S&P 500 Index is back to resistance at the July high, presenting a pivotal point for the market heading into the tax-loss selling period that dominates the first half of December.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

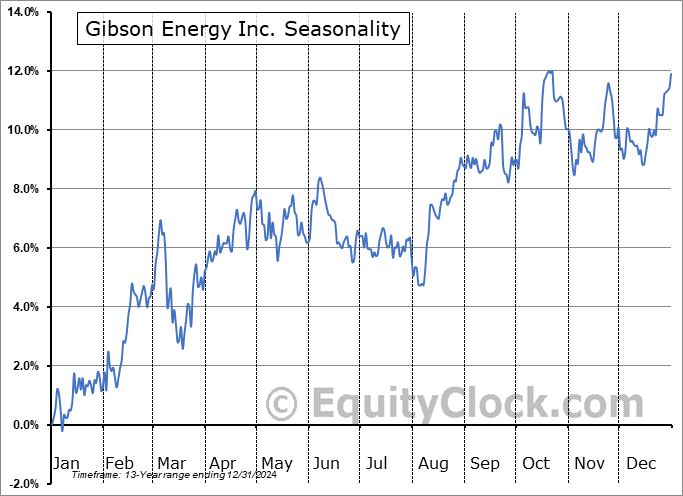

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks jumped on Friday as start of the month inflows and a renewed push lower in interest rates gave new life to the market after showing signs of stalling in recent days. The S&P 500 Index ended with a gain of just less than six-tenths of one percent, reaching back to previous resistance at the July high of 4600. The move has given reprieve to the near-term rollover of momentum indicators, which had been pulling back from overbought territory as investors refrained from adding new risk ahead of the traditional tax-loss selling period that spans the first half of December. The Relative Strength Index (RSI) is once again reaching above 70 and the contraction of the MACD histogram has taken a pause. Still, while the break of the recent consolidation range around the 4550 is promising to continue the normal strength in the market that runs through the last couple of months of the year, the near-term risk-reward to adding new equity exposure remains less than ideal at the present time. For our intermediate-term strategy that seasonality encompasses, we are still left with nothing to do and remain fully invested (no cash), whether it be in stocks, bonds, or commodities, a position we have retained since October. We will be looking for our next intermediate-term signal to sell around the end of the year, but, for now, stay the course.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite