Equity market looking toppy heading into the historically weakest time of year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

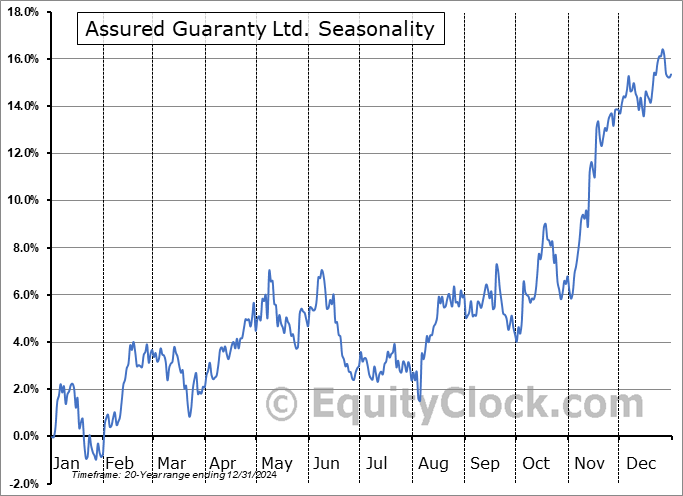

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks pulled back on Friday as portfolio managers started to rotate away from some of their winners in the technology sector, a normal gyration for this time of year. The S&P 500 Index closed with a loss of 1.22%, pulling back to short-term support presented by the 20-day moving average. MACD continues to get closer to charting a bearish crossover below its signal line, a sell signal that would hold significantly more weight given that it is occurring around the momentum indicator’s middle line. The risk of the re-adoption of characteristics of a bearish trend similar to what was observed through the first three quarters of last year is elevated. Seasonally, the weakest time of the year for the market has arrived, spanning the last couple of weeks of the month and the quarter and this is traditionally not the time to be aggressive on the risk spectrum until we get into the month of October.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite