The put-call ratio has fallen to the lowest level since the start of 2022 at the previous market peak.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

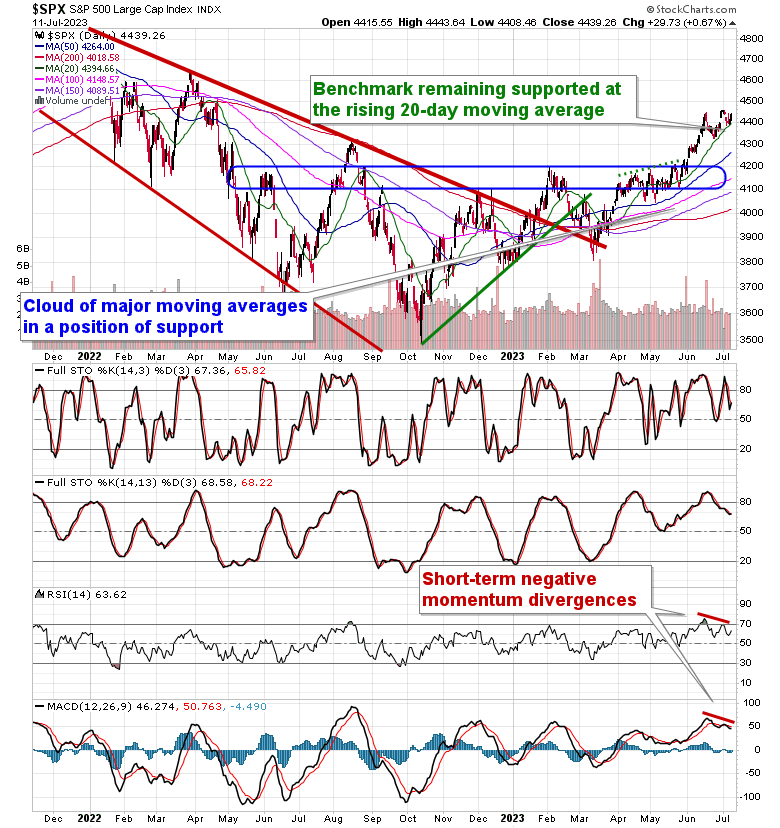

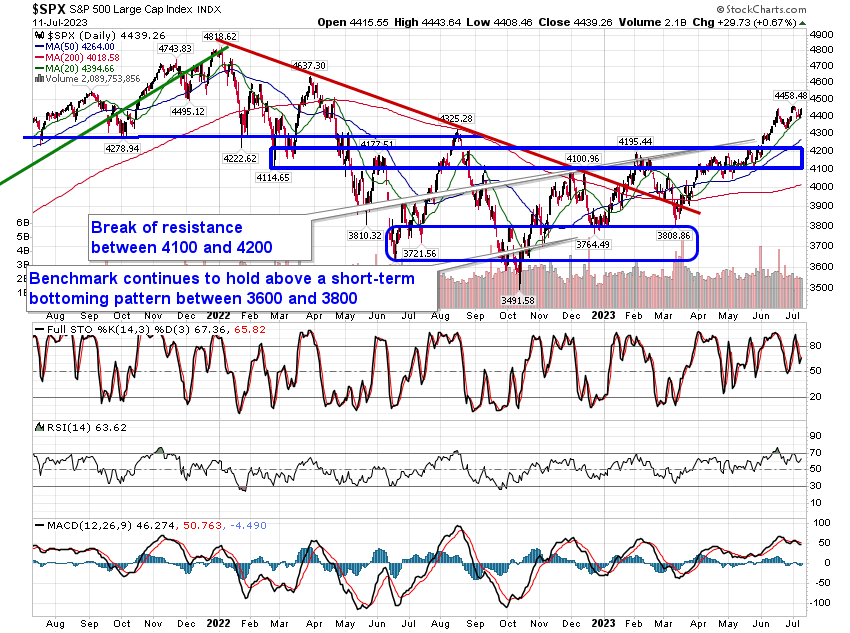

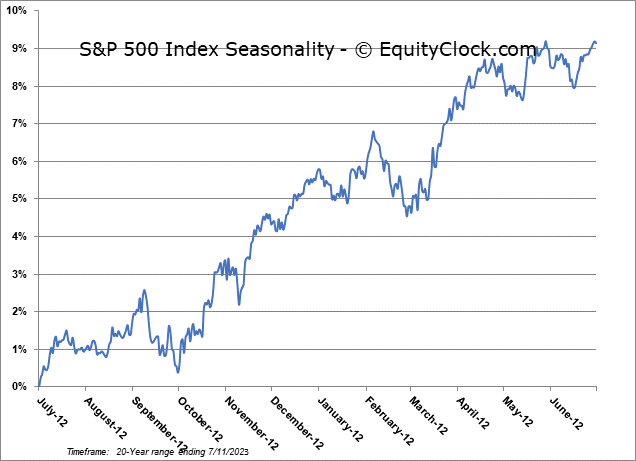

Stocks gained traction on Tuesday as the positivity surrounding the summer rally timeframe continues. The S&P 500 Index closed with a gain of two-thirds of one percent, bouncing from around its rising 20-day moving average that was tested in recent days. Despite evidence of waning upside momentum, both RSI