Consumers are leaning into credit card debt at an above average rate and, with delinquencies on the rise, the risks to the economy are growing.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

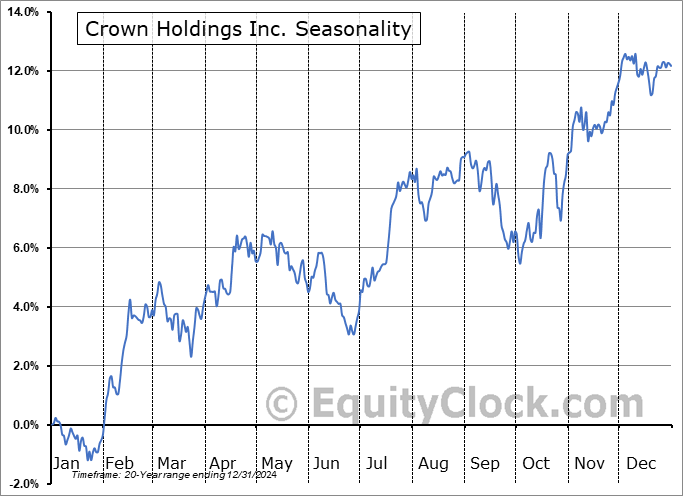

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed down for the fourth straight session as investors remained on edge about the recent rise in the cost of borrowing to fresh multi-year highs. The S&P 500 Index closed with a loss of just less than a quarter of one percent, ending near the low of the session. The benchmark continues to move below horizontal support and the neckline to a head-and-shoulders pattern at 4335. The downside target of the bearish setup suggests a theoretical downside move to levels just below 4100, however, previous resistance, now support, at 4200 is bound to put up a big fight. Momentum indicators remain on the decline and have adopted characteristics of a bearish trend. One more week remains in the weakest time of year for stocks that spans the last couple of weeks of September and, thus far, it has certainly lived up to its reputation.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite