A slate of upbeat economic data points has kicked off the summer rally period as stocks bounce from levels of short-term support.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

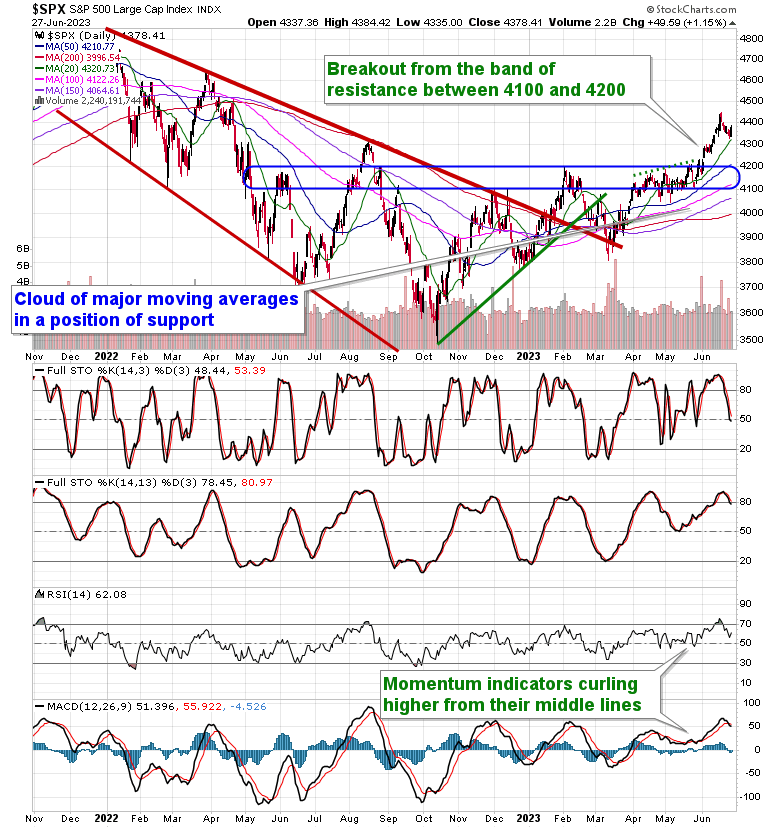

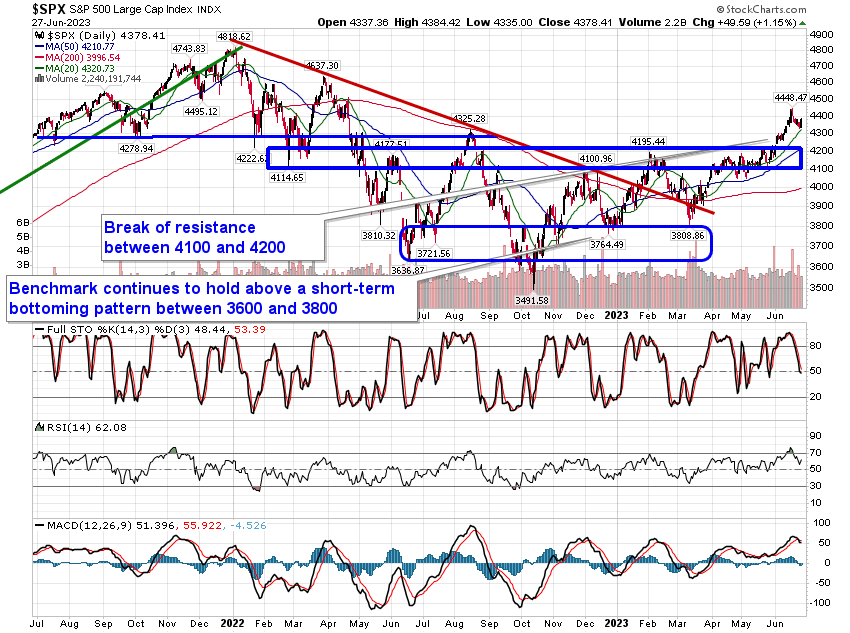

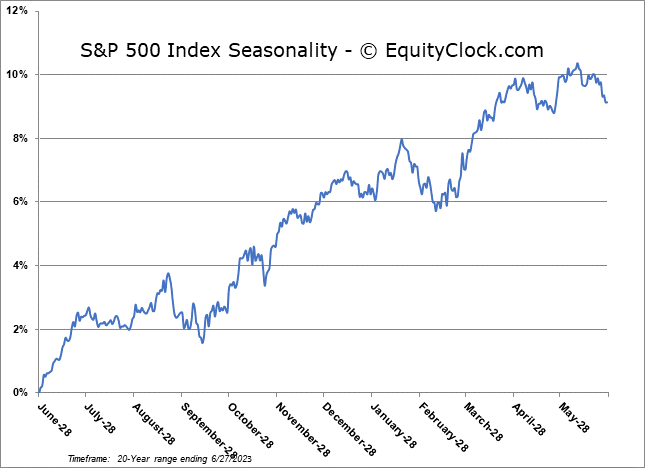

Stocks got an early jump to the summer rally period following a slate of upbeat economic datapoints released on Tuesday. The S&P 500 Index rose by 1.15%, bouncing from levels around the rising 20-day moving average that currently hovers around 4320. The benchmark could arguably do more to correct the parabolic rise that was charted through the month of June, but here we are at the start of the average summer rally period that tends to see the elevation of prices into at least the middle of July. Support remains persistent at major moving averages and momentum indicators have adopted positions above their middle lines, both characteristics of a bullish trend. In our soon to be released monthly outlook for July, we make the contention that the breakout of the approximately 400-point span between 3800 and 4200 has upside implications to 4600, a hurdle that could easily be achieved during this upbeat seasonal timeframe that is upon us. The intermediate path of the benchmark is bullish, which is what we look for to check the technical prong to our approach and it is just a matter of identifying those segments of the market that check the fundamental prong to tailor portfolio exposure towards. We highlight one such opportunity below.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

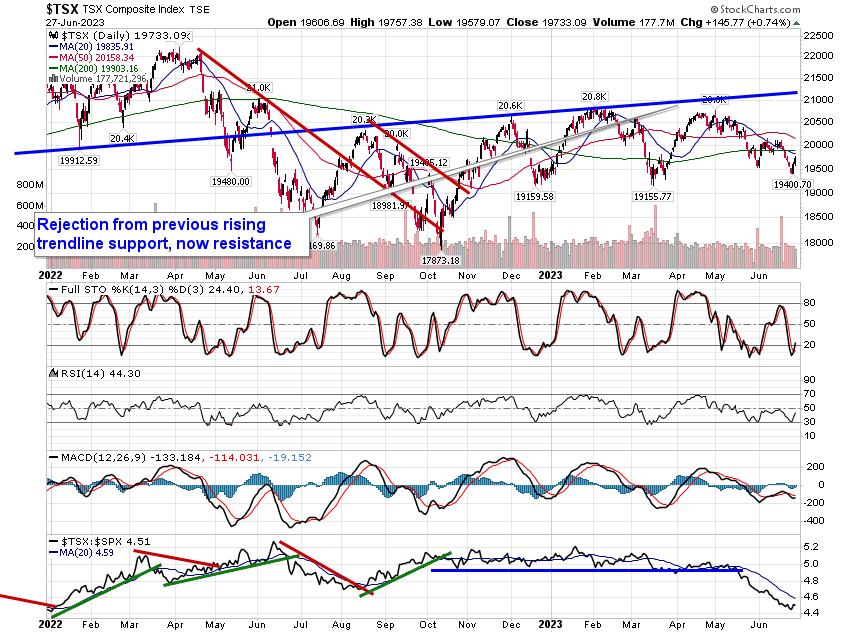

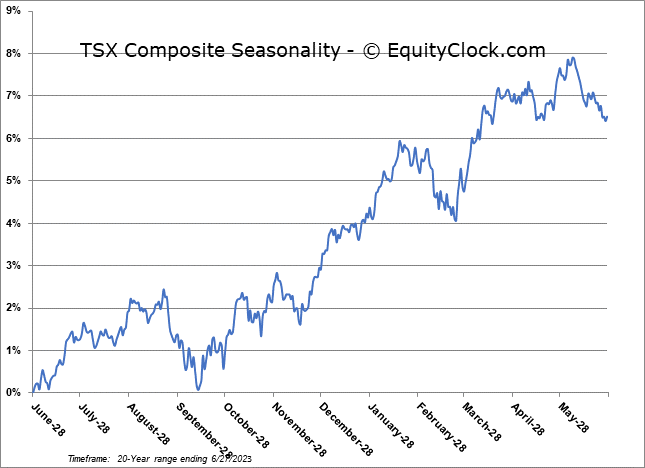

TSE Composite