and MACD are showing characteristics of a bullish trend above their middle lines. Seasonally, the summer rally period runs from the last week of June through the first three weeks of July before a more tumultuous pattern sets in during the month of August, resulting in escalating volatility through the end of the third quarter.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

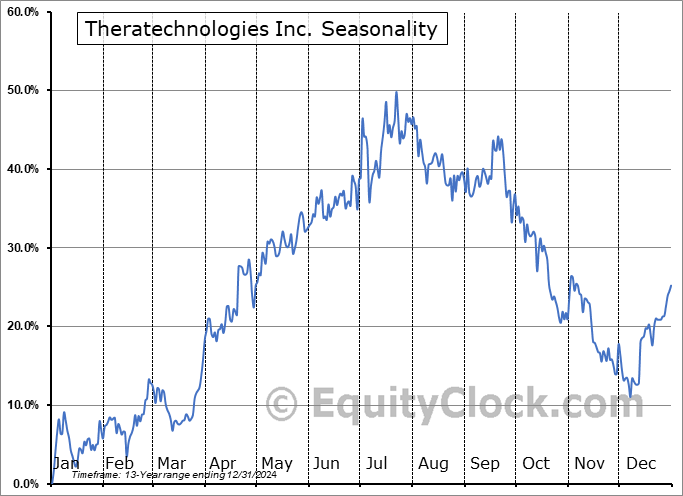

Seasonal charts of companies reporting earnings today:

S&P 500 Index

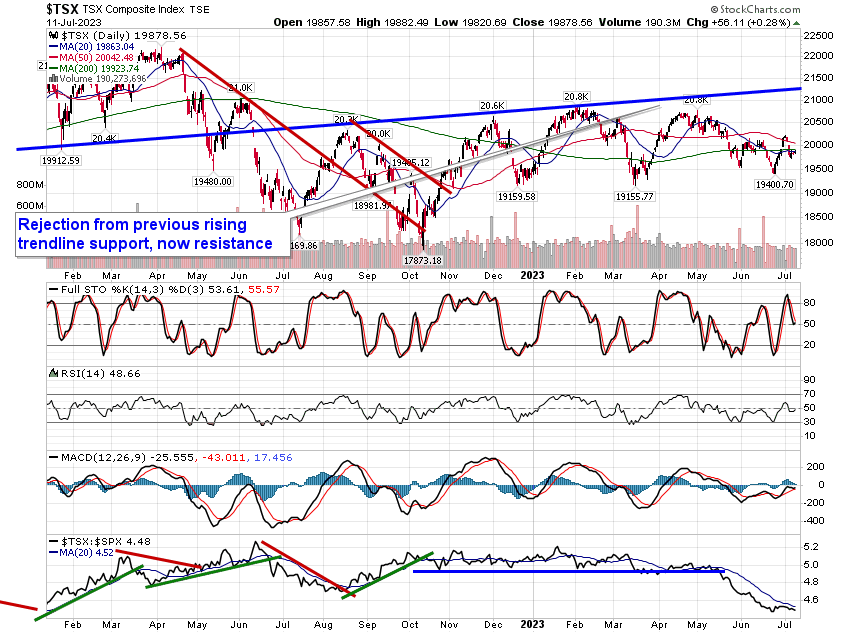

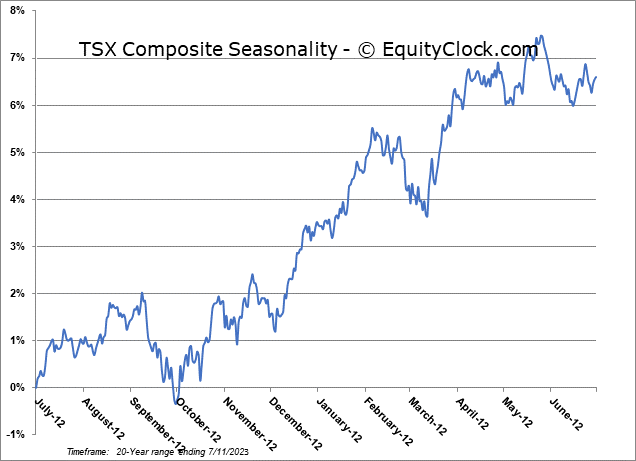

TSE Composite