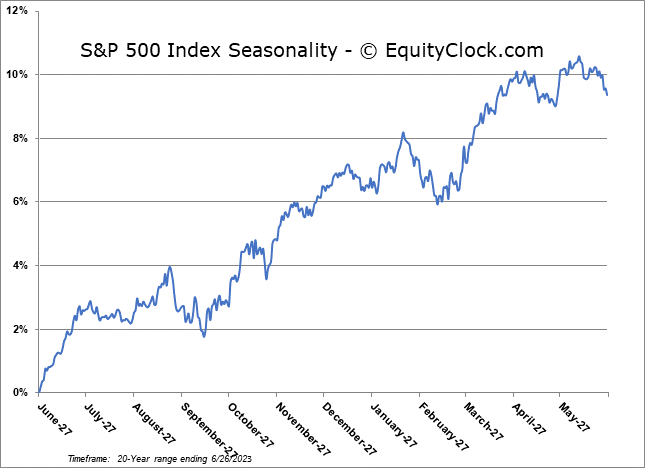

Stocks closed lower on Monday, led by many of the growth names that have flourished so far this year, as portfolio managers continue to rebalance their books back to investment policy guidelines ahead of the end of the quarter. The S&P 500 Index closed down by just less than half of one percent, pulling back towards short-term support at the 20-day moving average of 4312. Major moving averages continue to fan out, providing a number of points to shoot off of should a further correction ensue. Momentum indicators have alleviated overbought readings and MACD has now triggered a sell signal following the crossover below its signal line. Still, despite the sell signals that have been generated by both RSI and MACD in recent days, both are retaining characteristics of a bullish trend above their middle lines, which is a distinct shift from the bearish characteristics that were persistent through the first half of last year. Seasonally, the average start to the summer rally period begins as of the close of today (June 27th) and looking to increase risk (equity) exposure for this timeframe that typically runs through the middle of July can typically add alpha to portfolios.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

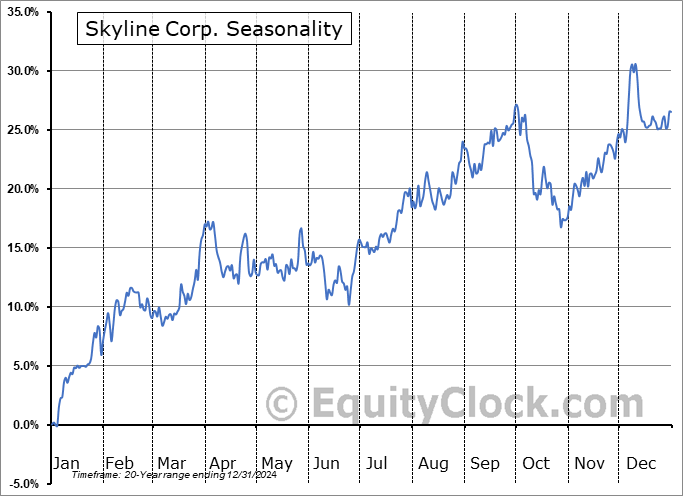

Seasonal charts of companies reporting earnings today:

S&P 500 Index

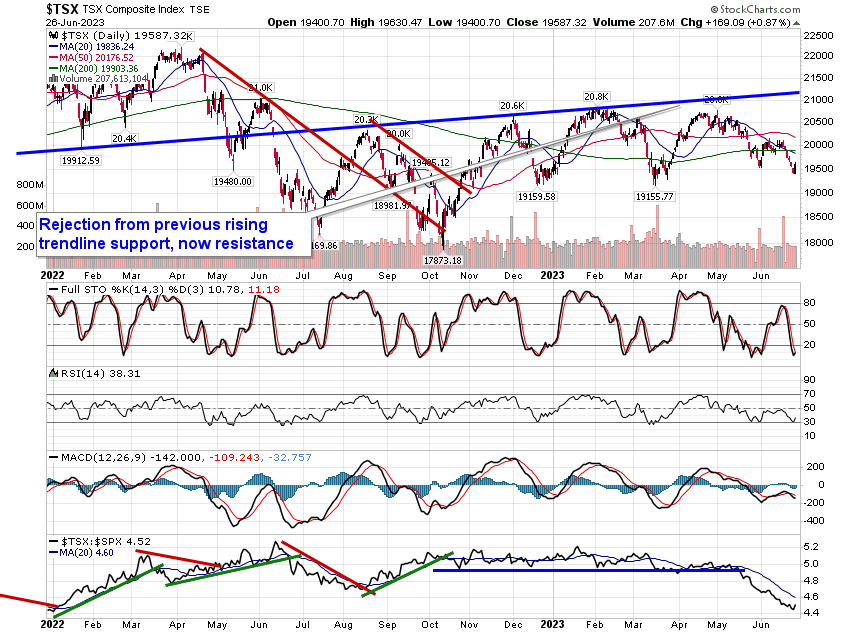

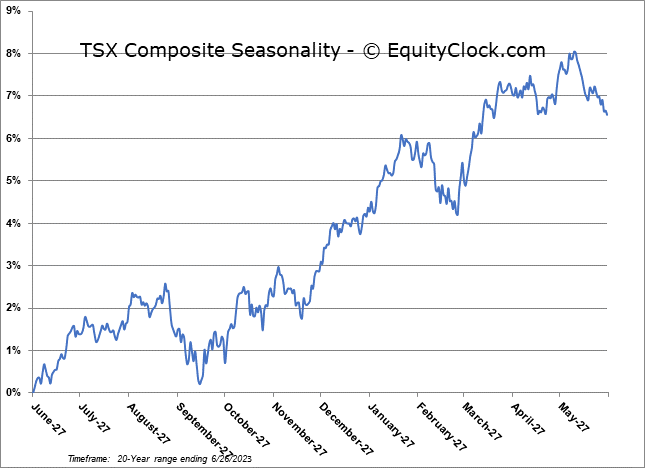

TSE Composite