Not one sector of the market has made meaningful upside progress in the past seven quarters and this is telling us something.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

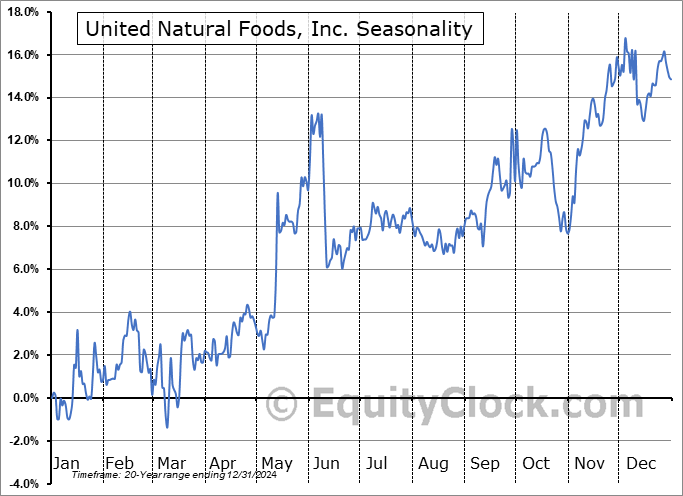

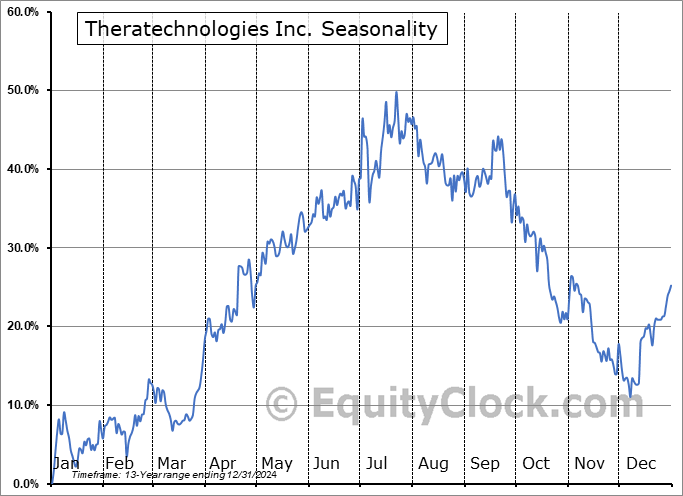

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

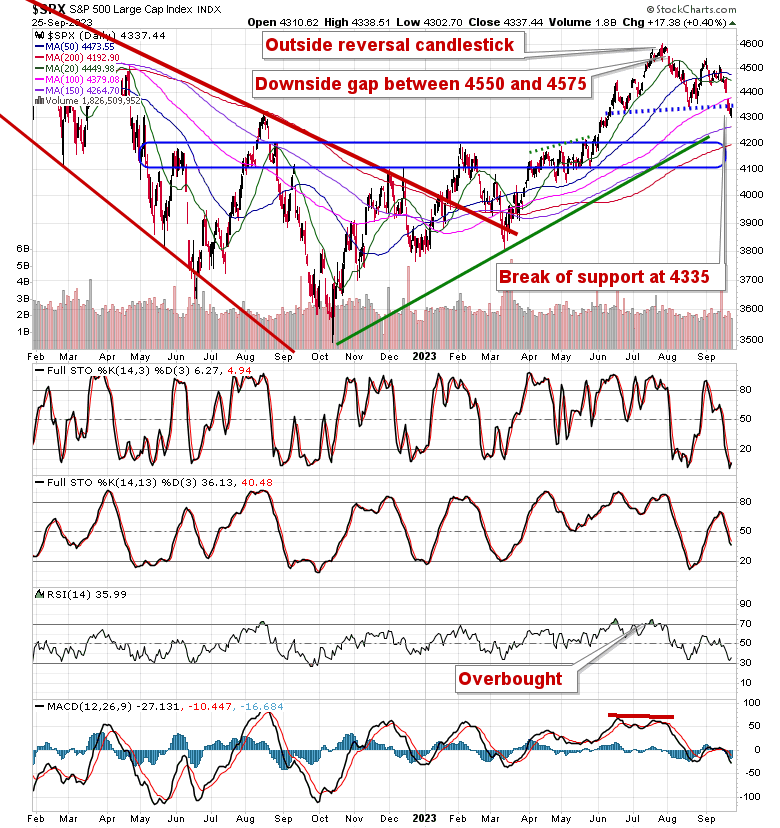

Stocks closed mildly higher on Monday as investors try to shake off concerns related to the ongoing rise of interest rates that triggered the sharp selloff in equity markets last week. The S&P 500 Index punched out a gain of four-tenths of one percent, closing back at previous short-term support at 4335 that was broken last week. The 50-day moving average has joined the 20-day curling lower, both providing points of resistance overhead as the market seeks to close out the weakest/most volatile time of the year during the back half of September. Momentum indicators are showing slight signs of stabilization following Monday’s reprieve in selling pressures, but characteristics of a bearish trend remain as they adopt positions below their middle lines. Levels down to previous horizontal resistance at 4200 remains fair game in order to mitigate any significant damage prior to the start of the best six months of the year for stocks; below this threshold, we have to consider longer-term negative implications, quite possibly coinciding with a recessionary downturn in the market.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

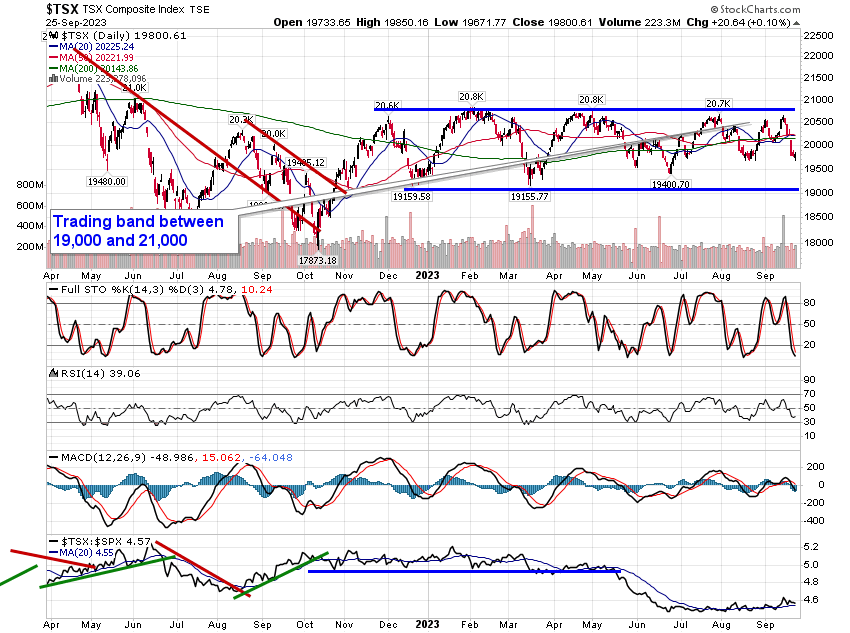

TSE Composite