While stocks look exhausted in the short-term, an upside bias is normal through the week of US Thanksgiving.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

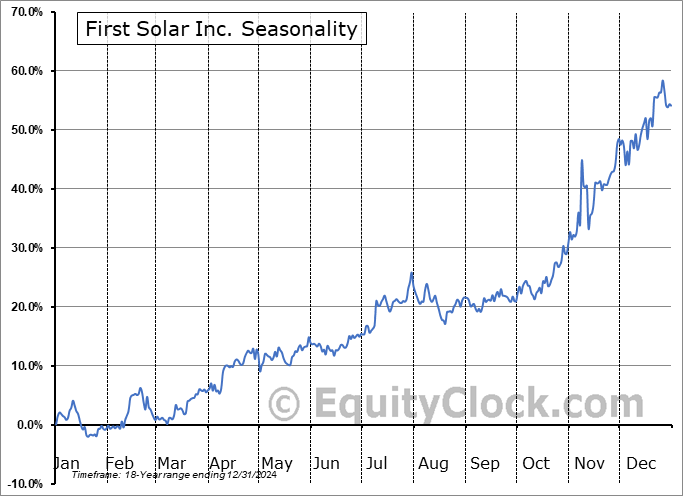

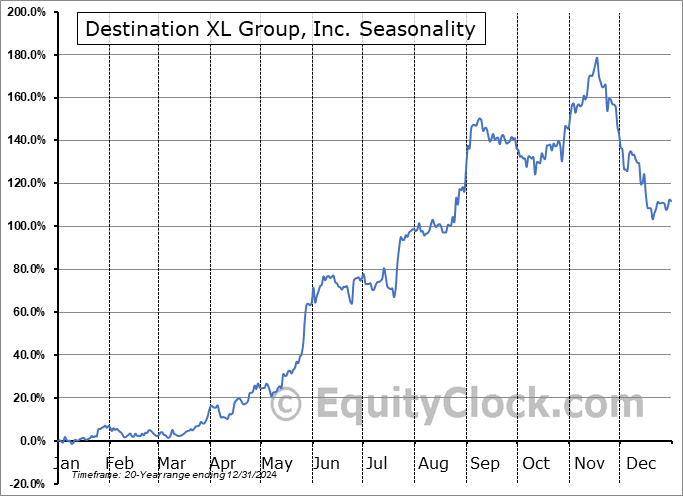

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed mixed on Thursday as questions pertaining to the health of the economy had investors selling down consumer stocks, both staples and discretionary. The S&P 500 Index closed with a gain of just over a tenth of one percent, continuing to show a slight stall around psychological resistance of 4500 as traders scrutinize how far price has come since the end of October. Levels of support below the benchmark remain plentiful, including open gaps and major moving averages, while levels of resistance are becoming fewer the higher the benchmark climbs. This is an attribute of a bullish trend and, although some digestion appears logical before the next advance materializes coinciding with the normal end-of year strength, holding a positive bias towards equity allocations in portfolios remains warranted. The Relative Strength Index (RSI) continues to knock on the door of overbought territory around 70 and the MACD histogram is showing signs of upside exhaustion, both conducive to realize a retracement lower in prices over the near-term.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite